XRP ETF Hits Exchanges So Why Is the Price Still Crashing Below $2?

0

0

This Article was first published on The Bit Journal.

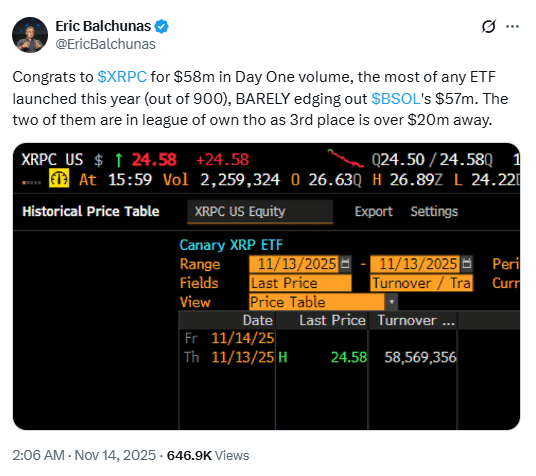

The XRP ETF hit the trading floor as U.S. investors gained a regulated way to access the token. According to the source, the product opened with substantial volume and low fees. Yet the token traded near $1.96, slipping below the key $2 level despite the headline launch.

This move means the token is now entering a new phase not just as an ecosystem and digital asset but rather into something more institutional. The question now is whether the ETF will drive new demand, or other sources will restrain prices in general?

What the Launch Means: Strong Foundation, Quiet Start

Institutional Access Finally Arrives

The XRP ETF offers U.S. investors direct exposure to the token through a trust structure. The fund launched with a 0.34% management fee, waived for the first month on the first $500 million in assets.

Day-one volume topped $22 million, according to the source.

That marks genuine interest from early adopters and asset allocators.

Token Price Moves Tell a Different Story

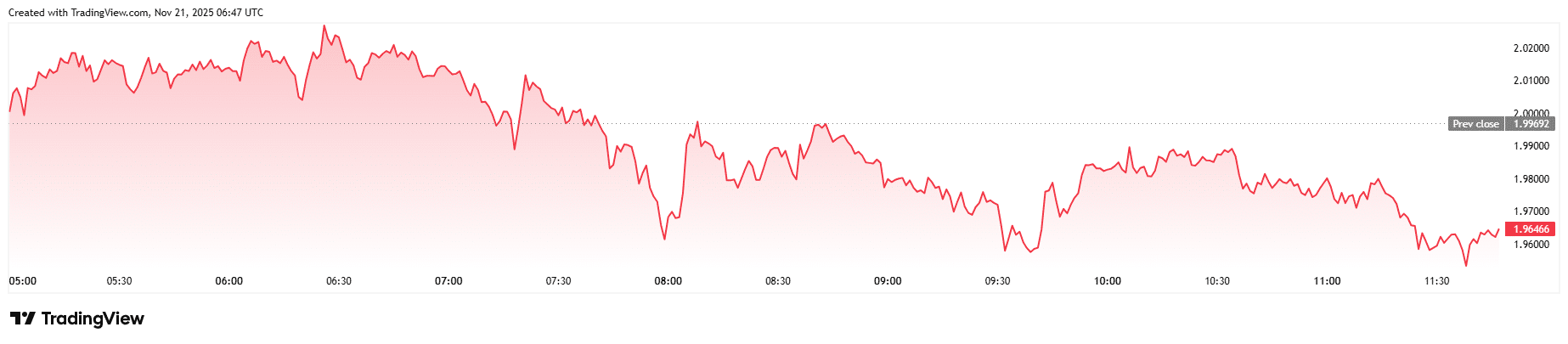

Although there was now another way for people in the United States to buy the ETF, the price of XRP remained under pressure. The token had dropped more than 7% in just one day and was nearly 18% lower over the past week as it fell under $2.00 overall.

Analysts point to heavy whale selling and macro headwinds.

“ETF approvals are a strong confidence signal, but they don’t guarantee a price jump.”

With large holders offloading and broader crypto equities weakening, the token faces short-term hurdles.

Price Chart and Data Snapshot

| Indicator | Latest figure |

|---|---|

| XRP token price | ~ $1.96 |

| Day-one ETF volume | ~ $22 million |

| Management fee (XRP ETF) | 0.34%, waived month one for first $500 m. |

| Token profit-holding share | ~ 58.5%, lowest since Nov 2024 |

Why Price Didn’t Surge

Macro and Market Pressure

The launch came amid a crypto market pull-back. The source reports heavy liquidations across primary tokens tied to the broader drop.

Even strong ETF headlines failed to offset the broader risk-off mood.

ETF ≠ Instant Token Demand

While the XRP ETF provides regulated access, the creation of new shares doesn’t always result in an immediate purchase of tokens. Secondary trading and hedging can mute the token correlation.

That explains why the token price lagged despite the fund’s strong debut.

Large Holder Activity

On-chain data shows significant volumes being moved or sold by large wallets. When big holders act, even an ETF launch can struggle to spark a rally.

What to Watch Going Forward

- Institutional Flow Timing: The ETF’s early volume is promising, but sustained inflows will drive real change.

- Support Level at $1.95–$2.00: Holding this zone matters. A breakdown may push the token down toward ~$1.75.

- Regulatory & Macro Signals: Rate decisions, crypto policy shifts, and global risk appetite will influence the token more than ETF headlines.

- Whale Behavior: Continued heavy selling could overwhelm the “legitimacy boost” from the ETF.

Conclusion

The XRP ETF launch marks a step forward for token access in regulated markets. Yet the token’s drop near $2 underscores that infrastructure advancement does not guarantee an immediate price rebound.

A slower-burn dynamic may play out: institutional flows and market sentiment will decide the next leg. For now, the story isn’t about hype but about adoption taking place under market pressure.

Glossary of Key Terms

- ETF (Exchange Traded Fund): An investment fund that is listed on a stock exchange and mirrors the price of an individual asset or a group of assets.

- Spot ETF: A category of ETF that owns the physical asset (tokens in this case) instead of derivatives such as futures contracts.

- Whales: Large holders of a cryptocurrency who can impact the market price with their trades.

- Seed Capital: Initial funding used to start a fund before it grows via investor inflows.

- Liquidation: Forced closing of leveraged positions, often triggered by price drops.

FAQs About XRP ETF

1: What is the difference between the token and the ETF?

The token is the digital asset itself. The ETF provides regulated exposure to the token through a trust structure, without the investor directly purchasing the coin.

2: Will the XRP token price immediately rise because of the ETF?

Not necessarily. Infrastructure upgrades like the ETF are positive, but price moves also depend on demand, market sentiment, and macro factors. The recent drop to near $2 illustrates the gap.

3: Does the ETF guarantee institutions will buy XRP?

No. It clears a regulatory path but doesn’t guarantee immediate, large-scale institutional capital. Many institutions wait and see before making sizable allocations.

4: What level should XRP hold for a potential rebound?

Many traders see the ~$2.00 mark as key. Losing that support could push the token toward ~$1.75.

References

Read More: XRP ETF Hits Exchanges So Why Is the Price Still Crashing Below $2?">XRP ETF Hits Exchanges So Why Is the Price Still Crashing Below $2?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.