Ethereum ETFs Top $5 Billion: BlackRock’s ETHA Just Hit a Record Week

0

0

Ethereum exchange-traded funds (ETFs) surpassed predictions in mid-July 2025, with net inflows exceeding $5 billion just 12 trading days after topping $4 billion. This milestone demonstrates Ethereum’s growing popularity among institutional investors and marks a significant shift in perception regarding the asset’s long-term utility and stability.

A Rapid Rise Reflecting Growing Institutional Confidence

The record-breaking rush into Ethereum ETFs coincides with a larger surge of cryptocurrency acceptance by traditional finance. According to CryptoSlate statistics, Ethereum-based ETFs increased by more than $1 billion in little under two weeks, a much faster rate than in previous months. This trend is being driven by increased regulatory clarity and investor demand for Bitcoin alternatives that nonetheless provide strong on-chain value.

BlackRock’s iShares Ethereum Trust (ETHA) has emerged as the major participant in this rally, generating $675 million in a single week. That amount put ETHA as the sixth-highest inflow ETF across all asset classes in the United States at that time.

“The demand for regulated Ethereum exposure is no longer speculative, it’s systemic,”

explained an ETF analyst at Fidelity, which also manages the FETH Ethereum fund.

ETHA Now Holds Over 2 Million ETH

Beyond inflows, ETHA currently owns over 2 million ETH, accounting for around 1.65% of Ethereum’s circulating supply. According to AInvest and RootData, the fund now has more than $5.5 billion in assets under management (AUM). Collectively, all spot Ethereum ETFs in the United States now manage more over $13.5 billion, or approximately 4% of ETH’s entire market capitalization.

This expanding ETF presence indicates a significant liquidity shift, as ETH is increasingly held in institutional-grade custodial systems rather than freely circulating. Market experts believe this might contribute to longer-term supply tightening and impact Ethereum’s price trend, particularly as ETF buyers are often long-term investors.

Ethereum ETFs Performance in Context

While Bitcoin ETFs continue to dominate the US crypto ETF market, with BlackRock’s IBIT leading the charge, Ethereum ETFs are quickly catching up. Last week alone, ETH funds received approximately $990 million, the fourth-highest weekly inflow ever recorded for Ethereum. According to CryptoSlate, ETH ETF inflows now account for around 10% of Bitcoin ETF inflows, indicating a growing parity in investor interest.

Notably, on July 11, ETHA received its single-largest daily inflow to date: $301 million in a single session. That record demonstrates both the rapid pace of capital deployment and investors’ belief in Ethereum’s future as a multi-layered smart contract platform.

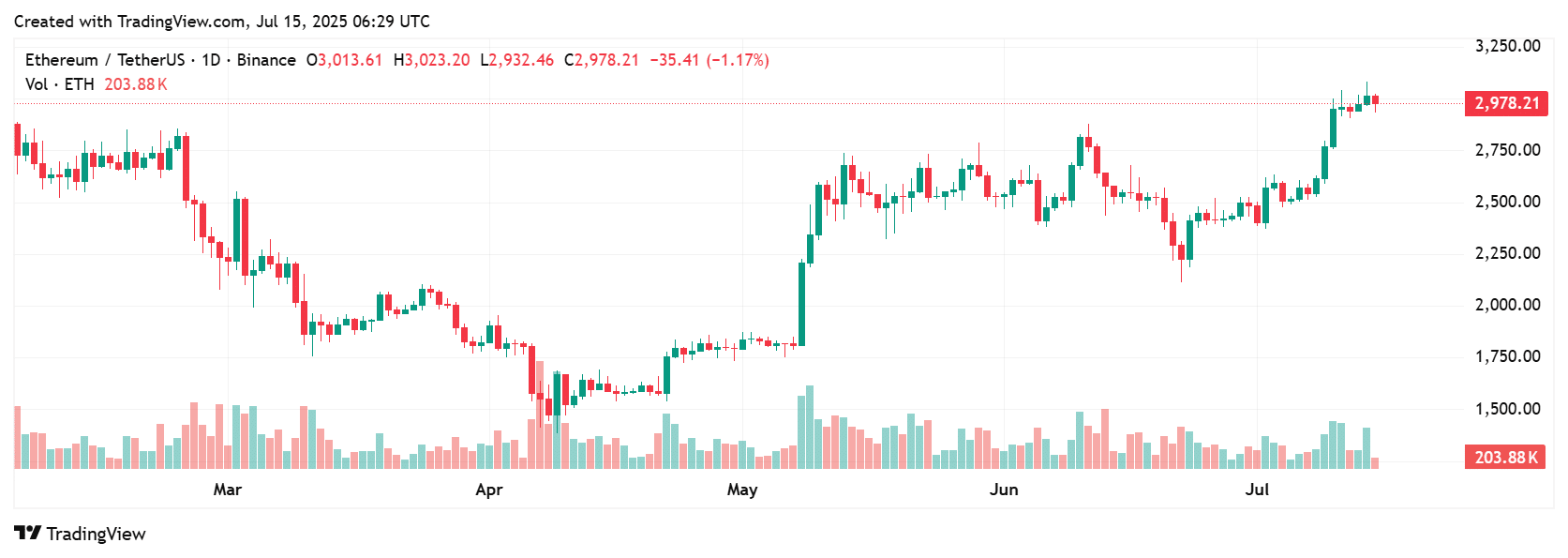

Impact on Ethereum Price and Ecosystem

Ethereum’s increasing ETF interest has coincided with a strong price boom, propelling the commodity above important psychological levels. While short-term price movements are still linked to larger macroeconomic situations, the underlying shift in demand dynamics cannot be overlooked. Analysts suggest that if inflows continue at this rate, Ethereum may soon face a supply shock akin to Bitcoin’s post-ETF rise earlier this year.

Furthermore, growing ETF activity is projected to boost Ethereum’s position in the portfolios of traditional investing institutions, ranging from hedge funds to pension providers. This increased exposure might boost institutional engagement in Ethereum’s DeFi, Layer-2, and staking ecosystems.

Summary

The $5 billion milestone in Ethereum ETF inflows is more than just a financial headline; it indicates the asset’s entry into mainstream investment portfolios. With BlackRock’s ETHA leading the push, Ethereum’s reputation as a mature asset gains even more legitimacy. With consistent inflows, strong AUM, and significant institutional interest, Ethereum is entering a new era defined by structure, strategy, and long-term adoption rather than speculation.

Frequently Asked Questions (FAQs)

What is the significance of Ethereum ETFs surpassing $5 billion in inflows?

It shows growing institutional trust in Ethereum, pushing it further into mainstream finance.

Which Ethereum ETF has the most inflows?

BlackRock’s ETHA led with $675 million in one week, and now holds over 2 million ETH.

How do Ethereum ETFs impact ETH price?

ETF inflows reduce circulating supply and may lead to upward price pressure over time.

Are Ethereum ETFs regulated?

Yes, U.S.-based Ethereum ETFs are SEC-approved and offered by established financial institutions.

How do they compare to Bitcoin ETFs?

While still trailing in total volume, Ethereum ETFs are gaining faster than expected and hold growing market share.

Glossary of Key Terms

ETF (Exchange-Traded Fund)

A security that tracks an asset or group of assets and trades on stock exchanges.

AUM (Assets Under Management)

The total market value of assets that a financial institution manages on behalf of clients.

Spot ETF

An ETF that holds the underlying asset directly, offering investors actual exposure rather than derivatives.

Inflows

Capital moving into a financial product, indicating growing investor interest.

Smart Contract Platform

A blockchain that enables automated, programmable agreements; Ethereum is the leading platform in this space.

Sources/References

Read More: Ethereum ETFs Top $5 Billion: BlackRock’s ETHA Just Hit a Record Week">Ethereum ETFs Top $5 Billion: BlackRock’s ETHA Just Hit a Record Week

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.