Did Aave and CoinDesk Change the DeFi And Stablecoin Game with CDOR?

0

0

Aave and CoinDesk Indices are launching CDOR, an onchain benchmark for stablecoin interest rates, starting with USDT and USDC. Built on Aave V3 data, CDOR could redefine DeFi, mirroring SOFR in TradFi.

The United States is keen on ensuring stablecoins backed by Treasuries thrive. With the passage of the GENIUS Act in the Senate, Congress now has to debate and is highly likely to approve the bill.

Despite some lawmakers, including Elizabeth Warren, arguing that certain amendments to the GENIUS Act were not considered, the bill has garnered bipartisan support. If passed in Congress, it will create a framework enabling companies to launch stablecoins with clarity on their legal standing.

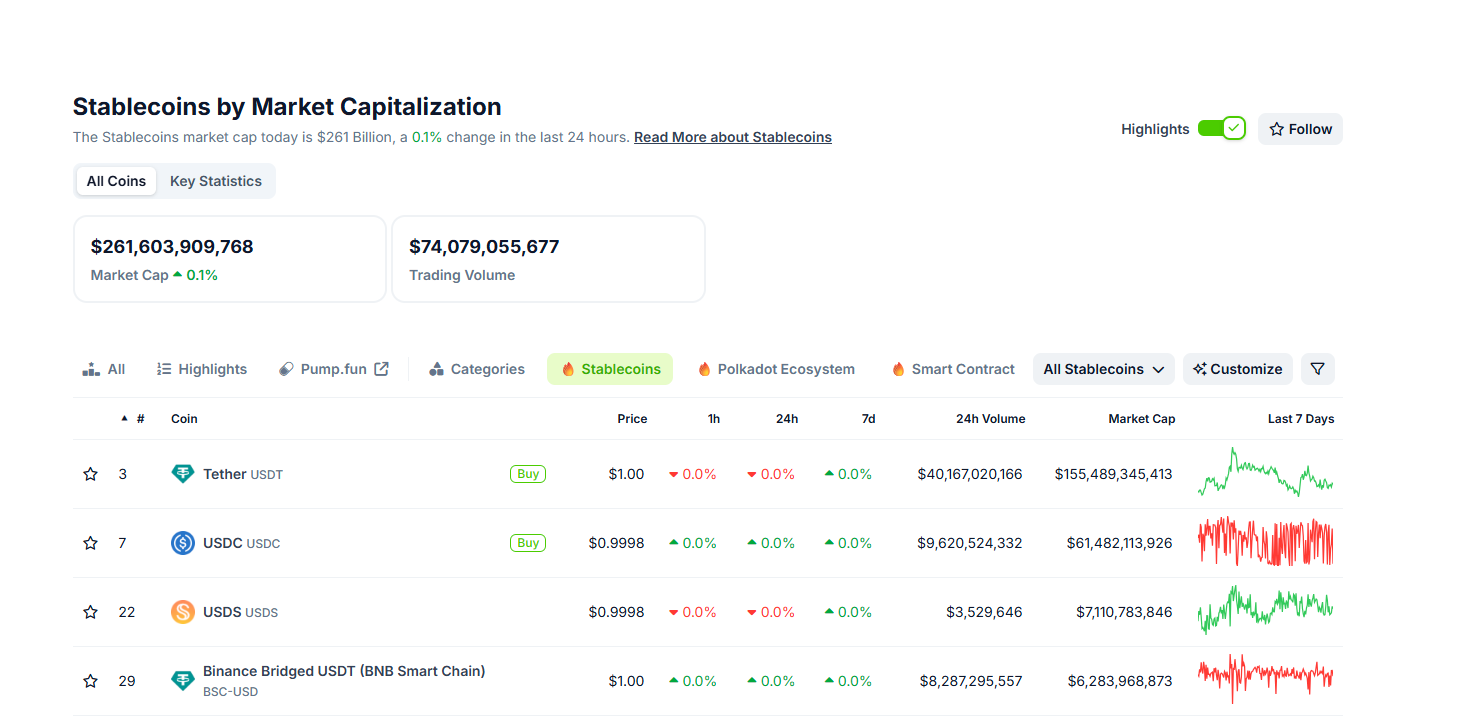

Presently, the stablecoin market is growing, even allowing investors to buy some of the next 1000X cryptos. As of June 18, the total market cap of all stablecoins was more than $261 billion.

(Source)

USDT, the first stablecoin, remains the largest, with over $155 billion in market cap. It is way more valuable than all of the best cryptos to buy, excluding BTC ▼-1.85%

ETH ▼-1.51%

USDC by Circle, which recently went public and listed on the NYSE, is the second largest, with over $61 billion.

Algorithmic stablecoins, such as USDS and Ethena Labs’ delta-neutral USDE, are also popular among yield-seeking investors.

DISCOVER: 9 Best Crypto Presales to Invest in June 2025 – Top Token Presales

Aave Partners With CoinDesk To Launch CDOR: What Does It Mean?

Recognizing that stablecoins are integral to crypto and power DeFi, primarily on Ethereum, CoinDesk Indices partnered with Sentora (formerly IntoTheBlock) and Aave, the largest DeFi protocol by total value locked (TVL), to launch the CoinDesk Overnight Rates (CDOR).

CDOR is the first institutional-grade on-chain benchmark interest rate for stablecoins, initially supporting USDT and USDC.

The tracker draws real-time borrowing activity from Aave V3’s variable-rate lending pools, making overnight interest rate pricing in DeFi more transparent and creating a standardized framework. Updates to overnight interest rates will be published daily.

In a press release, Stani Kulechov, founder of Aave Labs, said CDOR provides “a transparent, risk-free lending rate” to unlock new stablecoins use cases. He expects innovators to develop complex derivatives and fixed-income products, enhancing DeFi market efficiency.

Anthony DeMartino, CEO of Sentora, noted that CDOR enables users to “switch from floating to fixed funding or speculate on the curve in a single, capital-efficient trade; a crucial building block missing for years.”

DISCOVER: Best Meme Coin ICOs to Invest in 2025

A New Era for DeFi?

CDOR effectively creates a DeFi equivalent of SOFR and CORRA, which is used in traditional finance (TradFi).

Due to transparency concerns and the “subjectivity” of LIBOR, it was replaced by SOFR and CORRA in 2023. Like SOFR and CORRA, CDOR is risk-free and transparent, relying on actual transaction data rather than subjective estimates.

Uniquely, CDOR draws all data from on-chain sources, specifically Aave V3 pools, eliminating counterparty risk, unlike SOFR and CORRA, which are collateralized and exposed to TradFi.

CDOR addresses a major DeFi challenge: the lack of a standardized, reliable funding benchmark.

Without such a benchmark, institutions struggled to hedge borrowing costs or structure interest rate products, limiting DeFi’s ability to attract billions in institutional capital.

It remains to be seen whether CDOR will succeed. Rapid adoption could lead to an explosion in DeFi liquidity as new products emerge.

Galaxy, FalconX, and Tyr Capital are early backers, signaling strong institutional interest in leveraging the potentially multi-trillion-dollar stablecoin market.

DISCOVER: Next 1000x Crypto – 10 Coins That Could 1000x in 2025

Aave CoinDesk Releases CDOR For DeFi and Stablecoins

- Aave and CoinDesk releases CDOR

- The Stablecoin market now exceeds $262 billion

- CDOR mirrors SOFR and CORRA in tradFi

- Will CDOR change the DeFi game with new use cases?

The post Did Aave and CoinDesk Change the DeFi And Stablecoin Game with CDOR? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.