Massive U.S. Bitcoin and Ethereum Move Spotted — Is a Crypto Power Play Underway?

0

0

The United States government’s evolving engagement with digital assets, approximately $10 million worth of Bitcoin (BTC) and Ethereum (ETH) were transferred on March 27, 2025. This action aligns with President Donald Trump’s recent executive order establishing the Strategic Bitcoin Reserve and the U.S. Digital Asset Stockpile, aiming to consolidate and strategically manage the nation’s cryptocurrency holdings.

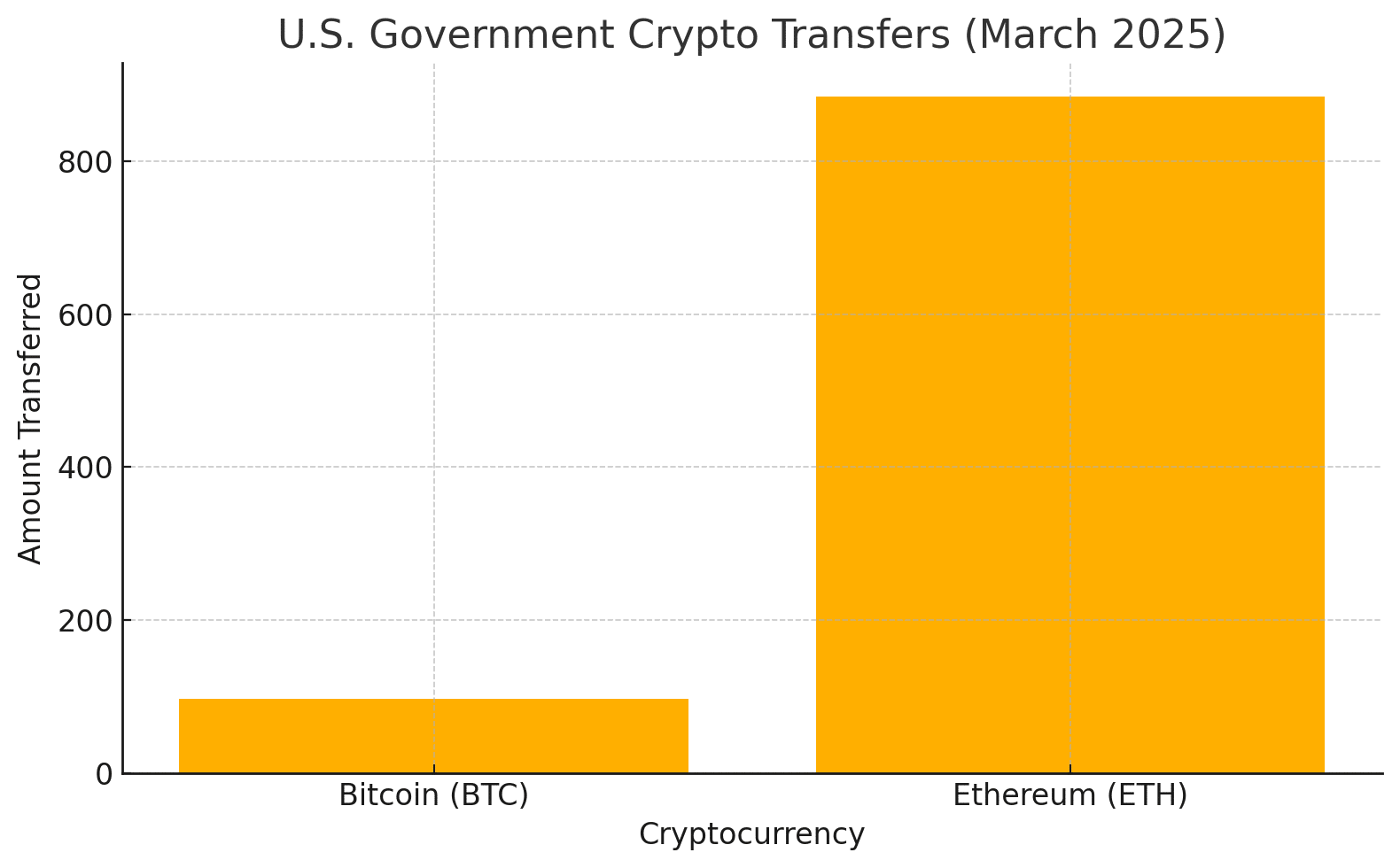

Breakdown of the Cryptocurrency Transfers

The recent transfers involved significant amounts of BTC and ETH. According to data from Arkham Intelligence, the U.S. government moved 97.34 BTC and 884.33 ETH. These assets, valued at approximately $10.23 million, were seized from individuals implicated in fraudulent activities and are now being reallocated in accordance with the new policy directives.

Strategic Bitcoin Reserve: A New Era in Digital Asset Management

On March 6, 2025, President Trump signed an executive order to establish the Strategic Bitcoin Reserve and the U.S. Digital Asset Stockpile. The reserve is designed to serve as a permanent repository for BTC assets seized by the government, ensuring they are maintained as strategic reserve assets. The U.S. Digital Asset Stockpile will similarly manage other digital assets obtained through forfeiture. This initiative reflects a significant shift in the government’s approach to digital currencies, recognizing their potential strategic value.

Historically, large-scale cryptocurrency movements by governmental bodies have led to market fluctuations. However, following this transfer, BTC’s price remained relatively stable, hovering around $86,600. This stability suggests that the market has absorbed the news without significant volatility, indicating a level of maturity and resilience in the cryptocurrency ecosystem.

Expert Insights on Governmental Crypto Holdings

Financial analysts are closely monitoring the implications of the U.S. government’s strategic accumulation of digital assets. Establishing the Strategic Bitcoin Reserve is viewed as a move that could influence market dynamics and investor confidence. Some experts believe that by holding substantial cryptocurrency reserves, the government may stabilize certain aspects of the market, while others caution that such actions could lead to increased regulatory scrutiny and potential market manipulation concerns.

Conclusion

The U.S. government’s recent transfer of $10 million in cryptocurrencies marks a pivotal moment in the integration of digital assets into national financial strategies. As the Strategic Bitcoin Reserve and the U.S. Digital Asset Stockpile take shape, stakeholders across the financial spectrum will be keenly observing the impacts on market stability, regulatory developments, and the broader acceptance of cryptocurrencies in mainstream finance.

FAQs

-

What is the Strategic Bitcoin Reserve?

The Strategic BTC Reserve is a U.S. government initiative established to serve as a permanent repository for Bitcoin assets seized through criminal or civil asset forfeiture proceedings. Its purpose is to strategically manage and maintain these assets as part of the nation’s financial reserves.

-

Why did the U.S. government transfer $10 million in cryptocurrencies?

The transfer was conducted to consolidate seized digital assets into the newly established Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, in line with President Trump’s executive order aimed at strategically managing the nation’s cryptocurrency holdings.

-

How did the market react to the government’s crypto transfer?

The market remained stable, with Bitcoin’s price holding around $86,600, indicating that the transfer did not cause significant volatility or impact investor sentiment.

-

Could this action lead to increased regulation of cryptocurrencies?

Potentially, as the government’s active involvement in the cryptocurrency market may prompt further regulatory scrutiny to ensure transparency, security, and stability within the digital asset space.

Glossary of Key Terms

Bitcoin (BTC): A decentralized digital currency that enables peer-to-peer transactions without the need for a central authority.

Ethereum (ETH): A decentralized platform that facilitates smart contracts and decentralized applications (DApps), powered by its native cryptocurrency, Ether.

Strategic Bitcoin Reserve: A U.S. government-established repository for seized Bitcoin assets, aimed at strategically managing and maintaining these digital assets as part of the nation’s financial reserves.

U.S. Digital Asset Stockpile: A collection of various digital assets, other than Bitcoin, seized by the U.S. government through forfeiture, managed strategically under the directives of the executive order.

Asset Forfeiture: A legal process wherein the government seizes assets from individuals or entities involved in criminal activity, transferring ownership to the state.

Market Volatility: The degree of variation in the price of a financial instrument over time, indicating the level of uncertainty or risk associated with price changes.

Sources

Read More: Massive U.S. Bitcoin and Ethereum Move Spotted — Is a Crypto Power Play Underway?">Massive U.S. Bitcoin and Ethereum Move Spotted — Is a Crypto Power Play Underway?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.