Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Outflow Amid “Fear” Sentiment

0

0

US issuers of spot Bitcoin BTC $113 291 24h volatility: 1.8% Market cap: $2.26 T Vol. 24h: $47.15 B ETFs, and spot Ethereum ETH $4 186 24h volatility: 2.6% Market cap: $506.05 B Vol. 24h: $45.43 B ETFs, faced heavy outflows of more than $1 billion on Tuesday, August 19.

ETFs for both the top crypto assets saw their second-largest outflows this month. On Tuesday, Bitcoin outflows went up by more than 300% while Ethereum outflows doubled.

Bitcoin and Ethereum ETFs See Three Consecutive Days of Outflows

Spot Bitcoin ETFs saw $523 million in outflows on Tuesday, accelerating 4 times the outflows on Monday, as per data from Farside Investors.

Similarly, Ethereum ETFs also faced heavy losses, with outflows jumping from $200 million on Monday to $422 million.

Combined Bitcoin and Ethereum funds have logged three straight days of outflows totaling $1.3 billion.

This comes along with a sharp Bitcoin price drop of 8.3%, and Ethereum price correction of 10.83% on the weekly chart.

8/19 Bitcoin ETF Total Net Flow: -$523.31 million$IBIT (BlackRock): $0.00 million$FBTC (Fidelity): -$246.89 million$BITB (Bitwise): -$86.76 million$ARKB (Ark Invest): -$63.35 million$BTCO (Invesco): n/a$EZBC (Franklin): -$3.27 million$BRRR (Valkyrie): $0.00 million$HODL… https://t.co/DzXQtqfr5T pic.twitter.com/6JI9w9aiGZ

— Trader T (@thepfund) August 20, 2025

Fidelity Investments saw the largest withdrawals on Tuesday, with $247 million exiting its Wise Origin Bitcoin Fund (FBTC) and $156 million from the Fidelity Ethereum Fund (FETH), for a combined $403 million in outflows.

Similarly, Grayscale also faced significant redemptions, as the Grayscale Bitcoin Trust ETF (GBTC) lost $116 million and the Grayscale Ethereum Trust (ETHE) saw $122 million withdrawn.

BlackRock remained the most stable, with its Bitcoin fund IBIT seeing no outflows and its iShares Ethereum Trust ETF (ETHA) experiencing only a minor $6 million withdrawal.

Crypto Market Sentiment Flips Into “Fear” Zone

Note that the current three-day outflows in Bitcoin ETF and Ethereum ETFs come after weeks of consecutive inflows, and minor in comparison.

Senior Bloomberg ETF analyst Eric Balchunas noted on X that Ether ETFs made Bitcoin the “second-best” crypto asset in July, as investors increasingly shifted from Bitcoin ETFs to Ether ETFs.

Ether ETFs Turn Bitcoin Into 'Second Best' Crypto Asset in July.. new from @SirYappityyapp and myself who awarded Ether ETFs as our ETF of the month for July. Normally we just pick one but the whole category caught fire pic.twitter.com/o9yql2hDHM

— Eric Balchunas (@EricBalchunas) August 18, 2025

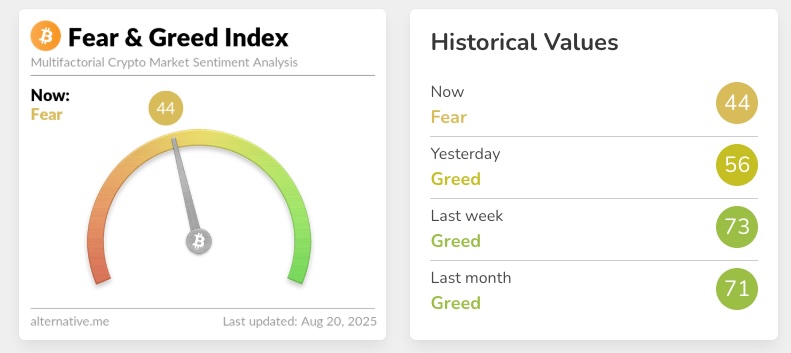

On Wednesday, August 20, the Crypto Fear & Greed Index shifted to “Fear,” recording a score of 44 after an extended stretch of bullish sentiment, signaling increasing caution among investors.

Crypto Fear & Greed Index showing a shift to fear with a score of 44 on August 20, 2025. | Source: Alternative.me

The broader crypto market correction continued today, with BTC and altcoins under pressure. Total liquidations reached $462 million, including $381 million in long positions.

The post Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Outflow Amid “Fear” Sentiment appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.