Ethereum Price Rebounds Slightly After Whale Dumps 10,000 ETH

8

5

- A whale cashed out 10,000 ETH after being invested for over two years and thus lost much more money than it could have.

- Ethereum has declined by over 50% in the year ending 2025 but has risen to somewhere near $1,594.

Ethereum (ETH) continued turbulent trading this week, recovering slightly from a low of $1,400 on what markets called “Black Monday.” Although it returned slightly to $1,594, the price of Ethereum is still significantly down for 2025, which is a concern for insiders of cryptocurrencies.

Whale Sells After 900-Day Holding Period

Significantly, a notable Ethereum whale has exited entirely, selling all 10,000 ETH holdings valued at approximately $15.71 million. The whale first bought the ETH tokens worth $12.95 million at an average price of $1,295 each in the last quarter of 2022. This could have been due to the fact that the said whale did not sell when ETH was hovering around $4000 or even higher.

However, the investor remained long during high volatility and consequently realized a substantially lower profit of $2.75 million today versus the maximum possible profit of $27.6 million. Such a large order of the whale indicates that the market requires more careful consideration. Market players have not remained idle, especially as uncertainty in terms of macroeconomic factors has crept into traders’ and investors’ calculations.

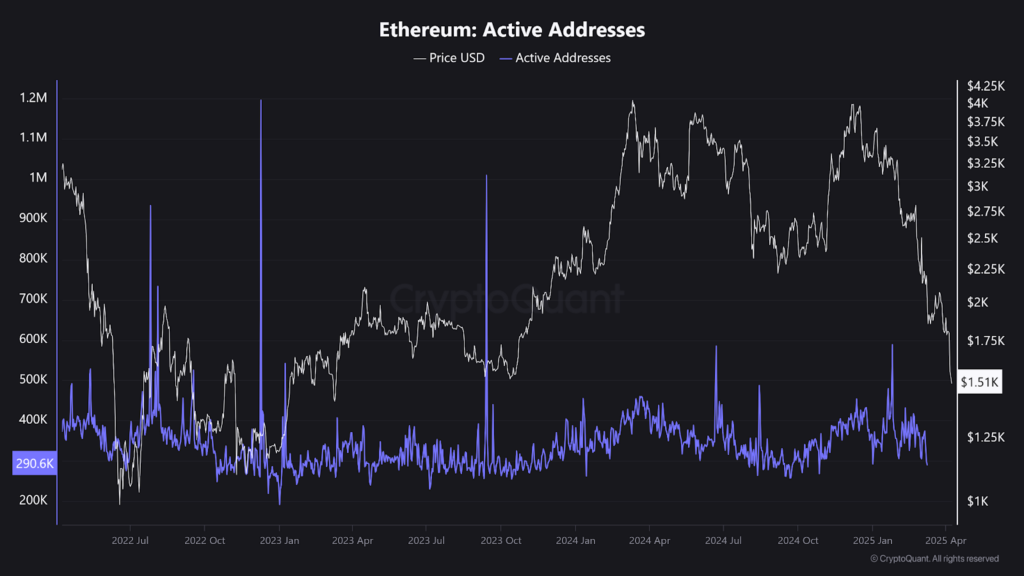

On-chain metrics reveal that the active addresses for Ethereum have dropped considerably and currently stand at 290,600. It is significantly lower than the peak activity, which was recorded in early 2022 when the network registered over 600 thousand daily active addresses.

Derivatives Market Signals Continued Uncertainty

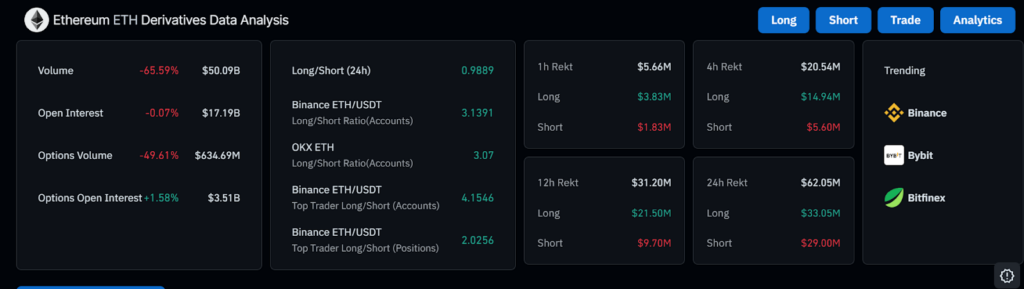

Ethereum derivatives data reveals that there is increased volatility and, therefore, uncertainty in the market. The trading volume has reduced by 65.59% to $50.09 billion, while the options volume has declined by 49.98%. This indicates the reduction of institutional investors. However, the open interest went up by a slight 1.58%, suggesting that there are still some traders that are covering for more volatility.

Data on short-term liquidations also support the bearish sentiment. In the last 24 hours, $62.05 million in long and short positions were liquidated, comprising $29 million. Similarly, the long/short ratio across exchanges is barely neutral at 0.9889.

Despite the neutral ratio, long positions dominate on Binance and OKX. Top traders on Binance show a long/short ratio of 4.15, indicating that whales and seasoned traders expect a potential recovery or are averaging during dips.

Despite having a neutral position balance, more long positions are opened on Binance and OKX. Recent data also reveal that the top traders on Binance are leaning with a long/short ratio of 4.15, meaning that whales and other professional traders anticipate a bounce or are accumulating during pullbacks.

Bearish Predictions Emerge for Ethereum’s Future

During Q1 2025, the ETH lost more than 50% of its value, which underlines this token’s weakness. According to technical analysis, Ethereum is in a very vulnerable zone, with prices slightly above $1,500. Technical analysis shows that support levels have been breached severally in this year, making it difficult for traders to establish support areas.

Amid the bearish outlooks, prominent economist and Bitcoin critic Peter Schiff predicted a significant decline in Ethereum, which could drop below $1000.

Schiff’s outlook seems plausible given that global markets are already wary due to macroeconomic issues such as current U.S tariffs.

8

5

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.