Western Union Initiates Stablecoin Transfers as Fed Targets Payment-Only Breakthrough

0

0

Western Union facilitates the movement of billions of dollars every year. As of October 27, the payment and remittance processor had a market cap of over $2.9Bn, generating over $1Bn in adjusted revenue in Q3 2025. And now that market share could be shifting onchain,

The problem is that, though many users still rely on traditional finance rails to move funds across the world, alternatives are quickly catching up and gnawing market share. A significant threat to Western Union is the emergence and expansion of stablecoin issuers like Tether and Circle.

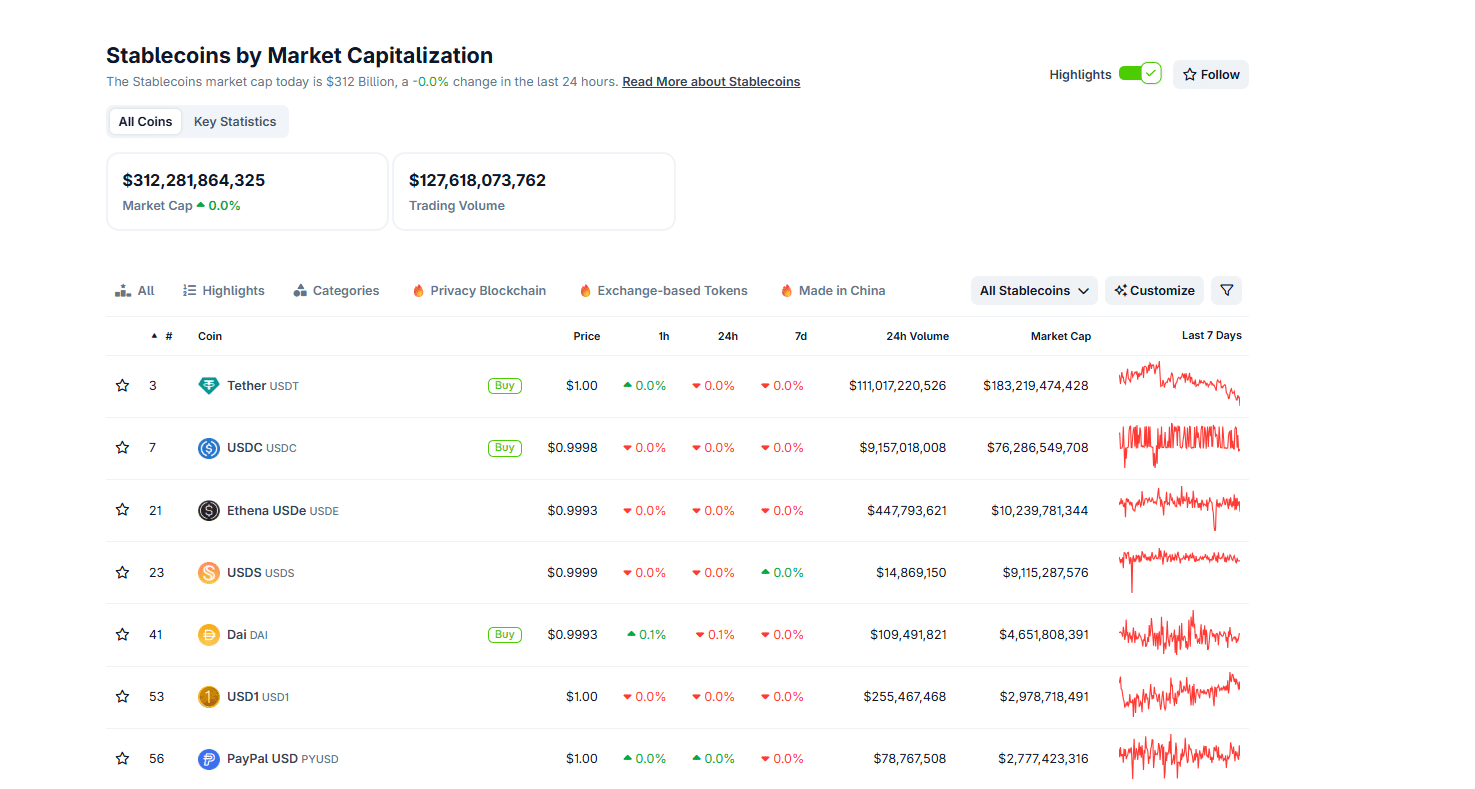

Presently, the stablecoin market stands at over $312Bn. The largest stablecoin issuer, Tether, has minted over $183Bn of USDT, which tracks the greenback. Circle, the issuer of USDC, is fast rising up the market cap ranks, issuing over $76.2Bn of stablecoins.

(Source: Coingecko)

DISCOVER: 10+ Next Crypto to 100X In 2025

Western Union Initiates Stablecoin Transfers: What’s the Impact?

Unsurprisingly, Western Union is jumping on the stablecoin bandwagon to avoid being left behind and perhaps even rendered obsolete. Since the enactment of the GENIUS Act in July 2025, many more firms have been experimenting with and integrating stablecoins.

On Thursday last week, during Western Union’s Q3 2025 earnings call, CEO Deven McGranahan said the financial services company had launched a pilot that leverages stablecoins for value transfer.

The CEO notes that the trial program will specifically focus on leveraging the blockchain and stablecoins to “reduce dependency on legacy correspondent banking systems.” In turn, this will shorten settlement times and, most importantly, improve capital efficiency.

By leveraging stablecoins and instead of entirely depending on traditional rails, Western Union has a chance to move money cheaply and with “greater transparency.”

Unlike fiat, which operates in opaque networks where the amount, source, and recipients are often obscured, crypto and stablecoin transfers are easier to track. If Western Union uses a public chain like Ethereum, every transfer will be easily monitored onchain, introducing higher transparency and trust.

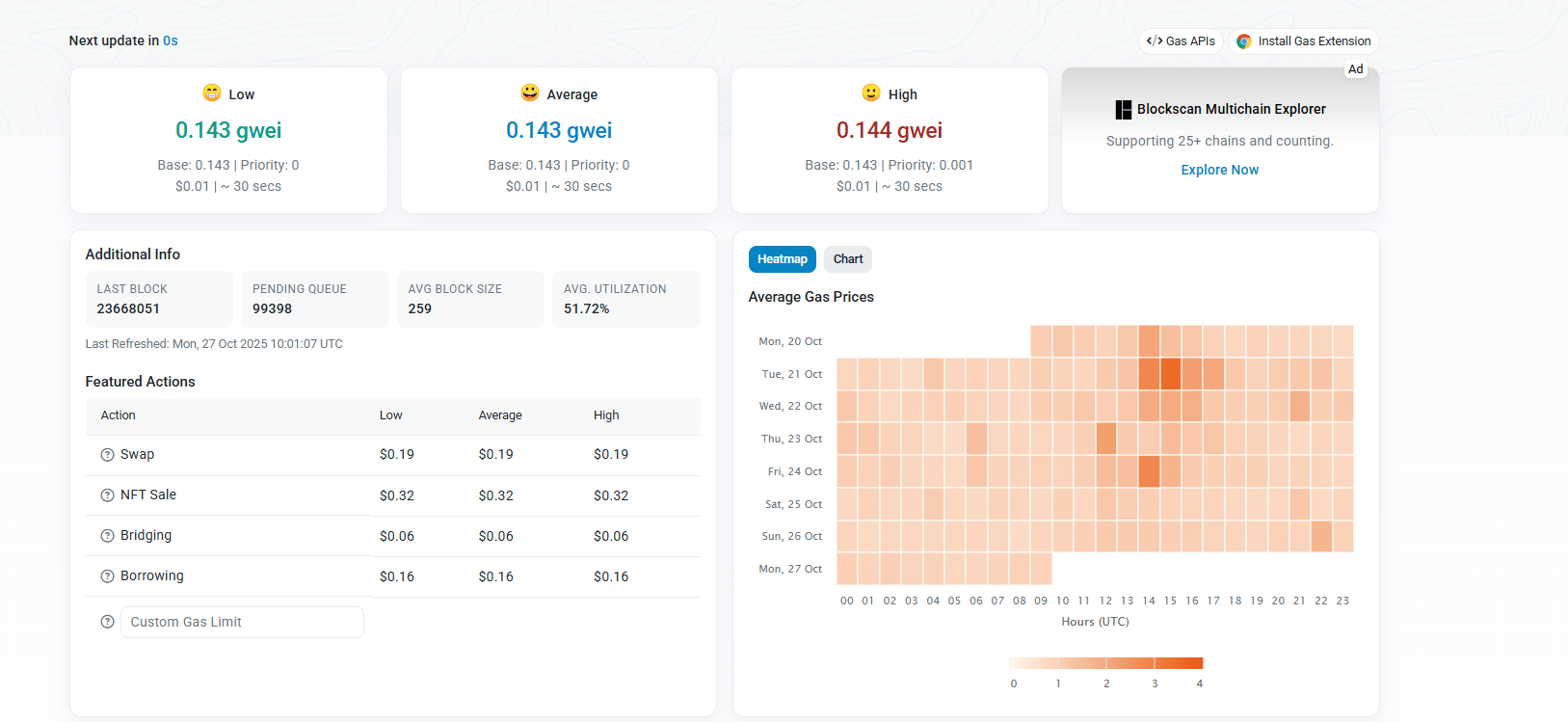

Still, it remains to be seen how Western Union will handle fluctuating gas fees, especially on Ethereum, which is a choice public chain for many finance companies. Ethereum continues to scale via layer-2s like Base, but fees on the mainnet can change drastically, sometimes spiking to over $50, depending on the network’s activity.

(Source: Etherscan)

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Is The Proposal For a Payment-Only Fed Account A Breakthrough?

If the Western Union pilot is successful, many more payments and finance companies will likely adopt the stablecoin approach, integrating this new technology or even becoming stablecoin issuers, such as PayPal.

PayPal, which also facilitates the transfer of value and processing of transactions, is one of the largest stablecoin issuers. Through a partnership with Paxo, over $2.7bn of PYUSD stablecoin has been minted and distributed, earning an attractive yield across DeFi.

As 99Bitcoins reported, Governor Waller recently proposed the creation of “skinny” Fed master accounts for Fintech companies, including stablecoin issuers.

These payment-only Fed accounts will have balance caps and will likely boost crypto and DeFi by enabling direct Fed connectivity to eligible entities. Here, stablecoin issuers will benefit from cheap and instant settlement via Fedwire without the need for intermediaries.

Big Crypto news from the Fed

Federal Reserve Governor Christopher Waller just proposed "payment accounts" (aka "skinny master accounts") that could give crypto and fintech companies limited direct access to the Fed's payment systems like FedNow. This means faster

, cheaper… pic.twitter.com/8DPgcmHKKx

— Daniela (@chicablockchain) October 22, 2025

As a result, if this proposal passes, not only will crypto and DeFi be stable, but stablecoin issuance will also be smooth, allowing the dominance of USD-backed stablecoins across the globe.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

- U.S. and China seek to resolve trade frictions

- Rare earth metal export controls might be delayed by a year

- China to import more soybeans from U.S.

- Bitcoin news: Will BTC USDT fly to over $126,000?

The post Western Union Initiates Stablecoin Transfers as Fed Targets Payment-Only Breakthrough appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.