0

0

This article was first published on The Bit Journal.

The Pi Network Lawsuit has become a significant story in crypto circles as an American investor accuses the project of serious misconduct.

According to the source, the legal complaint seeks $ 10 million in damages and raises questions about unauthorized token transfers, secret sales, and long delays in migrating to the mainnet.

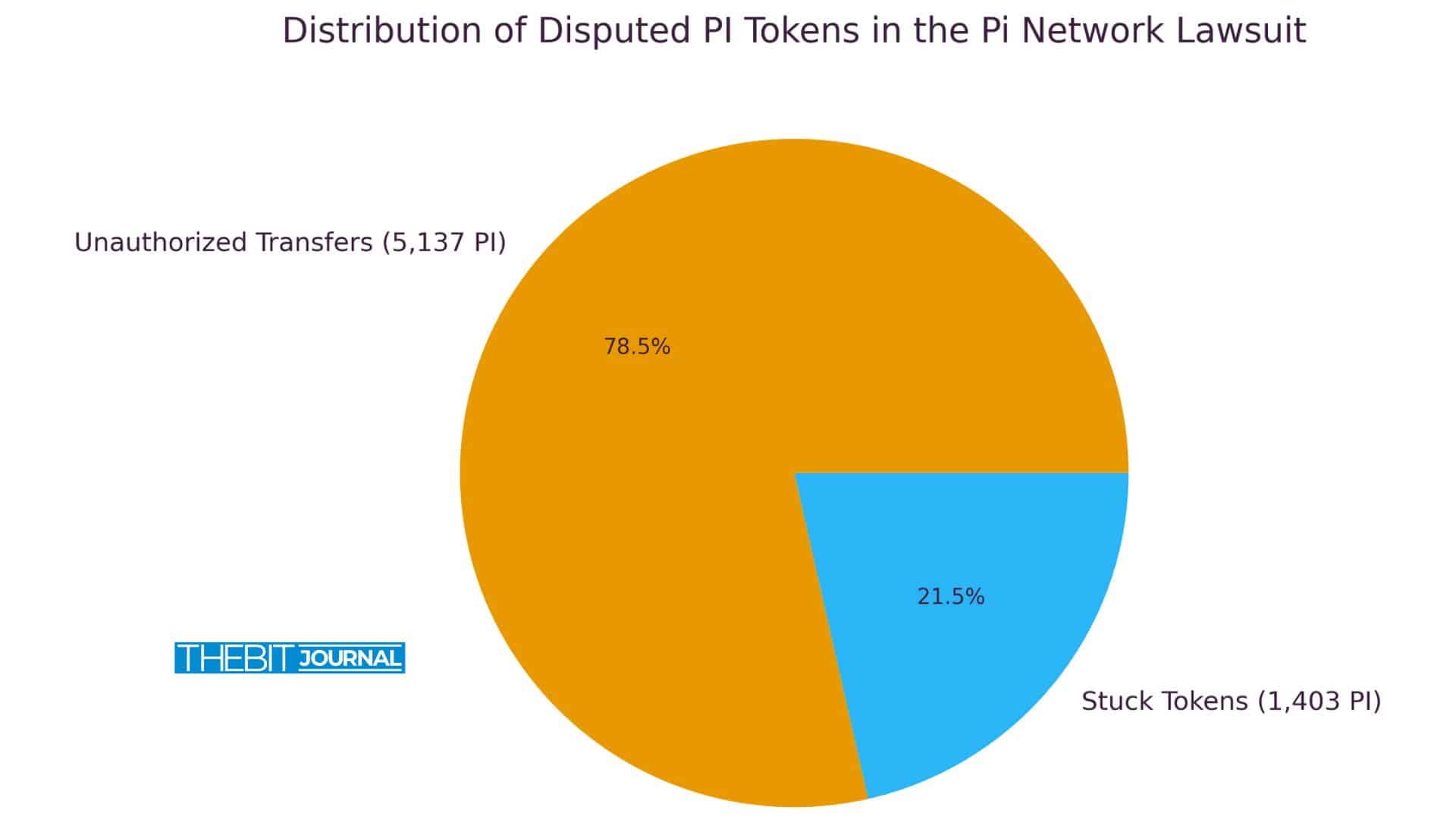

The investor claims that 5,137 PI tokens were left in his verified wallet in April 2024 without permission. He also states that 1,403 remaining tokens stayed stuck during migration to the mainnet. These claims are based on the official court filing submitted to the U.S. District Court for the Northern District of California.

The complaint argues that SocialChain Inc. and its executives secretly sold approximately 2 billion PI token. The suit also claims that the network remains under centralized control via just three validator nodes.

This alleged token mismanagement forms one of the core charges under the Pi Network Lawsuit. The plaintiff says these actions drove down trust and triggered a dramatic decline in token value.

According to the complaint, the value of PI plunged from a pre-mainnet IOU valuation to a far lower trading figure. Many community members argue that the high IOU value cited in the lawsuit, sometimes quoted as $307.49, never reflected the real market value.

Recent trading data shows PI now trades near 0.22 US dollars. Compared with the peaks seen earlier in 2025, when the price reached roughly 2.95 US dollars, the decline has been steep.

Beyond the court case, regulatory scrutiny is mounting. Some authorities abroad have warned that assets like PI, especially those lacking straightforward real-world utility, could become instruments for unregulated fundraising or pyramid-style schemes.

With both legal claims and regulatory pressure, the Pi Network faces a critical test at this juncture.

| Date | PI Price (approx.) | Key Market Context |

|---|---|---|

| December 9, 2025 | 0.22 USD | Following legal filings and community doubt |

| Early 2025 | ~ 2.95 USD | High trading volume and token hype |

The sharp drop in token value coincides with increased public scrutiny and growing concerns about transparency and liquidity.

The Pi Network Lawsuit brings sharp focus on long-standing questions about token control, transparency, and user trust. With PI trading near 0.22 USD and regulators watching closely, the coming months may define the network’s future direction. The case has already stirred global conversation.

The court’s next steps will likely shape not only the fate of Pi Network but also how crypto projects are evaluated under legal and regulatory lenses.

Mainnet: The live blockchain network where tokens become tradable and active.

Validator Node: Any server or node that verifies transactions and adds them to a block on the blockchain.

Migration: Makes tokens available on the live mainnet from initial state (e.g., IOU).

IOU Price: A temporary or speculated price amount prior to tokens trading, often not corresponding to the true market value.

The suit claims unauthorized token transfers, secret sales of an abundant supply and delays in migrating tokens to the mainnet.

The suit seeks $10 million in damages.

As of December 2025, PI trades near 0.22 US dollars.

No. These are allegations. The case is before the courts and no decision has been made.

Read More: Pi Token Crash and Lawsuit Breakdown: What Investors Must Know">Pi Token Crash and Lawsuit Breakdown: What Investors Must Know

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.