Why Pump.fun’s $56M Liquidity Surge May Not Mean Long-Term Strength

0

0

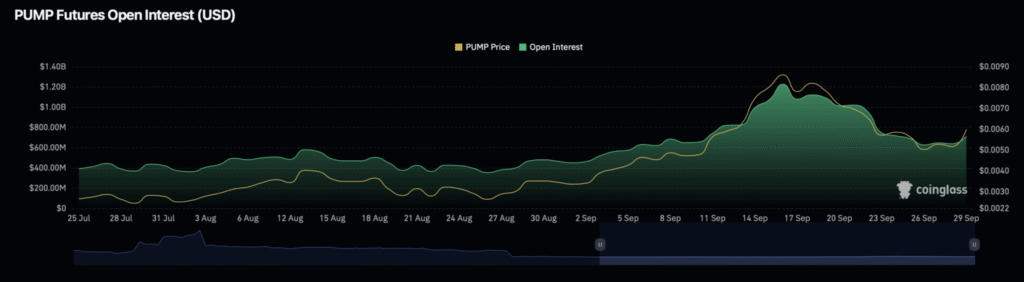

Pump.fun (PUMP) recorded a significant liquidity surge over the past 24 hours. While prices increased, revenue and fees have dropped sharply, raising questions about the sustainability of the rally. The recent PUMP liquidity surge is largely driven by increased activity in the Perpetuals market.

Perpetuals Market Drives PUMP Liquidity Surge

The PUMP liquidity surge can be attributed to the Perpetuals market, where large amounts of liquidity were poured into the meme coin. Recent analysis showed that inflows into the Derivatives market reached $56 million.

Additionally, the Open Interest-Weighted Funding Rate remained positive, signaling that long contracts were the primary drivers of liquidity. Spot investors also contributed to the surge, accumulating $2.94 million worth of PUMP.

Mixed Sentiment Amid PUMP’s Price Surge

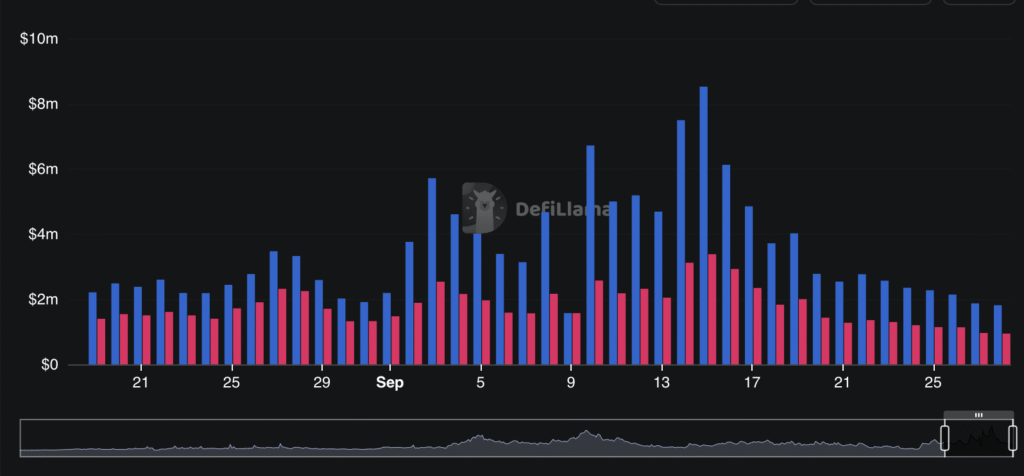

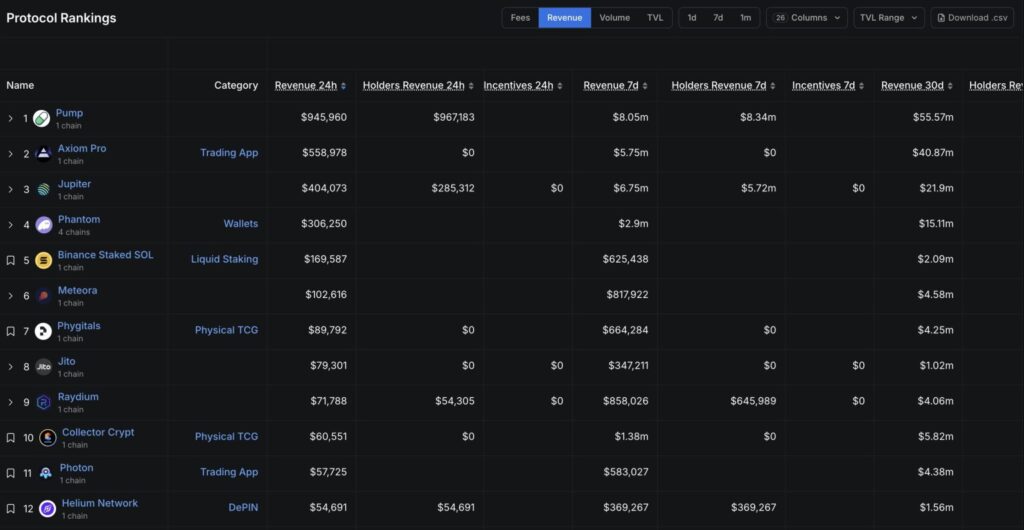

While the PUMP liquidity surge caused its price to rise, sentiment around the token remains mixed. Revenue from the Pump.fun platform fell sharply from $3.38 million to $945,960, while fees dropped even further, from $8.52 million to $1.82 million.

Also Read: Can Pump.fun’s $72M Buyback Machine Keep PUMP on Top of Solana’s Meme Market?

This decline in revenue and fees suggests that the rally may be speculative, with on-chain activity not matching the price surge. Investors are starting to question whether the rally can be sustained, given these declining metrics.

Declining Investor Activity Amid PUMP Surge

Despite the PUMP liquidity surge, key metrics related to investor activity have decreased significantly. The number of “Tokens Graduated,” which refers to tokens reaching a $100,000 market capitalization, fell sharply from 286 to just 70.

Similarly, the number of minted meme coins, a key indicator of market activity, dropped to 13,700. These declines reflect a reduction in investor interest, which could signal that the PUMP rally may be losing steam.

Furthermore, the Daily Active Users on the Pump.fun platform reached a new low of 85,700, reinforcing the idea that activity on the platform is weakening. While the PUMP price surge has captured attention, the drop in these metrics suggests that the rally may not last long.

Solana DApps Lead the Way, PUMP Maintains Dominance

While PUMP saw a liquidity surge, Solana’s decentralized applications (DApps) also performed well, generating over $22 million in revenue in the past week. Pump.fun led the charge, bringing in $9.65 million, marking its eighth consecutive week at the top of the revenue rankings.

Other platforms, such as Axiom and Jupiter, followed with $5.20 million and $6.75 million, respectively. However, PUMP maintained its dominant position in the Solana ecosystem, thanks to the recent liquidity surge.

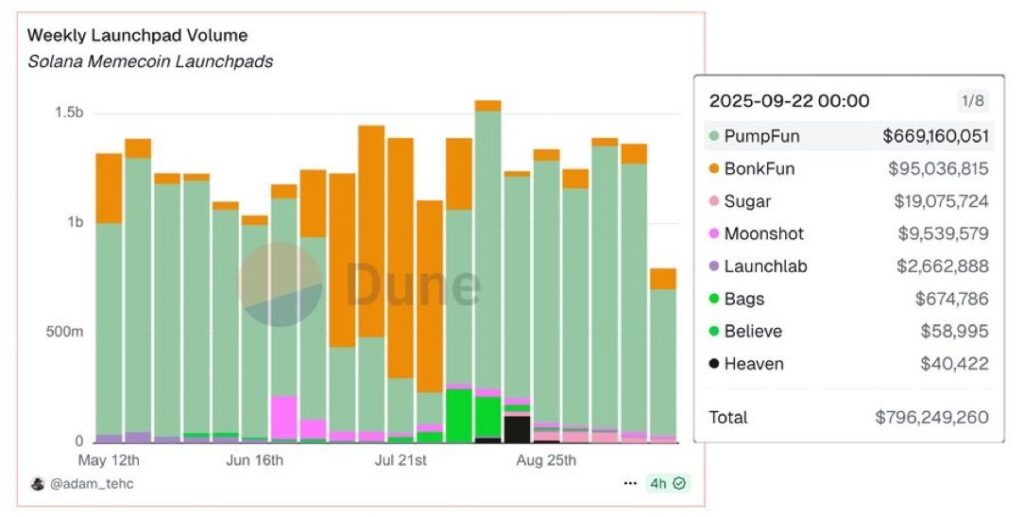

Despite PUMP’s success, the broader market for meme coins is showing signs of slowing. Data from Dune Analytics revealed a decline in bonding curve volumes, a key indicator of liquidity, which fell below $1 billion for the first time in six months.

The total launchpad volume was $796.4 million, with PUMP accounting for 84% of that total. This suggests that while PUMP is still dominant, the overall market is cooling.

PUMP’s Grip on the Meme Coin Market

PUMP continues to hold a dominant share of the meme coin market. Since May, it has consistently captured the majority of liquidity, reinforcing its status as the leading platform for meme coin launches on Solana.

However, BonkFun, a competitor in the space, has been gaining ground, though it remains far behind PUMP in terms of market share. The decline in bonding curve volumes hints at fading speculation, but PUMP remains dominant.

The Future of PUMP in a Cooling Market

Irrespective of the recent PUMP liquidity surge, the future outlook for the platform seems to be shaky. The meme coins market is dying down, and if PUMP wants to see more success, it will need to change things up.

If the drop in revenue and usage continues, it could disrupt the growth of the platform as well as investor enthusiasm. The issue for PUMP going forward is going to be maintaining liquidity in the face of the challenges brought on by a cooling market.

Conclusion

The recent PUMP in liquidity (more than 3 million gas within the past 36-48h) confirms a strong hunger, especially from Perpetuals market. But the mixed picture, which includes lower revenue and usage, raises questions about whether this rally can last.

With PUMP still holding a position of dominance in the Solana meme coin market, however, signs that trading activity is beginning to slow suggest that PUMP will need to evolve and adapt quickly if it wants to continue to capture investor attention.

Also Read: Pump.fun Unveils Project Ascend but Can It Fix Solana’s Meme Coin Problem?

Summary

PUMP had a massive influx of liquidity being poured in by its Perpetuals market, which saw $56 million worth of inflows. While above the high zone of the 6 cents per token level and near its peak for over one month, low revenues and weak user activity could threaten to put an end to this rally.

PUMP maintains its reign over the Solana meme coin space but indicators of faltering market activity are starting to appear. These tendencies indicate that PUMP needs to evolve or risk disinterest because the market is slowing down.

Appendix: Glossary of Key Terms

PUMP – The native meme coin of the Pump.fun platform.

Liquidity Surge – A significant increase in the volume of assets traded.

Perpetuals Market – A market for perpetual contracts, offering leveraged trading without expiration.

Open Interest – The total number of outstanding derivative contracts.

Spot Investors – Investors who buy the actual asset rather than derivatives.

Bonding Curve – A pricing mechanism used in decentralized finance (DeFi) platforms.

Frequently Asked Questions About PUMP Liquidity Surge

1: What caused the PUMP liquidity surge?

The PUMP liquidity surge was driven by strong inflows from the Perpetuals market, which dominated the rally. Long contracts played a significant role in providing the liquidity.

2: Why is sentiment mixed around PUMP?

Sentiment is mixed because, despite the price surge, revenue and fees dropped significantly, suggesting that the rally may not be based on genuine market demand.

3: How did Solana’s DApps perform alongside PUMP?

Solana’s DApps generated over $22 million in revenue, with PUMP leading the charge by bringing in $9.65 million, marking its eighth consecutive week as the top performer.

4: Can PUMP maintain its dominance in the meme coin space?

While PUMP remains dominant, the decline in bonding curve volumes and falling market activity suggest that maintaining its position may be challenging if these trends continue.

Read More: Why Pump.fun’s $56M Liquidity Surge May Not Mean Long-Term Strength">Why Pump.fun’s $56M Liquidity Surge May Not Mean Long-Term Strength

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.