Crypto ETFs Flows: Why Money Is Leaving Bitcoin And Ethereum For Solana

0

0

The Bit Journal first published this article.

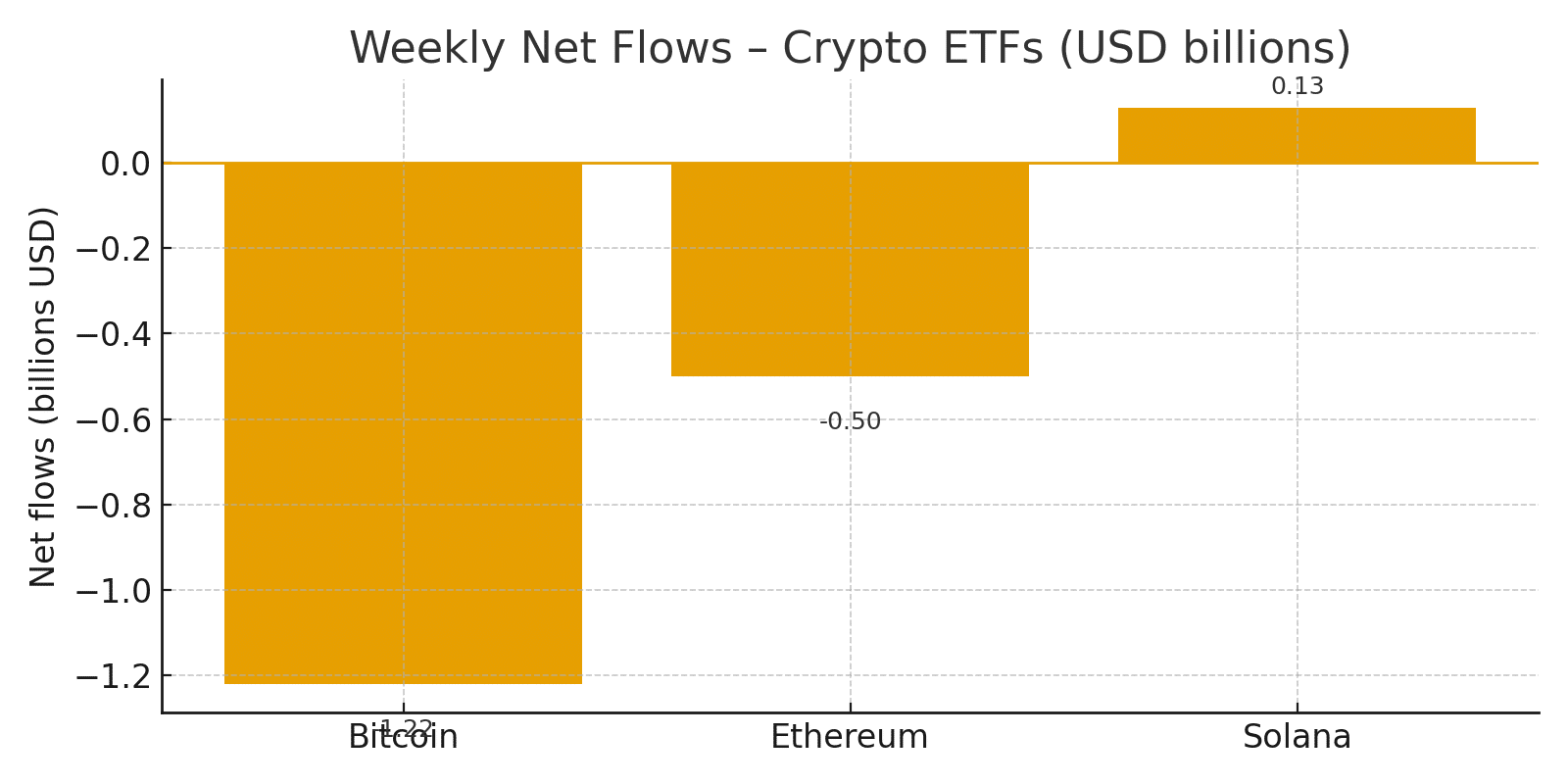

November has turned ETF flow data into one of the clearest signals of sentiment in digital assets. Recent figures for the week of November 17 to 21 show spot Bitcoin funds losing about 1.22 billion dollars, while Ethereum products see roughly 500 million dollars in redemptions over the same period.

For many desks, that mix of falling prices and accelerating outflows across crypto ETFs is a simple message: large investors are cutting risk rather than adding fresh exposure, at least for now.

Bitcoin and Ethereum lead the outflow wave

Spot Bitcoin ETFs are on track for one of their heaviest monthly withdrawal periods since launch, with multiple data providers pointing to several billions of dollars in net outflows in November alone. At the same time, the asset has slipped back to levels last seen months ago, pushing many late buyers into unrealised losses and encouraging longer term holders to lock in gains from earlier in the year.

Ethereum funds tell a similar story. Products tied to ETH have posted consecutive weeks of net outflows, lining up with some of the largest single day redemptions since trading began. In this environment, many portfolios treat Bitcoin and Ethereum crypto ETFs as the first place to raise cash when there is pressure to reduce exposure.

Behind the numbers sit familiar drivers. Investors are absorbing slower expectations for interest rate cuts, ongoing uncertainty around staking rules, and a broad retreat from high beta assets. When those worries combine, even flagship crypto ETFs start to look like short-term trading positions rather than long-term anchors in a portfolio.

Solana bucks the trend with persistent inflows

Solana is playing a very different role in this story. During the same week that Bitcoin and Ethereum funds lost capital, spot Solana ETFs attracted about 128 million dollars in net inflows, marking a fourth straight week of positive demand. Separate flow dashboards show that Solana-focused crypto ETFs have built up hundreds of millions of dollars in cumulative inflows since listing, including a 17-day streak of uninterrupted demand.

Price action makes the divergence even more striking. SOL has dropped sharply from its recent peak during the broader correction, yet investors continue to use regulated products to build exposure. Analysts point to Solana’s fast transactions, low fees, and growing developer ecosystem as reasons to keep adding through crypto ETFs even while headlines focus on red candles and liquidations.

What crypto ETFs flows reveal about risk appetite

Fund flows never tell the entire story, but they do show how traditional capital is behaving in near real time. Persistent redemptions from Bitcoin and Ethereum crypto ETFs suggest that larger holders are cautious after a powerful rally and prefer to de-risk rather than ride out a deeper drawdown. In contrast, sustained inflows into Solana products and a smaller group of alternative layer-one funds point to more selective risk taking instead of a full exit from the sector.

Other indicators point in the same direction. Research on stablecoin supply and derivatives shows capital leaving some trading venues while volatility remains elevated compared with the summer. In that setting, the behaviour of crypto ETFs looks less like panic and more like a rotation away from crowded trades and toward networks that seem earlier in their growth curve.

Why these signals matter for market structure

For professional desks and serious retail traders, daily updates on crypto ETFs now sit next to order book depth, options flows, and funding rates. Large and repeated outflows can flag stress before it fully appears on price charts, while steady inflows during a downturn highlight where long horizon capital is quietly building positions for the next cycle. Because these products connect regulated markets to public blockchains, they influence liquidity, spreads, and how sharply prices move when sentiment changes.

Conclusion

The latest numbers deliver a clear message. Money is leaving Bitcoin and Ethereum ETFs at a record pace, while Solana-related crypto ETFs stand out as rare bright spots in an otherwise difficult month. That split shows a crypto market that remains very active, but far more careful and discriminating than during the last speculative surge.

Over time, outcomes will depend on how each network handles regulation, technology upgrades, security, and real world demand. For now, the signal from crypto ETFs is straightforward: capital is cautious, still engaged, and in the process of quietly redrawing the leaderboard inside the digital asset market.

Frequently Asked Questions

Why do ETF flows matter for the crypto market?

ETF flows track how much money regulated funds send into or pull out of digital assets. Large, persistent inflows or outflows can reinforce or weaken price trends and often reflect shifts in institutional sentiment.

Why are Bitcoin and Ethereum funds seeing outflows while Solana gains?

Bitcoin and Ethereum led the earlier rally, so many investors are taking profits or cutting risk there first. At the same time, some view Solana as a higher growth play and are using ETFs to build exposure while prices are lower.

Do strong Solana inflows guarantee future price gains?

No. Flows can reverse quickly, and Solana remains a volatile asset. Inflows only show where capital is moving today, not what returns that capital will earn in the future.

Glossary of key terms

Spot ETF: An ETF that holds the underlying asset directly, rather than using futures contracts or swaps.

Net inflow: A period in which more money enters a fund than leaves it, often seen as a sign of rising demand.

Net outflow: A period in which more money leaves a fund than enters it, often linked with profit taking or risk reduction.

Layer-one network: A base blockchain, such as Bitcoin, Ethereum, or Solana, that processes and settles transactions without relying on another chain.

References

Read More: Crypto ETFs Flows: Why Money Is Leaving Bitcoin And Ethereum For Solana">Crypto ETFs Flows: Why Money Is Leaving Bitcoin And Ethereum For Solana

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.