Bitcoin Soars Past $112K as Fed Flags Tariff-Led Inflation: Can Bulls Push to $120K?

0

0

Bitcoin price climbed beyond the key $112,000 mark this week as the Federal Reserve warned of ongoing inflation threats caused by US tariffs. The digital asset’s breakthrough, driven by a combination of macroeconomic strain and technical momentum, is a big milestone for optimistic investors. With ETF inflows remaining high and market mood altering, many are wondering whether Bitcoin could hit $120K next.

“Bitcoin is behaving like a hedge against central bank uncertainty,” said Charles L. Allen, BTCS CEO. “Investors are rotating into hard assets amid signs the Fed may not pivot as soon as expected.”

A Quick Look Back: How Bitcoin Price Built Toward This Rally

Bitcoin’s present strength follows a months-long upswing that started in early 2025, when institutional demand surged after the approval of various spot Bitcoin ETFs. The creation of these ETFs provided mainstream exposure to Bitcoin, attracting additional cash from pension funds, wealth managers, and individual investors alike.

Earlier this year, Bitcoin stayed around $85,000 until surpassing $100,000 in late Q2. Tariff news started to influence market volatility in June, particularly when former President Donald Trump said that U.S. interest rates were “300 basis points too high.” As global markets wobbled, Bitcoin gradually gained traction.

“The move above $110K was inevitable,” said CryptoQuant analyst Juan Rios. “The longer-term structure pointed to a breakout amid falling dollar strength and high ETF inflows.”

Technical Outlook and Bitcoin Price Analysis: Bulls Take the Lead

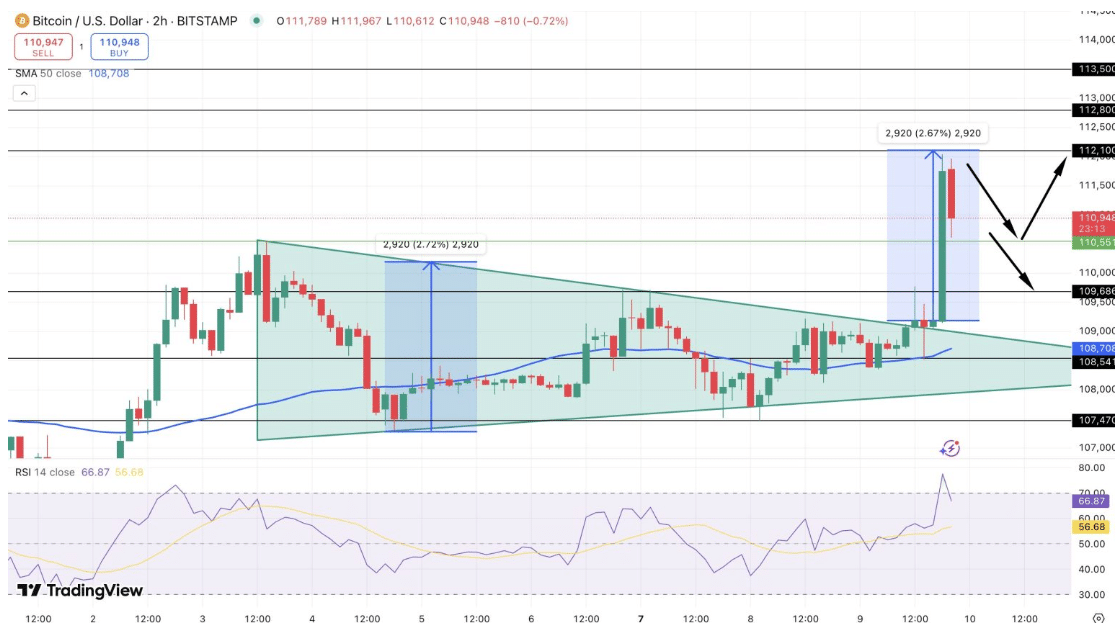

The current breakout comes after BTC formed a bullish symmetrical triangle pattern on the daily chart, a classic continuation structure. With RSI trending near 65 and the 20-day moving average pointing sharply upward, momentum remains strong.

| Date | Bitcoin Price (USD) |

|---|---|

| July 1, 2025 | $108,950 |

| July 8, 2025 | $110,420 |

| July 10, 2025 | $112,070 |

Analysts are watching key resistance at $113,000, followed by a psychological barrier at $115,000. Short-term support lies near $110,500.

“Unless Bitcoin dips below $109K with high volume, the trend remains intact,” said AvaTrade’s lead strategist Paul Rosenberg. “There’s a strong case for $120,000 by late July.”

Global Market Backdrop

The Fed’s most recent meeting minutes raised fears that tariff-related expenses might spark inflation, postponing any future rate decreases. Global stock markets were shaken by the news, but Bitcoin remained solid, cementing its position as a macro hedge.

Meanwhile, institutional inflows into Bitcoin ETFs continue strong. According to CryptoSlate, more than $75 million was invested in U.S.-based spot ETFs on July 8 alone. According to Reuters, the Brazilian real plummeted when Trump announced tariffs, but Bitcoin increased by 2.7%, demonstrating its dissociation from conventional markets.

Trump Media’s latest ETF registration, which made news as well, fueled the flames. When combined with more retail participation and a supportive regulatory tone, the BTC surge looks to have multi-layered support.

Expert Views and What Lies Ahead for Bitcoin

Analysts remain cautiously optimistic. If Bitcoin remains over $110,000 for the next week, a rally to $120,000 is likely, especially if the Fed softens its attitude in subsequent meetings.

“Bitcoin price prediction is now about managing volatility,” said Bitwise CIO Matt Hougan. “We’re seeing a perfect storm of retail interest, institutional commitment, and macro dislocations.”

Retail traders on Binance and Coinbase have also boosted their leverage longs, according to Deribit data, indicating confidence. However, with resistance near $113K and larger economic risk, traders are recommended to exercise caution.

Conclusion: Bitcoin’s Resilience Reinforces Long-Term Bull Case

Bitcoin’s breakthrough of $112,000 despite geopolitical and monetary instability strengthens its position as a robust digital asset. If support zones hold and ETF demand remains strong, “Bitcoin price prediction” might soon include six-figure objectives much above the current top.

BTC is an important allocation for investors seeking long-term value, particularly as conventional assets become more volatile.

FAQs

Q1: Why is Bitcoin rising now?

Due to ETF inflows, Fed’s inflation concerns, and investor flight from fiat assets.

Q2: What is the next resistance level?

$113,000 followed by $115,000.

Q3: Can Bitcoin reach $120K soon?

If support holds and macro conditions remain favorable, $120K is a likely target by late July.

Q4: Is Bitcoin reacting to U.S. tariffs?

Yes, BTC is behaving as a macro hedge against inflation triggered by tariff policy.

Glossary

Bitcoin ETF: An exchange-traded fund that tracks Bitcoin’s price.

RSI (Relative Strength Index): A momentum indicator used to assess if Bitcoin is overbought.

Tariff Inflation: Price increases caused by import taxes or trade policies.

Symmetrical Triangle: A chart pattern indicating price consolidation before a breakout.

Support/Resistance: Key price levels where assets tend to bounce or reverse.

Sources

Read More: Bitcoin Soars Past $112K as Fed Flags Tariff-Led Inflation: Can Bulls Push to $120K?">Bitcoin Soars Past $112K as Fed Flags Tariff-Led Inflation: Can Bulls Push to $120K?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.