PEPE at a Crossroads – Can The Meme Coin Rebound For a 54% or Even 150% Rally?

0

0

PEPE has lost nearly half its value recently, dropping about 47.78%—and the past 24 hours have only deepened that slide with an additional 1.89% drop. However, fresh market signs suggest a turnaround might be on the horizon. Some experts believe that if these trends continue, it could bounce back with a rally of around 54%, potentially turning its fortunes around.

Accumulation Fuels Optimism

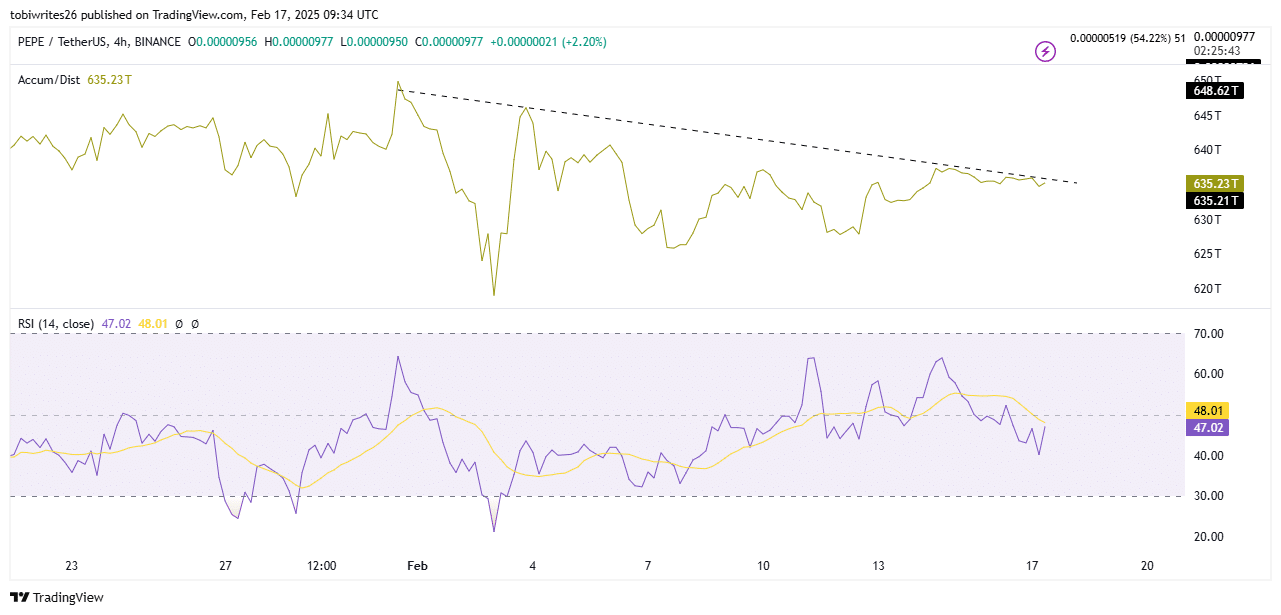

Market sentiment appears to be turning around for this memecoin. The Accumulation/Distribution Ratio shows significant buying, with 635.23 trillion tokens changing hands—an indication that investors may be expecting a rebound. Meanwhile, the RSI is climbing toward 50, which could confirm increasing buying momentum.

Adding to this, exchange data from Coinglass reveals a negative netflow, which usually points to buying rather than selling. While spot market buys have been significant—one transaction alone was $148.86 million. Since the start of 2025, the spot market has seen a steady stream of buyers, with about $30 million worth of the coin purchased just last week—and one standout transaction reaching $148.86 million. Such large acquisitions suggest that investors may be gearing up to push the coin past its near-term resistance levels.

Can PEPE Survive the Negative Funding Rate?

However, not all indicators are positive. The Open-Interest Weighted Funding Rate, which mixes derivatives market data with funding rates, has fallen significantly and remains in negative territory. After peaking at 0.0101% on February 14, this rate has since dropped to a mere 0.0002, remaining in the negative territory.

However, market observers warn that if the Open-Interest Weighted Funding Rate begins trending upward, it would further lead to a bullish case.

Can Ascending Channel Lead Towards A Breakout?

Recent technical analysis reveals that this memecoin navigates an ascending channel on the 4-hour chart. After bouncing off a key support level, the coin now seems to be moving toward a critical resistance area at about $0.00001056. Breaking above this barrier could open the door to a broader rally, possibly lifting PEPE to $0.00001477—a potential gain of about 54.22%.

However, it also needs to overcome resistance points at $0.00001137, $0.00001217, and $0.00001331 to maintain any bullish momentum. There is a “death cross” (where the 50-day WMA falls below the 200-day WMA) and a “bearish flag” pattern, plus the price is now below the key 61.8% Fibonacci retracement level ($0.000011).

If this continues, Pepe could slide to around $0.0000058, which it last touched in August. There is a silver lining, though. A “falling wedge” pattern on the charts sometimes points to a bullish reversal. If its price breaks above the top of this wedge, it could climb to around $0.000025—roughly a 150% increase from current levels.

Memecoin Hype Meets Reality

Pepe is now trading at about $0.000010—down 65% from its December high—wiping out roughly $6 billion in market value and mirroring a wider meme coin downturn. Yet, the holder count has climbed from 384,000 to over 404,000, indicating that some investors are still accumulating despite the price drop. However, with a massive 4.21 billion trillion coins, reaching that price would push its total value to about $842 billion—bigger than Bitcoin and even the whole crypto market. Even if a lot of coins were burned, the huge supply problem wouldn’t just go away.

Realistically, this memecoin might stay around $0.000009 soon. Dropping a zero (to push up the price) would require a big jump in demand, which isn’t guaranteed. Long-term, hoping for $0.01 by 2030 is still a stretch.

Conclusion

Pepe has dropped nearly 50% recently, but technical signs like an ascending channel and a falling wedge hint at a possible rebound of 54% to 150%—if it breaks through key resistance levels. Despite large buys, the negative Open-Interest Weighted Funding Rate signals caution. Given PEPE’s massive supply and the broader meme coin slump, a big price jump remains doubtful.

Stay tuned to The BIT Journal and watch Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

1. Is a 54% or even 150% price rally possible?

Yes, if PEPE breaks key resistance levels and maintains bullish momentum.

2. Why are investors optimistic despite the drop?

Accumulation and a climbing RSI suggest renewed buying interest.

3. Does negative netflow point to more buying?

Generally, yes—negative netflow often indicates higher buying pressure than selling.

4. Is the negative funding rate a deal-breaker?

It’s a concern, but if it turns positive, PEPE’s bullish case could strengthen.

5. What’s crucial about the ascending channel?

It could lead to a breakout above $0.00001056, paving the way for a 54% rally.

Glossary of Key Terms:

PEPE: A meme-inspired cryptocurrency known for its extreme price swings.

Accumulation/Distribution Ratio: A metric showing if traders are mainly buying (accumulating) or selling (distributing).

Near-term resistance levels: Price thresholds where an asset tends to struggle moving higher in the short term.

Death cross: A bearish signal triggered when a shorter moving average falls below a longer moving average.

Falling wedge: A chart pattern often indicating a potential bullish reversal once it breaks out upward.

Fibonacci Retracement: A technical analysis tool used to identify potential support and resistance levels by applying Fibonacci ratios to recent price movements.

Funding Rate Data: Metrics derived from futures contracts that indicate the cost or credit for holding a position are used to gauge market sentiment.

On-chain Signals: Data points obtained directly from the blockchain (such as transaction volume, wallet activity, and staking behavior) that provide insights into market trends and investor behavior.

References:

Binance: https://www.binance.com

Crypto News: https://crypto.news

AMB Crypto: https://ambcrypto.com

Coinglass: https://www.coinglass.com

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.