Bitcoin Whale Dump Sends 115K BTC Into Market: Is More Pain Ahead?

0

0

According to recent market data, the latest bitcoin whale dump has sent ripples through the crypto market, raising questions about its short and long-term impact. Whales offloaded more than 115,000 BTC in a single month, the heaviest unloading since mid-2022.

Traders and institutions are watching closely, wondering if this signals weakness or a new opportunity.

Bitcoin Whale Activity at a Glance

It was a week where whales moved over 95,000 BTC. This operation of bitcoin whale dumping not only forced prices down but also demonstrated the significant influence a few large players still wield. Thus, this round of selling pushed Bitcoin into the $108,000-$110,000 band, forcing small traders to run for cover.

23,000 BTC was dumped by another whale on August 25, which set off a flash crash. Billions of dollars of open interest were wiped out within hours as the coin tumbled by about $4,000. Yet, this whale still possesses more than 152,000 BTC, a stark reminder of just how much concentrated ownership can rattle the markets.

Also read: Bitcoin Whales Rotate Billions into Ethereum as ETF Inflows Explode

Why Whales Matter

Whales wallets holding between 1,000 and 10,000 BTC, remain the most powerful market force.

As analysts often say, “When a whale sneezes, the market catches a cold.”

The latest bitcoin whale dump shows how liquidity can evaporate when big wallets move billions.

In the meantime, as whales were selling BTC, institutional buyers were quietly adding some through the exchange-traded funds. This tug-of-war highlights the delicate balance between profit-taking by whales and long-term accumulation by funds and corporates.

Ethereum Rotation

Another twist emerged when some proceeds from the bitcoin whale dump flowed into Ethereum. Reports confirmed leveraged ETH long positions worth hundreds of millions were opened shortly after.

According to on-chain data, this points to a strategy where whales hedge or seek better short-term returns in competing assets.

Market Impact: Charts and Data

- BTC sold by whales in 30 days: 114,920 BTC

- Value of sell-off: $12.7 billion

- Price reaction: BTC dipped below $110,000

- Flash crash: Triggered by a 24,000 BTC dump

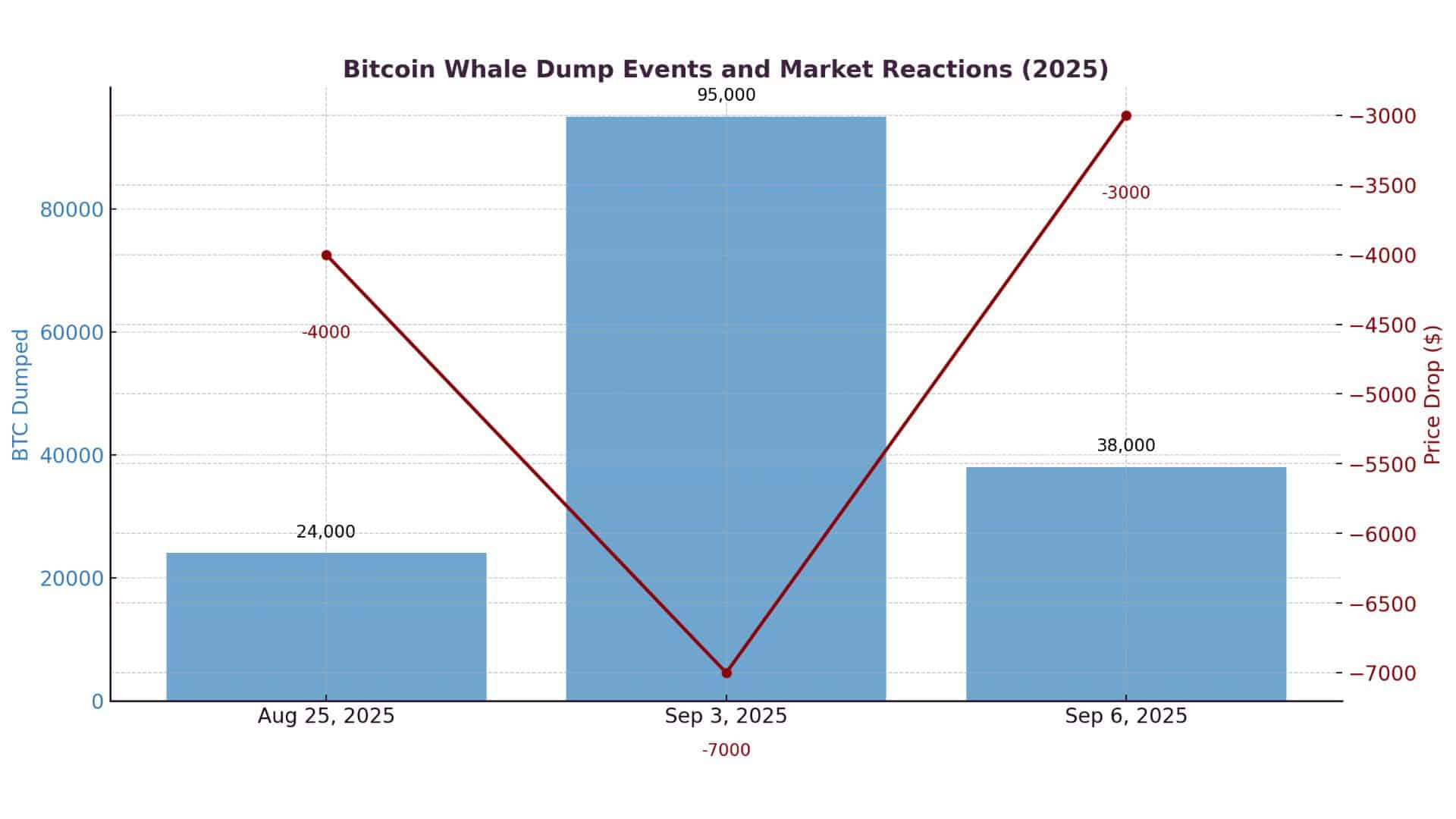

| Event Date / Week Ending | BTC Dumped | Price Reaction |

|---|---|---|

| Aug 25, 2025 | 24,000 | Flash crash triggered a $4,000 drop |

| Sep 3, 2025 | ~95,000 | Largest weekly whale movement in years |

| Sep 6, 2025 | ~38,000 | Whale activity slowed |

Conclusion

Based on the latest research, bitcoin whale dump trends suggest more volatility ahead. It scares short-term traders, flattens selling pressure, but upsurges purchases by institutional investors, making it a balanced opportunity for both.

Therefore, the dimension to imbibe is that, in fact, movements by whales often mean a change of strategies, like going from one cycle to another, rather than ceasing a cycle altogether. Cast your sight over these patterns, and it’s an absolute prep course for the next market swing for most traders.

Also read: $9.5B Bitcoin Whale Transactions Spark Panic and Opportunity

Summary

The latest bitcoin whale dump marks the largest sell-off since 2022, with over 115,000 BTC offloaded in a month. On August 25, a 24,000 BTC dump triggered a flash crash, cutting prices by $4,000. September also saw heavy weekly turnover.

While whale activity sparks sharp declines, institutions continue accumulating. Tracking these moves helps traders manage volatility and prepare for both risks and entry points in the Bitcoin market.

Glossary of Key Terms

Whale: An entity holding large amounts of Bitcoin.

Dump: A rapid, large-scale sale of an asset.

Liquidity: The ease with which an asset can be bought or sold.

Flash Crash: A sudden and steep price drop in a short time.

FAQs for Bitcoin Whale Dump

Q1: What is a bitcoin whale dump?

A bitcoin whale dump occurs when large holders sell significant amounts in a short period, causing the market to shake.

Q2: Why do whales sell?

They sell for profit-taking, portfolio shifts, or to rotate into assets like Ethereum.

Q3: How does a whale dump affect small traders?

It can cause sudden price drops, liquidations, and panic selling.

Q4: Can whale dumps be predicted?

Not precisely, but on-chain wallet monitoring often gives early warnings.

Read More: Bitcoin Whale Dump Sends 115K BTC Into Market: Is More Pain Ahead?">Bitcoin Whale Dump Sends 115K BTC Into Market: Is More Pain Ahead?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.