Why ETH Beats BTC for Treasury Strategy: SharpLink CEO Says

0

0

SharpLink has become one of the most aggressive Ethereum treasury companies of 2025. In May, it raised $425 million in a private placement led by Consensys, and in July, it appointed former BlackRock executive Joseph Chalom as co-CEO. By August 24, SharpLink disclosed holdings of 797,704 ETH and more than 1,799 ETH in staking rewards.

BeInCrypto sat down with Chalom to discuss why SharpLink bet on Ethereum, how it plans to survive volatile cycles, and what its expansion into Asia means for investors at a time when rivals like Bitmine already hold 1.7M ETH.

Why Ethereum, Not Bitcoin or Stablecoins

The interview opened with the obvious question: Why Ethereum instead of Bitcoin or stablecoins? Chalom said SharpLink’s mission was to go beyond being another corporate holder and to treat Ethereum as infrastructure.

“We are positioning SharpLink to essentially be the definitive institutional gateway to Ether exposure, Ether being the token that secures the Ethereum network. Our goal is to become the world’s most trusted Ethereum treasury company and the leading institutional advocate for Ethereum as a platform.”

Chalom then contrasted Ethereum’s programmability with Bitcoin’s narrower focus. He said Bitcoin had been fantastic as a digital store of value and its network as a layer moving that value back and forth. This instead emphasizes why Ethereum is his long-term bet.

“Ethereum allows for many, many different types of applications to be built on it. We are of the view that right now we’re at a moment that matters. There is a long-term Ethereum opportunity, not an Ethereum trade. The traditional financial system is long overdue for an upgrade, and we strongly believe that Ethereum will be that future platform of financial interest.”

Transparency and ETH Per Share

From the beginning, SharpLink has highlighted transparency. The company publishes weekly updates that list capital raised, ETH purchased, average purchase price, and ETH per share.

“We aim to acquire and accumulate as much ETH as possible for our stockholders at the lowest entry point. And we are completely committed to transparency. Every week, we publish how much capital was raised, how much ETH we purchased, at what price, and ETH per share. That last one — ETH per share — is the number one metric we want investors to follow.”

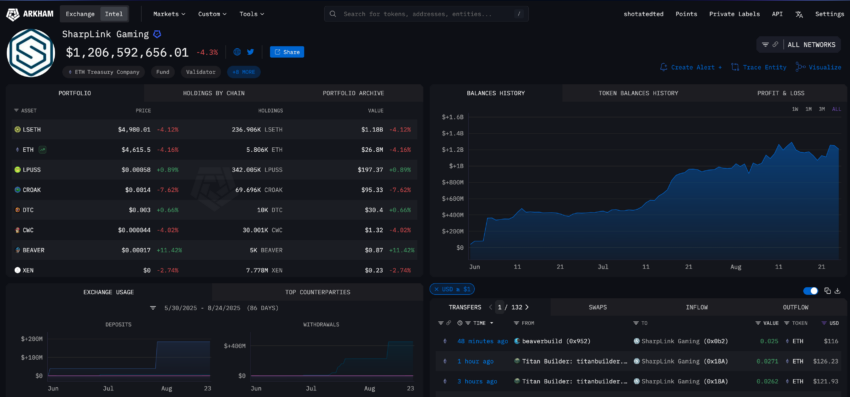

SharpLink’s On-Chain Portfolio | Arkham

SharpLink’s On-Chain Portfolio | Arkham

As of August 24, the firm reported 797,704 ETH in its treasury and 1,799 ETH in cumulative staking rewards. This cadence lets investors track accretion in real time.

Staking, DeFi, and Risk Management

Now that they have accumulated ETH, they will benefit from staking. By late August, SharpLink had earned nearly 1,800 ETH in rewards. Chalom described how the company uses Ethereum’s staking design.

“ETH is unique relative to Bitcoin because it can generate yield through staking, which becomes revenue. We currently use native staking through custodians and liquid staking tokens. Future plans include native staking, restaking, and leveraging DeFi yield, aiming to build a diversified portfolio of staking yield along an efficient frontier.

Native staking yields around 3%, but opportunities exist to increase this yield through risk-managed, institutional methods. The number one responsibility of an Ethereum treasury is to protect the principal, ensuring no undue risks are taken.”

SharpLink anchors its strategy with custodial staking and selectively adds higher-yield approaches only with oversight. Partners include Consensys, Anchorage Digital, and Coinbase.

Leadership Priorities and Competition

Chalom was appointed as SharpLink co-CEO in July after two decades at BlackRock. He said his priorities were investor education and team building.

“After a 20-year career at BlackRock, where I was responsible for launching impactful digital asset strategies across stablecoins, crypto access, and tokenization, my focus at SharpLink has been twofold. First, educating investors and the public about the long-term macro Ethereum opportunity, distinguishing it from short-term trades.

Second, building a best-in-class team in conjunction with partners like Consensys and Joe Lubin to ensure a differentiated offering and top talent in the ETH treasury industry.”

SharpLink faces rivals like Bitmine Immersion Tech, which has driven the recent Ethereum treasury strategy together, and already holds 1,800,000 ETH. Chalom called this healthy competition.

“Competition is healthy. We call it co-opetition. It brings bright minds and institutional capital into the Ethereum opportunity. What sets us apart is being the most institutional Ethereum treasury company — best-in-class governance, disciplined capital raising, and strategic partnerships that no other firm can replicate.”

Ethereum’s volatility led to questions about resilience. Chalom said SharpLink’s model is structured to endure downturns.

“Ethereum is volatile, and we know there will be downturns. The way we survive is by keeping expenses lean, avoiding leverage, and being totally transparent. ETH per share is the key number. Investors can see exactly whether we are creating value. That’s how we build trust in good times and bad.”

Analysts warn that treasuries reliant on debt face a $12.8 billion maturity wall by 2028. SharpLink’s equity-funded approach and weekly reporting aim to keep it away from forced sales.

How SharpLink Differs From Spot ETH

When asked whether SharpLink’s stocks, if tokenized and traded alongside spot ETH, would be seen as a proxy for Ethereum or as competition, Chalom said SharpLink stocks would complement ETH, not compete with it.

“SharpLink is an access vehicle for ETH, wrapped in a public company structure that offers accumulation, capital appreciation, and staking benefits. If our equity were tokenized, it would simply extend that model into a 24/7 market environment.”

He added that the bigger trend is tokenization of all assets, with Ethereum as the settlement layer.

“But what’s coming is much larger. Tokenized funds, tokenized equities, tokenized ETFs — that’s the next wave. The digitization of finance will happen on Ethereum.”

Chalom said the tokenization trend will drive Ethereum’s long-term value. He positioned SharpLink as an access vehicle for ETH and a way for investors to capture the broader transformation.

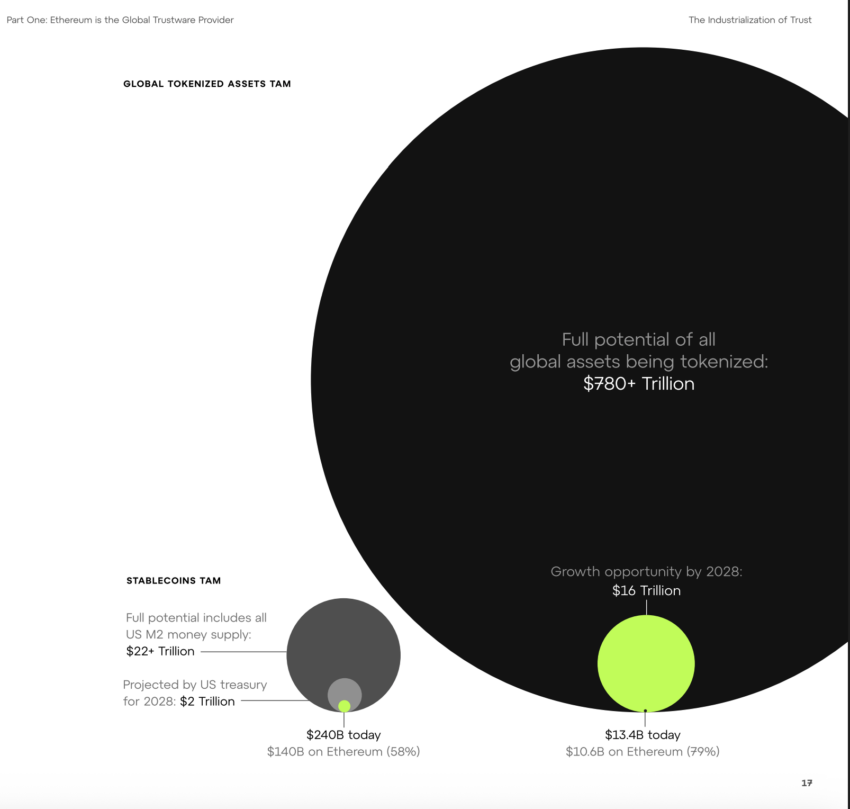

RWA Market Prediction | Consensys

RWA Market Prediction | Consensys

“SharpLink is an access vehicle for ETH, wrapped in a public company structure that offers accumulation, capital appreciation, and staking benefits. But what’s coming is much larger. Tokenized funds, tokenized equities, tokenized ETFs — that’s the next wave.

Global markets are $100 trillion. Crypto today is $4 or $5 trillion. The digitization of finance will happen on Ethereum. Assets will trade 24/7, settle instantly, and be programmable. Tokenization is not just a crypto story. It is the future of finance.”

He explained that this is why SharpLink holds ETH exclusively, not layer-2 tokens. Ether secures the stack and offers clean exposure for institutional investors.

APAC Expansion and Investor Education

SharpLink will establish a presence in Asia, especially Korea, Japan, and Singapore, and it plans to attend Korea Blockchain Week and Token2049 Singapore. Chalom said the region has been retail-heavy but is shifting toward institutions as regulations mature.

“Asia has always been more retail-driven than the US or Europe. But I think we’re at the beginning of a generational shift. Regulators are clarifying frameworks, and institutional capital is ready. We plan to be present in Korea, Japan, and Singapore soon, raising capital globally and building a truly international treasury.”

BeInCrypto noted that family offices in Asia already allocate 3%–5% of portfolios to crypto. Chalom compared today’s environment to the early internet era, stressing that education and transparency will be key to accelerating institutional flows.

ETH Price Outlook and Final Comments

Asked about ETH price targets, Chalom avoided specific numbers and pointed to Consensys’s Trustware model instead.

“It’s very simple. What do you think adoption and transaction volume will be in crypto and tokenized funds on the Ethereum network? That’s layer ones and layer twos. Plus, what will be the real-world activity on Ethereum? For every $2 of value secured, it drives about $1 in market cap for ETH.

If you believe what Secretary Bessent has said about the adoption of stablecoins and the tokenization of assets — both largely happening on Ethereum — then you can calculate that the value of the ETH token will be significantly higher in the short, mid, and long term. That is the Ethereum opportunity we’re betting on. That is why we think this is a successful strategy for the long run.”

He summarized the thesis as a macro allocation: Ethereum is not a trade but a programmable infrastructure for stablecoins and tokenized capital markets.

Chalom urged investors to focus on companies that pair transparency with institutional capabilities, arguing that these qualities will decide which treasuries will endure as the market matures.

“We believe this is a long-term Ethereum opportunity and not a trade. If you see this as a macro investment thesis, you should look at the most trusted and most transparent Ethereum treasury companies. That is why we differentiate SharpLink and why we are building for the long run.”

With that, Chalom underscored SharpLink’s ambition to become the benchmark Ethereum treasury company: transparent, institutional, and built to endure cycles while betting on tokenization and stablecoin adoption as the anchors of Ether’s long-term value.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.