Huma Finance (HUMA) sheds 14% ahead of 377 token unlock: what’s next?

0

0

Bears dominated the digital assets landscape on Tuesday as the cryptocurrency market capitalization lost nearly 4% in the past 24 hours to $3.79 trillion.

Bitcoin has plunged below $110,000, while Ethereum hovered at $4,430.

Altcoins have suffered the most, with LINK, SOL, and DOGE losing up to 10% of their value in the past day.

Meanwhile, Huma Finance appeared to suffer the most by losing over 14% within the previous 24 hours.

HUMA price looks poised for further declines as the PayFi project prepares to release 377.92 coins, worth approximately $9.03 million, in the coming hours.

Huma braces for massive token unlock

While token unlocks are common in the crypto space, they often trigger volatility as they add new supply into the circulating assets.

While HUMA’s 377 release could be modest compared to its 1.73 billion supply in circulation, it’s enough to shake markets.

Market players often expect bearish momentum from unlock events, which catalyzes price dips.

The ‘sell the rumor’ narrative might be behind HUMA’s current substantial plunge.

Investors and traders are likely eager to avoid more losses, especially as the broader market remains in the red.

The prevailing sentiments suggest that Huma Finance will hardly absorb the increased supply.

The event requires a surge in demand from ecosystem activity, governance participation, and staking to keep HUMA prices afloat during the upcoming $9.03 million token release.

Thus, the altcoin may struggle to secure a reliable footing in the near term.

What for HUMA traders?

Indeed, Huma Finance’s short-term bias looks shaky. Nonetheless, various factors might shape the asset’s performance in the coming times.

HUMA traders should watch for the immediate post-unlock performance.

Price stability or intensified selling pressure could define the short-term trajectory.

Also, Huma Finance’s trajectory will hinge on broader sentiments.

Small caps would record notable bounce-backs if Bitcoin and Ethereum switch to uptrends.

Prevailing sentiments suggest extended dips or consolidation before considerable recoveries.

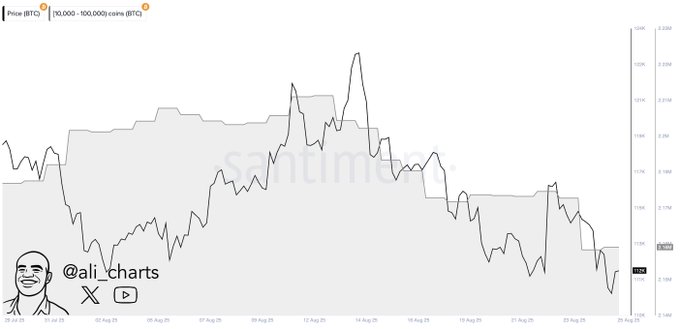

Large-scale investors have offloaded BTC worth around $6 billion in the previous week.

Such developments signal a lack of conviction for solid rallies in the upcoming sessions.

Nevertheless, this could be whales booking profits after Bitcoin’s latest run to all-time highs.

Bitcoin should reclaim $112,000 to support rebounds to $120,000.

Meanwhile, Huma Finance has positioned itself as a crypto project with real-world utility.

It aims to democratize the global payment industry with instant liquidity access.

The payment sector has seen green traction lately, especially after the US stablecoin regulation.

Enthusiasts will watch how Huma Finance demonstrates its competitiveness in the PayFi space in the coming months and years.

HUMA price outlook

The native coin lost around 14% on its daily chart after dipping from an intraday high of $0.02663 to $0.02288.

HUMA trades at $0.02414 after a brief jump from 24-hour lows.

On-chain data and technical indicators suggest further declines for the digital coin.

Huma Finance will likely plummet to new weekly lows amid the upcoming supply increase.

Moreover, HUMA has shown weakness since its debut, currently down 80% from its launching peaks.

However, sudden shifts in the broader market could trigger significant recoveries for Huma prices.

The post Huma Finance (HUMA) sheds 14% ahead of 377 token unlock: what’s next? appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.