Polygon Crypto Eyes 125% After Break As Unique Addresses Surge

0

0

Polygon (POL) crypto price suggested a potential reversal after the breakout from a long-term downtrend. A spike in unique addresses indicated increased activity. Keep reading to learn how Polygon price may perform in the coming weeks.

Polygon Crypto Price Analysis

After spending time within a descending channel, Polygon crypto price clearly indicated a market correction at its exit point. The price reached $0.25 shortly after its existing $0.22 breakout point, which confirmed the potential bullish market trend.

The projection indicated an upcoming mid-term target of $0.52 if the upside channel that occurred sustains. That would result in a 125.29% growth from the breakout point.

The market continued its upward trajectory as the buy candles extended beyond typical trading ranges. The trading volumes also increased steadily.

A successful breakout above the $0.24–$0.25 zone could guide POL toward $0.30. It is the price’s next psychological ceiling before potentially exploring $0.38, then $0.52 throughout the next several weeks.

A price drop below $0.22 support or back inside the channel could lead to an inspection of $0.195 and eventually $0.165 levels.

The pattern indicated robustness, but market weakness at any time scale could potentially limit price growth. Short-term traders could aim for $0.30 but needed to watch $0.52 as their midterm objective. A continuous failure to recapture $0.25 would suggest decreasing investor participation.

The market structure change after the breakout remains valid only if Polygon crypto sustains its position above the $0.22 zone.

Daily POL Unique Addresses

Looking at the network of Polygon, it hosted more than 500 million distinct addresses on April 25th, 2025. In that, its daily user count expanded by 136,214.

The user adoption rate consistently increased at an exponential rate. It showed no signs of changing, even when Polygon crypto price fluctuated.

The steady address growth since the beginning of 2023 reflected general ecosystem sentiment bullishness. POL price exhibited a different pattern compared to this market activity.

Market re-evaluation did not occur despite user adoption due to there potentially being other macro conditions external and supply dilution with prudent demand-side speculation.

An increase in all operational parameters, including transaction volumes, DApp usage, and fee revenue from existing user growth, could drive future price surges.

The price may stay stable if the utility fails to grow at the same rate as address creation, and when most wallets remain inactive. However, the market performance depended on successful value appropriation from momentum indicators.

Market Sentiment

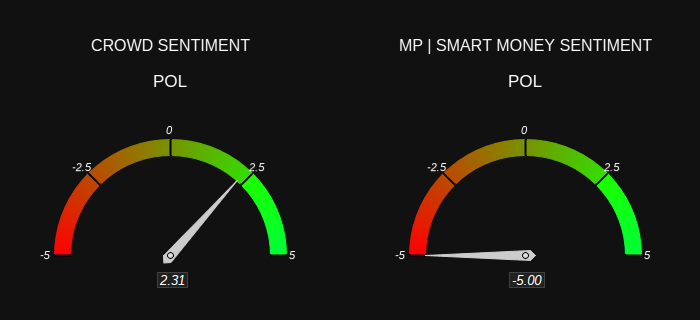

Retail investors who maintained an extremely positive Polygon crypto sentiment drew attention. Conversely, professional investors showed their most bearish stance.

Unfavorable sentiment scores at +2.31 revealed high retail support and strong potential stocknet buying patterns throughout the marketplace.

Smart money sentiment stood at the maximum negative value of -5.00. That implied institutional investors have adopted a strongly bearish approach toward POL. Different signals produced by these measures created an essential risk versus reward situation.

The crowd sentiment, with a +2.31 rating, represents retail traders. It could keep POL prices rising in the short term. However, a Polygon crypto price reversal could occur if institutions correctly forecast market movement, which they tend to do.

Institutional sell-offs would start a market decline that would surprise retail investors heavily invested in the asset class. The price of polygon crypto is likely to become more unstable over the coming periods.

Winding up, traders needed to track order book depths along with big wallet activities. Such sentiment incongruence seldom continues without producing market movement. Caution was warranted.

The post Polygon Crypto Eyes 125% After Break As Unique Addresses Surge appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.