Bitcoin and Ethereum ETFs See Massive Outflows as Prices Continue Declining

0

0

Highlights:

- Bitcoin ETFs faced $523 million in outflows, led by Fidelity’s FBTC fund.

- Spot Ether ETFs recorded $422.3 million in withdrawals, marking the second-largest daily outflows.

- Bitcoin and Ether declined as traders took profits ahead of key upcoming economic events.

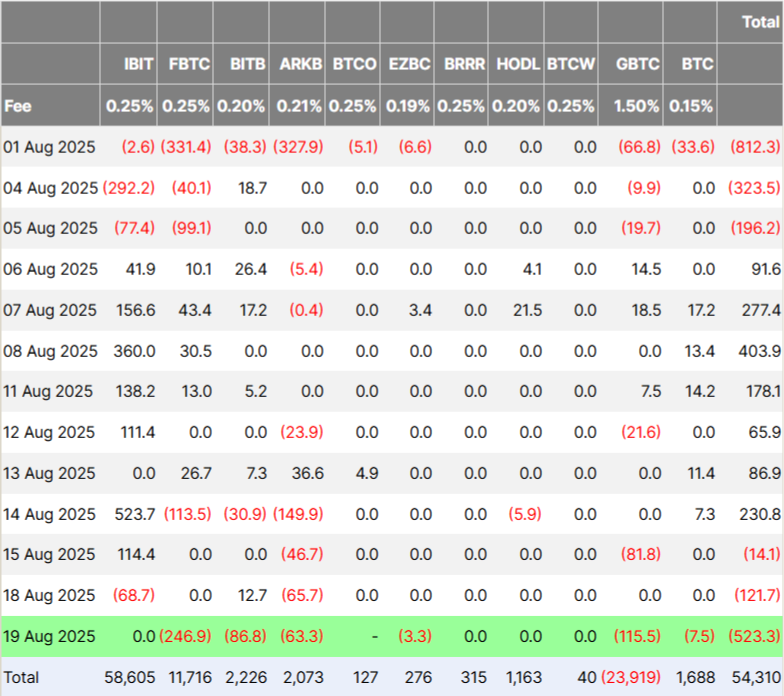

On Tuesday, U.S. spot Bitcoin and Ether exchange-traded funds (ETFs) recorded heavy net outflows as large investors adjusted their positions before upcoming macroeconomic events. As per data from Farside, Bitcoin ETFs faced combined daily outflows of $523 million, not including data from Invesco’s BTCO, which has not yet been released.

Fidelity Wise Origin Bitcoin Fund (FBTC) recorded outflows of $246.9 million on Tuesday, while Grayscale Bitcoin Trust ETF (GBTC) experienced withdrawals totaling $115.53 million. Funds managed by Bitwise, Ark, and 21Shares also experienced significant investor withdrawals. In contrast, BlackRock’s iShares Bitcoin Trust (IBIT) remained unchanged, showing no activity in flows during the day.

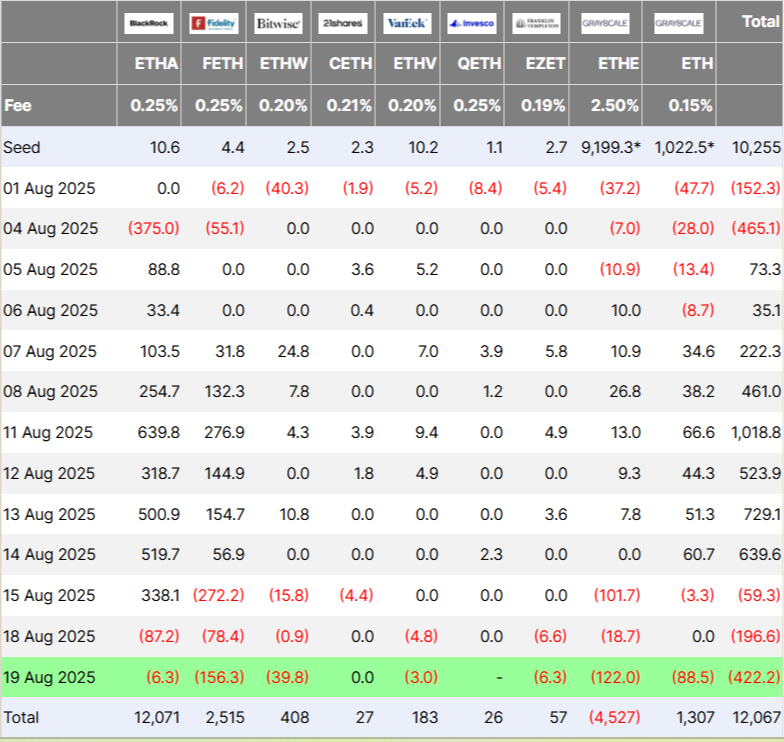

Spot Ether ETFs saw total outflows of $422.3 million, led by Fidelity’s FETH fund, which alone faced $156.32 million in withdrawals. Grayscale Ethereum Trust ETF (ETHE) saw $122 million in outflows, and the Grayscale Ethereum Mini Trust ETF (ETH) recorded $88.5 million leaving the fund. These withdrawals marked the second-biggest daily net outflows for spot Ether ETFs since their launch.

Crypto Fear and Greed Index Signals Growing Investor Caution

Bitcoin and Ether funds faced three straight days of outflows worth $1.3 billion. The recent three-day outflows may not match the record-breaking inflows Bitcoin and Ether funds saw in 2025. Still, the withdrawals highlight a clear change in investor mood as prices continue to drop. On Wednesday, the Crypto Fear and Greed Index, which tracks market sentiment, moved into the “Fear” zone with a score of 44. This shift comes after a long stretch of optimism, showing investors are now becoming more cautious.

Bitcoin and Ether Decline as Traders Watch Fed Events

Bitcoin and Ether fell further as traders booked profits from the recent market rally and prepared for upcoming economic events. Data from CoinMarketCap showed Bitcoin declining 3% to $113,235, with intraday lows reaching $112,710. Ether slipped 5% to $4,104 by 9:00 p.m. on Tuesday.

Vincent, CIO of Kronos Research, said Bitcoin’s price is under pressure from profit-taking. He added that leveraged liquidations are also weighing on the market after its recent all-time high. Traders had hoped the U.S. Federal Reserve would cut interest rates in September. However, last week’s higher-than-expected producer price index (PPI) weakened market confidence somewhat. Market Committee meeting minutes released today. Investors are also keeping an eye on Fed Chair Jerome Powell’s Jackson Hole speech on Friday.

Retail crypto traders seem to have turned negative after Bitcoin fell below $113,000, hitting a 17-day low. Santiment analysts said traders changed their mood when Bitcoin couldn’t bounce back from the drop. They added that social media reflected the most intense negative mood in a single day since June 22, when Middle East war fears triggered mass panic selling. The firm added that very negative sentiment can create buying opportunities for investors, especially when fear is high. Short-term retail traders tend to sell quickly or take profits, unlike long-term “diamond-handed” investors. Santiment noted that this panic selling could indicate a potential bounce after the dip.

Retail traders have done a complete 180 after Bitcoin has failed to rally and dipped below $113K. The past 24 hours have marked the most bearish sentiment seen on social media since the June 22nd fears of war caused a cascade of panic sells.

Historically, this negative… pic.twitter.com/UYKOpWoOkn

— Santiment (@santimentfeed) August 20, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.