Bitcoin Is ‘Flirting’ with Danger: Early Black Friday?

0

0

Bitcoin BTC $110 599 24h volatility: 2.4% Market cap: $2.21 T Vol. 24h: $66.72 B has once again slipped below the crucial $112,000 level, a zone that has historically acted as both support and resistance. The downturn is triggered by mounting macroeconomic concerns and a staggering $19 billion futures liquidation across exchanges.

According to Glassnode, the crypto market is entering a “reset phase,” marked by a large-scale leverage flush, slowing ETF inflows, and surging volatility. The platform called the current situation “an Early Black Friday,” signaling a period of deep discount and fear in the market.

An Early Black Friday

Bitcoin’s rally to $126k reversed amid macro stress and a $19B futures wipeout. ETF inflows slowing and volatility spiking, the market enters a reset phase marked by a historic leverage flush.

Read the full Week On-Chain below👇https://t.co/Osm96VjuJg pic.twitter.com/BgYTJ7qfIe

— glassnode (@glassnode) October 15, 2025

At the time of writing, Bitcoin is trading around $111,000, down roughly 9% over the past week. The decline below the key $117,000–$114,000 cost-basis zone, which began on Oct. 10, has left many top buyers at a loss.

On-chain data shows continued selling from long-term holders since July and reduced institutional interest, as Bitcoin ETFs recorded a 2,300 BTC outflow this week.

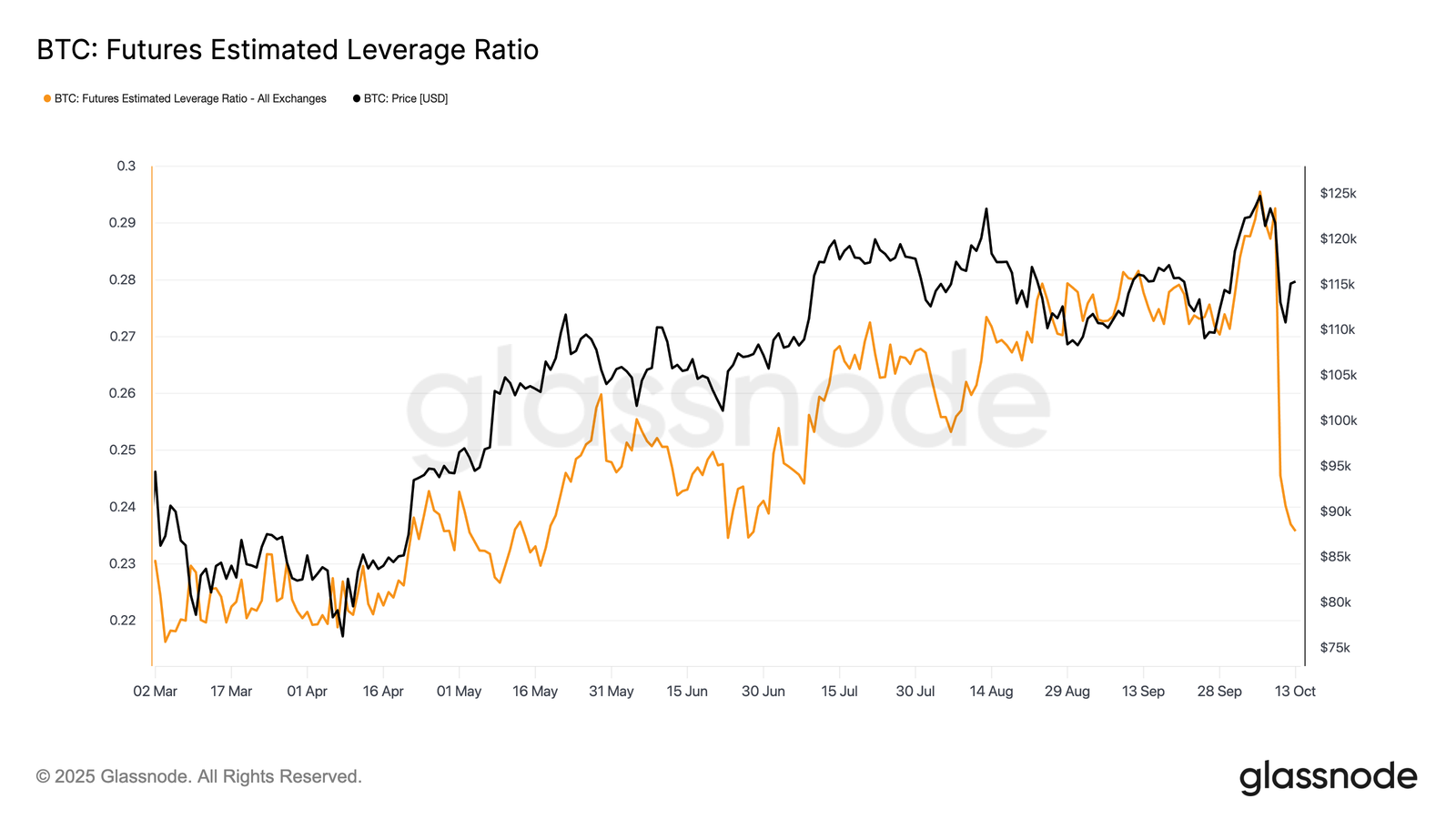

Meanwhile, the futures market experienced a dramatic cleanup. The Estimated Leverage Ratio fell to multi-month lows, and funding rates plunged to levels not seen since the 2022 FTX collapse. These are both signs of intense liquidation and peak market fear.

BTC futures estimated leverage ratio | Source: Glassnode

Analysts Split on Bitcoin’s Next Move

The options market has shown early signs of stabilization, with open interest rebounding even as volatility surged to 76%.

Bitcoin options open interest | Source: Glassnode

Short-term options remain “put-rich,” reflecting cautious sentiment. However, some traders view this as the final stage of a market reset before Bitcoin price recovery.

Experts like Ted believe Bitcoin could reclaim new highs by 2026, advising traders to use current dips as buying opportunities. He added that as long as the $102,000 level holds, Bitcoin will be in a bull run.

$BTC long-term structure is still looking good.

As long as the $102,000 level holds, Bitcoin will be in a bull run.

If BTC closes a monthly candle below the $102,000 support level, I would be concerned. pic.twitter.com/1FZ9uKgMQe

— Ted (@TedPillows) October 15, 2025

However, crypto analyst Jason Pizzino noted on X that a move below $108,000 puts the bull market on “thin ice.”

Bitcoin is flirting with danger — a move below $108,000 puts the bull market on thin ice. But things aren’t looking as bad for gold, silver, and the stock markets, either, hitting new all-time highs day after day or very close to it. So, it’s hard to see the BTC cycle being over… pic.twitter.com/V0eJvKdUkP

— Jason Pizzino 🌞 (@jasonpizzino) October 16, 2025

However, he also pointed out that other assets like gold and stocks remain near record highs, suggesting the broader economic cycle still supports long-term growth.

The post Bitcoin Is ‘Flirting’ with Danger: Early Black Friday? appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.