Bitcoin News: Powell’s Resignation Affects Sentiment, Pantera Capital CEO Praises BTC

0

0

Bitcoin news showed price action pushing to a new ATH above $112,000 on some exchanges such as Coinbase and OKX, among others.

This newfound momentum was fueled by renewed sentiments about crypto prospects that could possibly influence long-term outlook.

Federal Reserve Chairman Jerome Powell is reportedly resigning. This was among the factors that likely fortified the bullish resolve for Bitcoin.

Interestingly, President Trump recently pushed for Powell’s resignation over his failure to lower rates.

Bitcoin price spiked following news of Powell’s resignation, indicating that the market saw this as a favorable outcome.

Risk-on asset investors have been losing patience with Powell due to his refusal to lower interest rates. Especially when some other big economies, including the UK lowered rates substantially.

Powell’s exit raised prospects that his successor will adopt a more dovish approach to interest rates. Lower rates historically favored a bullish outlook in risk-on assets including cryptocurrencies.

This may explain the positive reaction to news of Powell’s exit. Meanwhile, President Trump reportedly expects the Federal Reserve to slash rates by as much as 3 basis points.

Can Bitcoin Bypass Looming Tariff War Concerns?

Bitcoin just pushed to a new historic high despite looming concerns of another tariff war escalation. But could things turn out differently this time? Some industry participants believe that could turn out to be the case.

Among them was Dan Morehead, the CEO of Pantera Capital. He noted that Bitcoin remained one of the best store of wealth assets especially considering the surging fiscal deficits and tariffs threats.

His statement was a nod to the recent surging concerns regarding the rising government debt. The Pantera CEO also acknowledged BTC’s impressive revenue and believes it could continue to deliver robust returns in the future compared to traditional investments.

Morehead’s sentiments revealed the possibility that BTC may bypass tariff concerns in August. However, that may turn out to be a big “if” considering how the markets responded when the tariff wars first began.

Meanwhile, the latest update on the tariff war situation revealed that President Trump had already sent out tariff letters to some countries. In other words, the world is gearing up for more economic disruption in the coming weeks.

Will Bonds be the Wild Card for Bitcoin (BTC)?

We previously noted that one of the main reasons BTC managed to bounce back so quickly during the tariff war pause was the lack of direct exposure.

The same factor highlighted the potential for Bitcoin to act as a safe haven asset, especially from a bonds perspective.

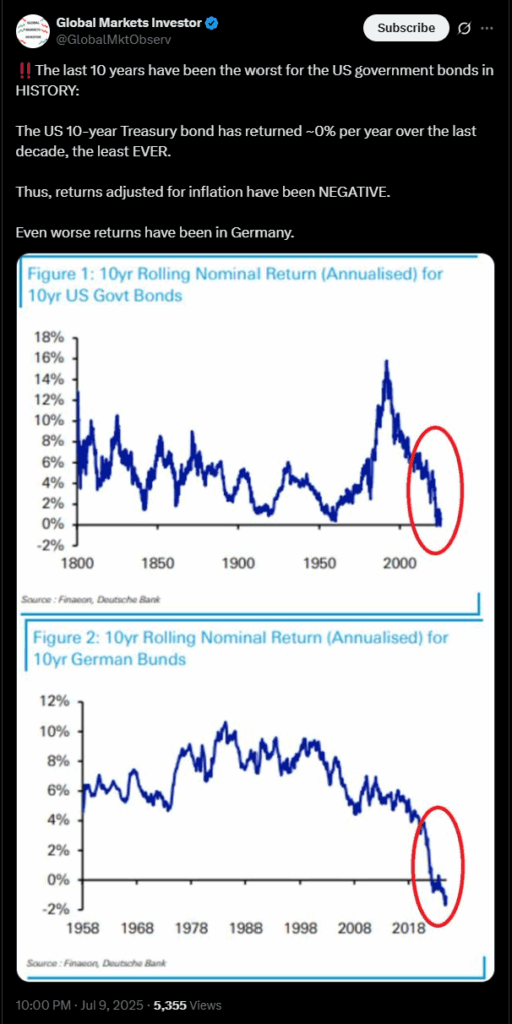

Government bonds, especially those from the U.S, were traditionally considered low-risk assets. As a result, they were mainly used as safe haven investments not long ago.

However, the U.S has been grappling with runaway debt which raised default risks. Bonds were severely affected judging by the declining return in the 10-year U.S treasury bill.

The declining bond yields will likely make them less attractive investments, and this may shift the tide in favor of Bitcoin.

The latter’s characteristics as an alternative investment may push investors to view it as a viable alternative, especially with the rising institutional involvement.

On the other hand, Bitcoin may be experiencing a rally before the storm. This potential outcome draws parallels with BTC’s price action during the December 2024 and January 2025 peaks.

Another double top scenario could be brewing amid the risking possibility economic disruption. This could happen especially if Bitcoin fails to gain enough traction as the market enters defensive position against upcoming disruption.

The post Bitcoin News: Powell’s Resignation Affects Sentiment, Pantera Capital CEO Praises BTC appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.