Ripple’s XRP Sees ETF Boom With 3x Leveraged Products and $500M in Assets

0

0

The XRP leveraged ETF market is gaining substantial traction as traders look for amplified exposure to Ripple’s token. The latest filings and fund flows indicate that this is not a passing trend but a sign of structural change in how XRP is traded and held.

New Funds, Bigger Stakes

ETF issuers have recently filed for 3x Long and 3x Short XRP leveraged ETF products, allowing investors to multiply XRP’s daily gains or losses without using derivatives directly. These products complement existing futures-based offerings such as Teucrium’s 2x Long XXRP ETF and ProShares’ Ultra XRP ETF (UXRP).

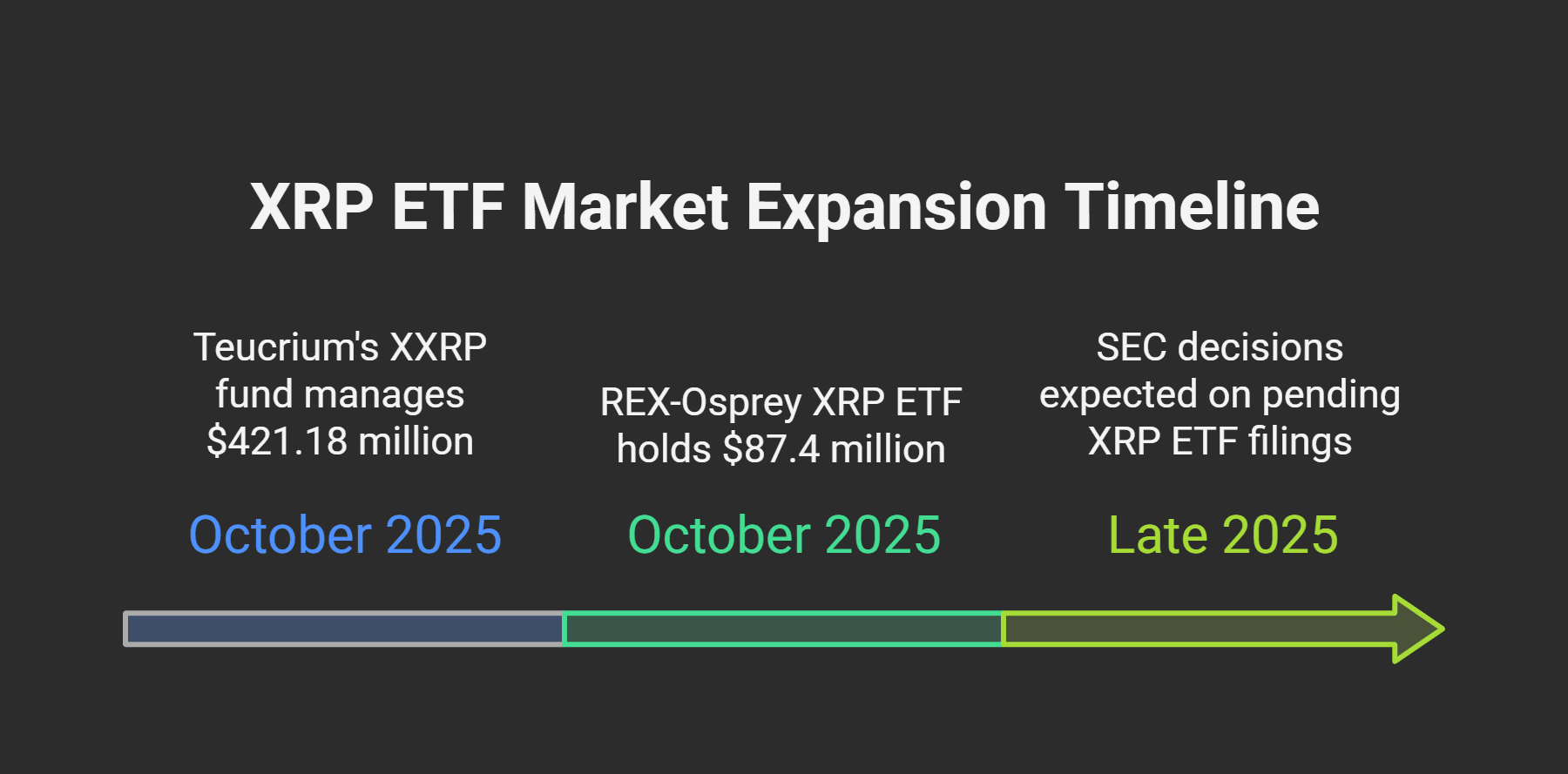

As of October 2025, Teucrium’s XXRP fund manages about $421.18 million in assets, with a unit price near $37.21. The REX-Osprey XRP ETF (XRPR), a live spot fund in the United States, holds approximately $87.4 million in assets. This growth reflects the increasing demand for regulated XRP-based investment tools among both institutional and retail investors.

Several other issuers, including Grayscale, Bitwise, CoinShares, and WisdomTree, have pending XRP ETF filings awaiting U.S. SEC decisions, which are expected by late 2025.

Also Read: Leveraged Solana and XRP ETFs Surge to $3B as SEC Decision Looms

Derivatives Growth and Open Interest Trends

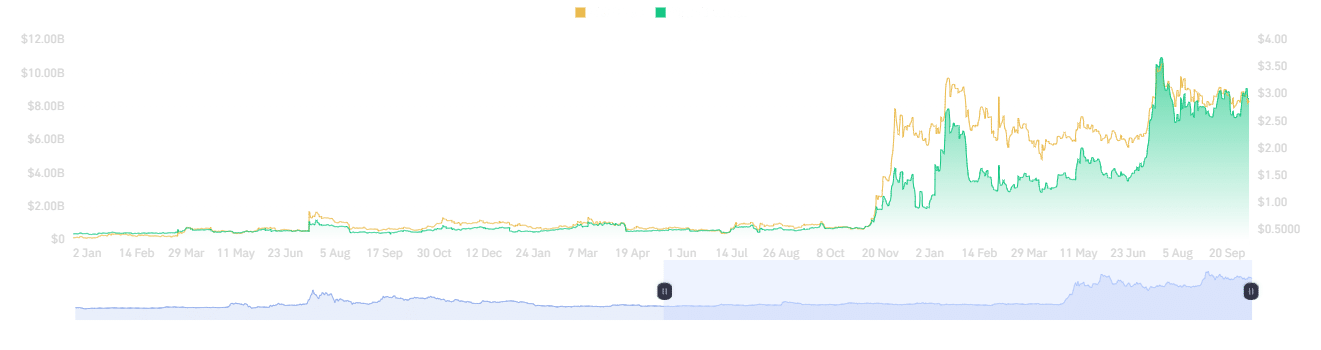

The derivatives market reflects similar enthusiasm. CoinGlass data indicates that XRP futures open interest stands at around $8.47 billion, while daily trading volumes consistently exceed $7 billion across exchanges.

Another official source reports that XRP’s spot price has hovered between $2.83 and $2.86, with support forming near the $2.85 mark. This combination of high derivative activity and steady price levels indicates an increasingly liquid and mature market environment.

The consistency in open interest also shows that leveraged positioning in XRP is no longer a fringe activity. Institutional desks and active traders appear to be using leveraged instruments to express both bullish and defensive strategies.

What This Means for XRP’s Market Structure

The rise of XRP leveraged ETF products is adding new depth to the market. Spot holders anchor stability, derivatives traders boost liquidity, and ETF investors gain regulated access without needing crypto wallets.

Leveraged ETFs come with risks such as volatility decay and compounding losses, so they are better suited for short-term use rather than long-term holds. Still, they connect traditional finance with crypto, drawing more traders into XRP through familiar tools.

If the SEC approves spot XRP ETFs, leveraged funds could become more mainstream. Together, spot growth, derivatives, and ETFs are helping to shape a more mature XRP market.

Conclusion

Based on the latest research, the growth of XRP leveraged ETFs marks a key moment for Ripple’s token. With billions in futures positions and growing ETF assets, XRP is gaining credibility as a structured financial asset.

If regulators approve more ETFs, XRP’s focus may shift from speculation to stability. Its expanding mix of leveraged and spot markets could strengthen its position as one of the crypto sector’s most established assets.

For expert insights and the latest crypto news, visit our platform.

Summary

The XRP leveraged ETF market is expanding quickly as traders explore new 3x long and short funds. With over $8 billion in futures open interest and $500 million in ETF assets, XRP’s market now looks more structured and liquid than ever. Leveraged ETFs are reshaping access to Ripple’s token by connecting crypto’s volatility with the discipline of regulated finance.

Glossary of Key Terms

- ETF: A fund that tracks an asset and trades on exchanges like a stock.

- Leveraged ETF: A product designed to multiply the daily returns of an underlying asset.

- Open Interest: The total value of active futures or options contracts.

- Volatility Decay: Loss in performance over time due to daily rebalancing in volatile markets.

FAQs About XRP Leveraged ETF

1. What is an XRP leveraged ETF?

It’s a fund that amplifies XRP’s daily price movements, often by a factor of 2x or 3x, providing traders with higher short-term exposure.

2. Is an XRP leveraged ETF suitable for long-term holding?

No. Leveraged ETFs are best for short-term strategies due to daily compounding and volatility drag.

3. How does it differ from a regular XRP ETF?

A standard XRP ETF mirrors the token’s daily price. A leveraged version magnifies those moves, offering greater risk and reward.

4. What are the current XRP figures?

Futures open interest stands at nearly $8.44 billion, with ETF assets totaling approximately $508 million, and XRP trading around $2.85.

Read More: Ripple’s XRP Sees ETF Boom With 3x Leveraged Products and $500M in Assets">Ripple’s XRP Sees ETF Boom With 3x Leveraged Products and $500M in Assets

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.