Ethena Crypto is Expanding Its Team: Could You Be The Future of USDe?

0

0

How’s your mental health 99Bitcoins fam? Not good? Great? Well for the Ethena crypto it’s been a rollercoaster of a year.

After two quiet years, the team behind USDe, the third-largest stablecoin on the planet, is gearing up for something big. Co-founder Guy Young confirmed on X that Ethena is expanding its staff by nearly+ 50%, the first major hiring push since launch.

The move hints at new products in the pipeline and a broader attempt to tighten Ethena’s grip on decentralized finance.

DISCOVER: Top 20 Crypto to Buy in 2025

Ethena Crypto Expansion Marks a Turning Point: Is It About to Rocket?

After maintaining a team of roughly 20–25 contributors since 2023, Ethena will add about 10 new hires across engineering, product, and business development.

“We are expanding the team meaningfully for the first time with 10 new roles across engineering and product for two entirely new business lines and products,” Young said.

Ethena $ENA might be printing a higher high! If confirmed, a run to $1.30 is on the table. pic.twitter.com/v6rtCcIm4K

— Ali (@ali_charts) October 16, 2025

Both of these initiatives have the potential to be the size of USDe.

The company’s job listings include openings for a Head of Security, Senior Backend Engineer, and several DeFi and Trading Engineers, along with new business development and design roles.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Institutional Momentum Builds Around Ethena: What Does The Data Say For ENA?

Ethena’s upcoming products will build on its stablecoin ecosystem of USDe and USDtb, both designed to maintain on-chain price stability without direct fiat backing. The new initiatives, expected to roll out within three months, could create parallel product lines comparable in size to USDe, which already sits among the top-tier stable assets in DeFi.

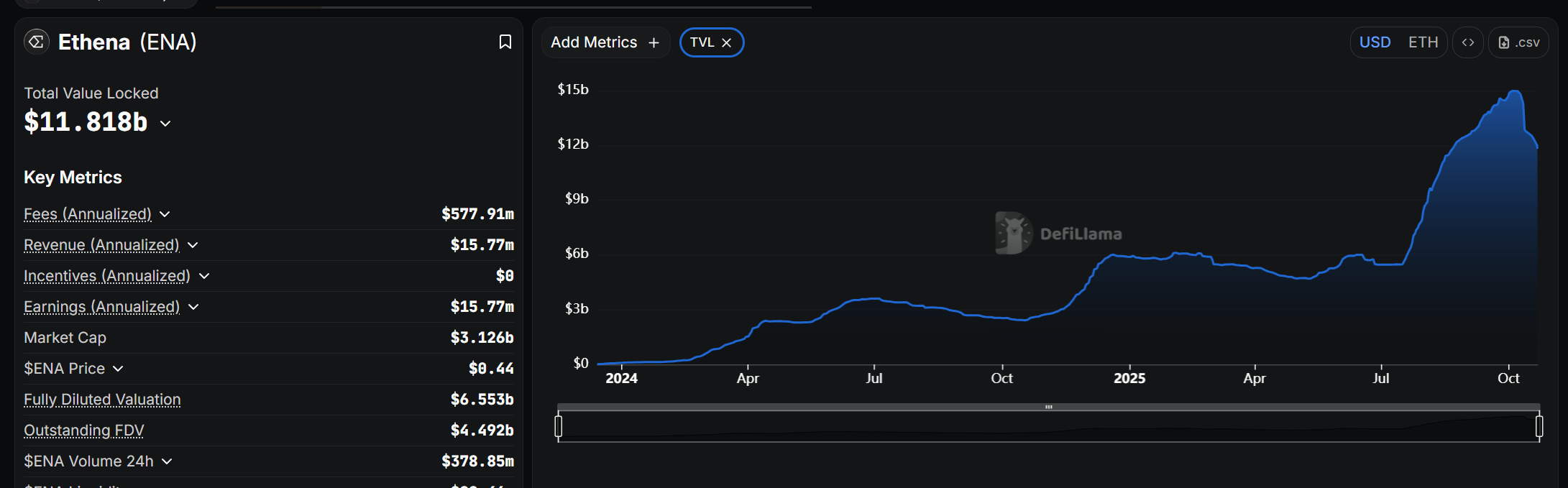

According to DeFi Llama, Ethena’s total value locked (TVL) has risen to nearly $11.8 Bn, up more than 18% month-over-month, driven by integrations across Ethereum Layer-2s and Solana-based liquidity venues.

Ethena’s reputation has grown in lockstep with its backers, Binance Labs, Dragonfly, Fidelity, and Franklin Templeton, names that usually don’t fund vaporware. Its reach deepened further in September when M2 Capital, the UAE-based investment arm of a digital asset conglomerate, came on board as a strategic partner, expanding Ethena’s global footprint.

Momentum is already spilling into other networks. Solana’s top aggregator, Additionally, Jupiter, plans to roll out its new stablecoin JupUSD through Ethena’s infrastructure.

A Broader Trend Toward Synthetic Dollar Dominance

As regulatory scrutiny continues around traditional stablecoins like USDT and USDC, Ethena’s “synthetic dollar” model has gained traction. Data from CoinGecko shows trading volumes for USDe have surged more than 25% in the past month, with daily volumes averaging $220 million.

Ethena’s expansion reflects more than growth but a bet on the future of programmable dollars.

EXPLORE: Now That the Bull Run is Dead, Will Powell Do Further Rate Cuts?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- How’s your mental health 99Bitcoins fam? Not good? Great? Well for the Ethena crypto it’s been a rollercoaster of a year.

- Ethena’s expansion reflects more than growth but a bet on the future of programmable dollars.

The post Ethena Crypto is Expanding Its Team: Could You Be The Future of USDe? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.