Ethereum ETFs Outshine Bitcoin with $455M Daily Inflows

0

0

Highlights:

- Ethereum ETFs attract $455M in inflows, extending their winning streak to four days.

- Bitcoin ETFs suffer $1.5B in outflows, which signals a cautious investor sentiment shift.

- Ethereum ETFs continue outperforming Bitcoin ETFs as ETH rises faster than BTC.

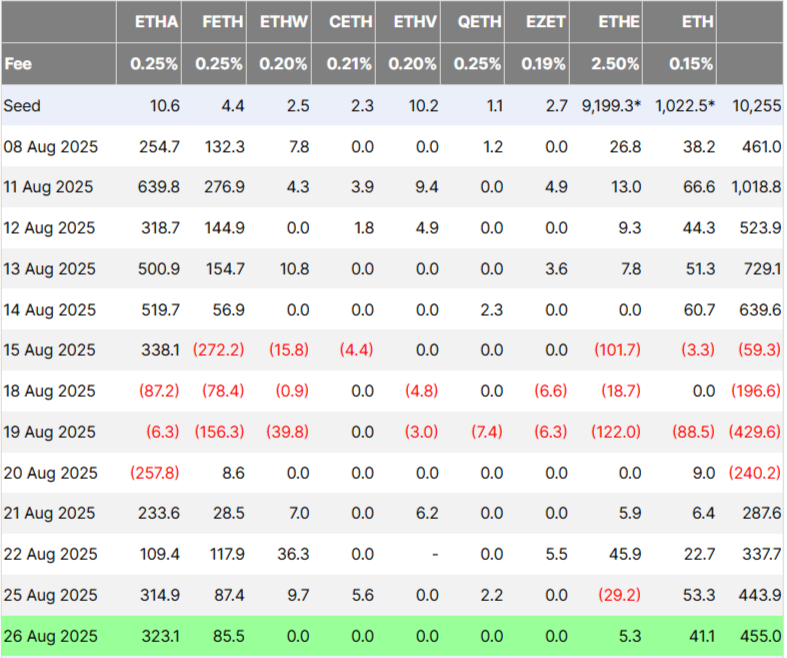

U.S.-based Ethereum (ETH) exchange-traded funds (ETFs) continued their winning streak on Tuesday. They recorded total daily net inflows of $455 million, marking the fourth straight day of gains. As per the data from Farside, BlackRock’s spot Ethereum ETF (ETHA) and Fidelity Ethereum Fund (FETH) led yesterday’s inflows, with ETHA adding $323.1 million and FETH $85.5 million, respectively. Grayscale’s ETHE and the Mini Ethereum Trust also recorded positive net flows.

Ethereum ETFs Surpass Bitcoin with Stronger Daily Inflows

Conversely, spot BTC ETFs recorded combined daily inflows of $88.1 million across six different funds. The data highlights the ongoing trend of Ether ETFs outperforming BTC ETFs. On Monday, Ethereum inflows were more than double those of BTC ETFs.

At the same time, the underlying cryptocurrencies showed a strong recovery on Wednesday morning. Data from CoinMarketCap indicated that Bitcoin climbed 0.72% over the past 24 hours, reaching $110,990. Ethereum gained 3.28% to trade at $4,580, while other leading altcoins also experienced a similar rebound.

“BTC is at a make-or-break point,” Swissblock said in a Wednesday post on X. The wealth manager emphasized that $110,000 is Bitcoin’s critical support, which bulls need to defend to maintain the uptrend. “BTC has proven resilience above $100K, but survival above $110K will decide if the trend continues bullish or tips into structural weakness,” he added.

$BTC is at a make-or-break level:

$110K = lifeline support

$121K = ceiling to break

In short: BTC has proven resilience above $100K, but survival above $110K will decide if the trend continues bullish or tips into structural weakness. pic.twitter.com/g24CMc96cN

— Swissblock (@swissblock__) August 26, 2025

Investors Pull Billions from Bitcoin ETFs: Bitfinex Alpha

Bitcoin ETFs are currently seeing the largest withdrawals, which are closely mirroring movements in the underlying cryptocurrency’s price. Analysis of data from the crypto exchange Bitfinex indicates that investors pulled out at least $1.18 billion from spot Bitcoin ETFs over the past week. Ethereum ETFs recorded smaller outflows, likely benefiting from the ongoing reallocation of capital into the broader altcoin market. Ethereum ETFs recorded smaller outflows, likely benefiting from the ongoing reallocation of capital into the broader altcoin market.

Over six trading days from August 15–22, Bitcoin ETFs experienced outflows exceeding $1.5 billion, after a prior week of gains before BTC reached $124,000. Experts say the decline signals cautious investor sentiment in this bull cycle. Ethereum ETFs also faced outflows exceeding $918 million, but only until August 20. Despite this, ETH reached a $4,940 all-time high on August 24, while Bitcoin dropped more than $15,000 from its peak.

Bitcoin faced difficulty sustaining its upward movement, whereas Ethereum kept rising, supported by consistent buying from Ethereum treasury firms. These firms absorbed significant selling pressure, helping limit ETH’s downside risk. Their consistent support has given Ethereum ETFs an edge over Bitcoin ETFs. Looking ahead, the price trends of BTC and ETH this week largely depend on inflows from institutional investors and treasury firms. However, Bitfinex cautions traders to temper expectations, as historically, risk-focused ETFs tend to experience slower inflows in late summer, particularly in August and September.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.