Ripple (XRP) Volumes Surge 140% as CBOE Confirms XRP ETF Listing

0

0

Ripple XRP $3.10 24h volatility: 1.8% Market cap: $185.29 B Vol. 24h: $6.98 B price crossed the $3.10 mark on Thursday, Sept. 18, trading at its highest for the week. The widely anticipated Fed rate cut on Wednesday and Rex Shares’ official launch of XRP ETF products form a major bullish catalyst behind XRP’s 5% price gains over the past week. However, the latest trends in derivatives trading metrics suggest a much larger market impact could follow.

On Thursday, US-based asset manager Rex Osprey announced the first U.S.-issued ETFs to offer exposure to Spot Dogecoin and Spot XRP, listed on the CBOE exchange.

According to the official press release, the first-ever Dogecoin ETF will trade under the DOJE ticker, while the XRPR product will have the majority of its assets held directly in spot XRP, with the remainder invested in exchange-traded products backed by XRP.

Greg King, CEO and founder of REX Financial and Osprey Funds emphasized institutional demand for ETFs as trading vehicles for cryptocurrencies.

“Investors look to ETFs as trading and access vehicles. The digital asset revolution is already underway, and to be able to offer exposure to some of the most popular digital assets within the protections of the U.S. ’40 Act ETF regime is something REX-Osprey is proud of and has worked diligently to achieve,” King said.

DOJE and XRPR ETFs are now listed on the CBOE, one of the largest trading platforms for financial assets in the US, with the exchange confirming the listing in a post on its official X account.

Pleased to welcome two new REX-Osprey ETFs our U.S. market:

🔹REX-Osprey XRP ETF $XRPR

🔹REX-Osprey DOGE ETF $DOJELearn more about REX-Osprey's #CboeListed ETFs: https://t.co/qlimuVSdU2@REXShares @OspreyFunds pic.twitter.com/sfbHmSLICm

— Cboe (@CBOE) September 18, 2025

As the news drew global reactions, XRP gained 4% before facing major resistance at the $3.10 mark. XRP underperformed relative to top altcoins like SUI $3.95 24h volatility: 7.0% Market cap: $14.10 B Vol. 24h: $2.15 B and Avalanche AVAX $35.14 24h volatility: 16.8% Market cap: $14.84 B Vol. 24h: $1.95 B , which posted double-digit gains on the Fed’s first rate cut of the year.

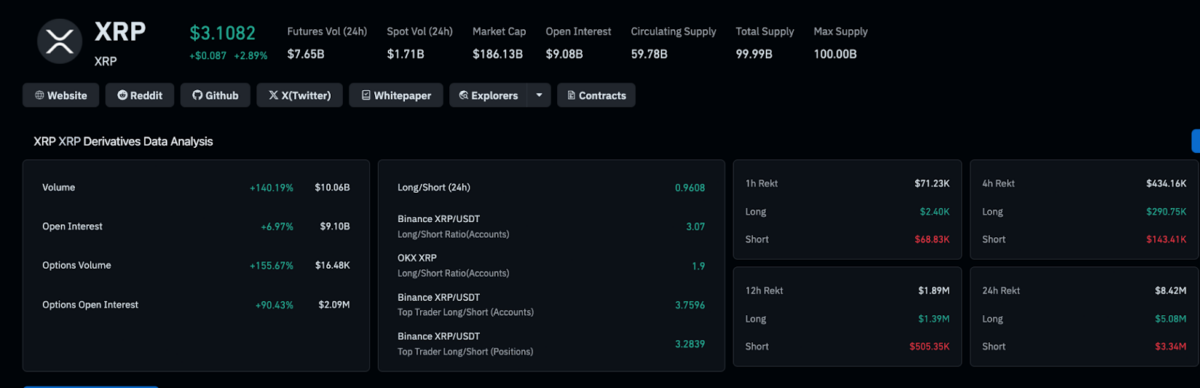

Ripple (XRP) Derivatives Markets Analysis | Coinglass

However, reactions in the XRP derivatives markets in the last 24 hours suggest a much larger market impact could follow. Real-time data from Coinglass shows trading volumes on XRP futures contracts rose 140% in the same period, crossing the $10 billion mark at publication. Open interest, which tracks the value of new XRP leveraged positions, also increased by 6.7% to hit $9 billion.

This signals a potential bullish breakout ahead for two key reasons. First, XRP open interest of 6.7% exceeds the spot price increase of 4.2%, signaling the rally is supported by new capital entering the market.

Also, the intraday trading volume of $10 billion exceeds open interest of $9 billion, showing intense market turnover with bullish new entrants absorbing selling pressure from profit-takers.

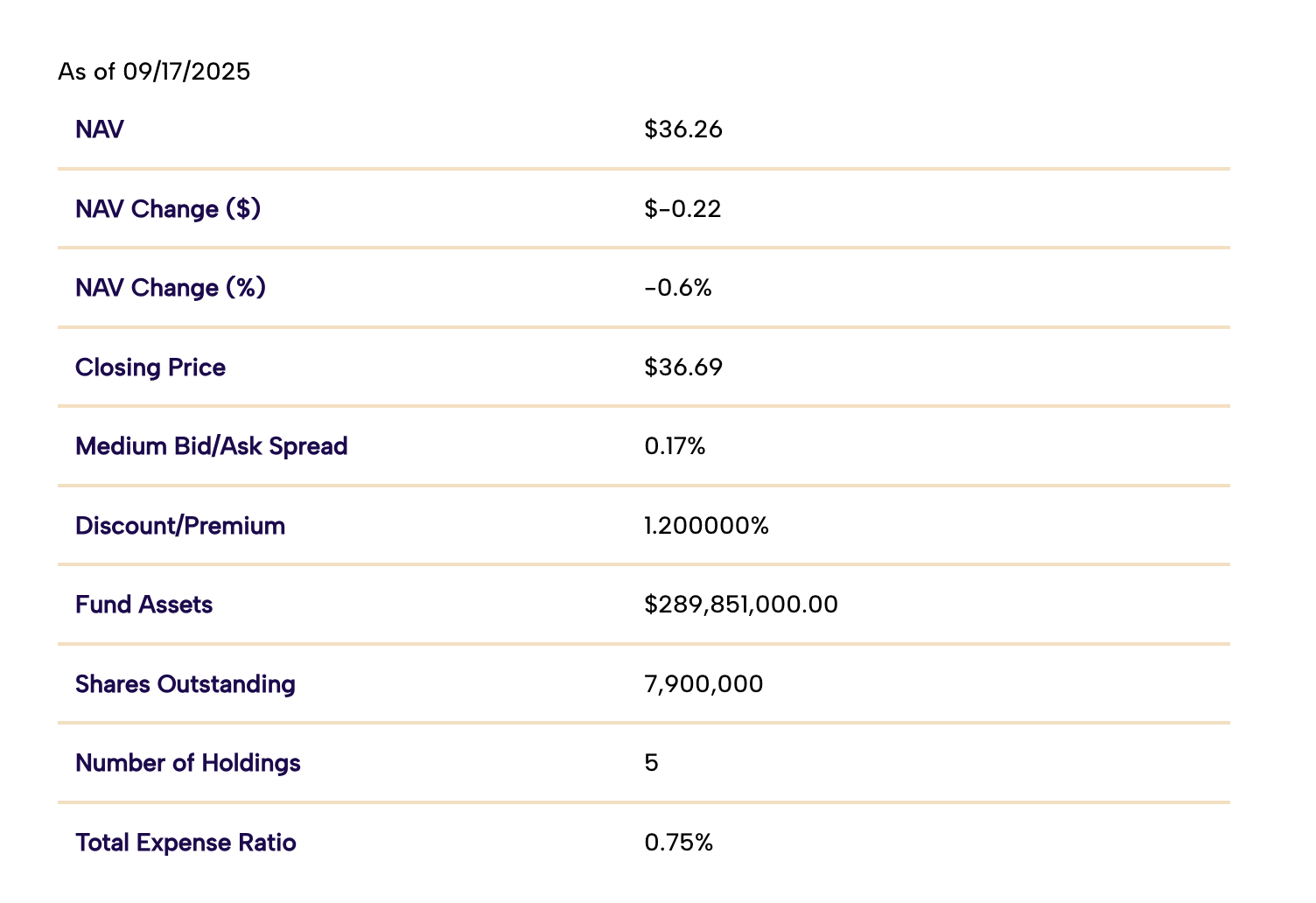

Rex Osprey’s Solana Staking ETF trading data as of Sept. 17, 2025 | Source: RexShares.com

Notably, Rex Osprey’s Solana Staking ETF (SSK) has pulled nearly $300 million in inflows in less than three months after its launch on July 2, with Solana SOL $248.3 24h volatility: 3.6% Market cap: $134.88 B Vol. 24h: $10.76 B price climbing 68% from $148.3 to $248.7 at press time.

If XRP price closes decisively above the $3.10 mark, a similar breakout towards $4 could be on the cards, as markets anticipate persistent ETF inflows from institutional investors.

The post Ripple (XRP) Volumes Surge 140% as CBOE Confirms XRP ETF Listing appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.