Michigan Moves Closer to Building a State Bitcoin Reserve With New Bill Progress

0

0

According to recent legislative updates, Michigan’s proposed law to build a Michigan Bitcoin reserve has passed to its second reading in the House. Below are fresh figures and verified data to help readers understand what that means, and why it matters now.

What is at stake with HB 4087

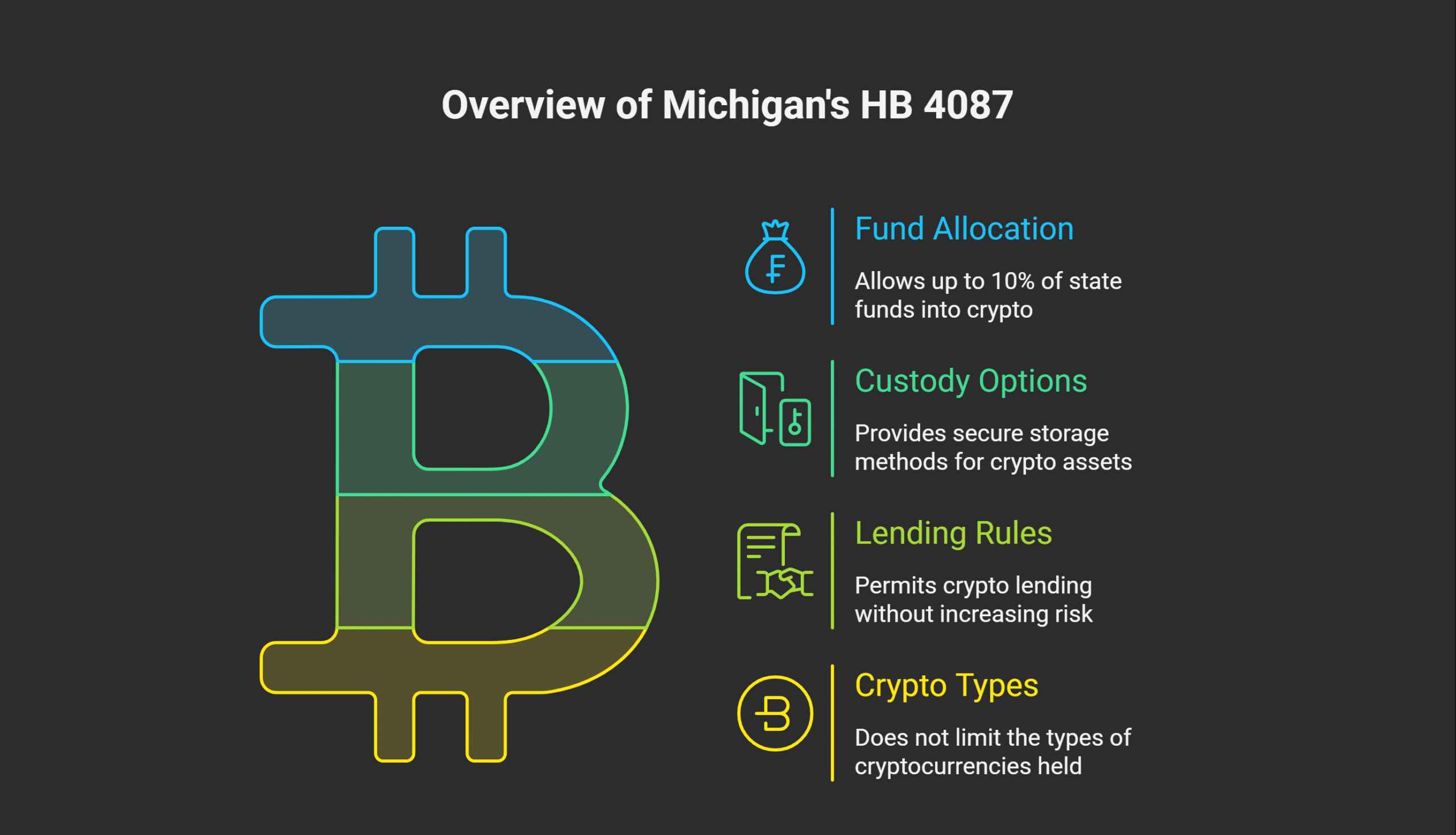

Michigan’s HB 4087 would allow the state treasurer to allocate up to 10% of funds from the general fund and economic stabilization fund into cryptocurrency assets. It sets specific rules for custody: either via a secure custody solution, a qualified custodian (like a regulated bank or trust company), or via exchange-traded products from registered investment companies.

Lending of crypto is allowed under the bill, so long as it does not increase financial risk. The bill does not explicitly limit which cryptocurrencies the state may hold. While much of the discussion refers to Bitcoin, other digital assets could qualify under its terms.

Also Read: Why Lawmaker Gerald Connolly Rejects Strategic Bitcoin Reserve Proposal

Pros and concerns

Advantages

- If passed, the Michigan Bitcoin reserve bill gives the state a legal pathway to broaden its investments into crypto assets under regulated conditions.

- It could increase public portfolio returns in times of inflation or when traditional interest rates are low.

- The law requires safeguards, such as qualified custody and risk controls. That adds protection compared to unmanaged exposure.

Risks

- Volatility remains a significant concern. Bitcoin’s price swings of several thousand dollars in a day show the exposure to market risk.

- Lack of clarity over which cryptocurrencies qualify could expose the state to unproven or high-risk tokens.

- Legislative unknowns: timing of passage, any amendments that may tighten or loosen rules, and how regulatory supervision will work in practice.

What happens next

The Michigan Bitcoin reserve bill must pass out of committee, then gain approval in both houses of the legislature, and be signed by the governor. Public hearings, amendments, and pushback are still possible. Watching how other states have passed similar bills may hint at Michigan’s likely path.

Conclusion

Based on the latest research, Michigan Bitcoin reserve legislation could reshape how the state manages its funds. The 10% cap and clear safeguards add weight to HB 4087.

If approved, Michigan would be among the first states to build a strategic crypto reserve. Its success will depend on the choice or selection of assets, how custody is enforced, and how Bitcoin prices hold up in the market.

For more expert reviews and insights into the world of cryptocurrencies, visit our dedicated platform featuring the latest news and forecasts.

Summary:

Michigan is crafting a bill that establishes a reserve specifically for Bitcoin and enables even up to ten percent investments of state funds in cryptocurrency but allows for very strict precautions.

It would therefore place Michigan among states with regard to digital reserves, and the success of it would depend on asset selection, custody parameters, and the market’s stability from Bitcoin.

Glossary Terms

Bill: A statutory proposal that may either be a proposal private to its drafter, or, in the case of a bill of general application, another nation may enforce it in its laws.

Generally Fund: A general fund is Michigan’s most common pot of money for every day uses by government.

Economic Stabilization Fund: Reserve fund for emergencies or budget shortfalls.

Custodian / Secure Custody: Trusted entity that holds and protects digital assets.

Exchange-Traded Product (ETP): A financial product traded on exchanges that tracks an asset or basket of assets.

FAQs on Michigan Bitcoin Reserve

1. What percentage of Michigan state funds could go into the Michigan Bitcoin reserve?

Up to 10% of the general fund and the economic stabilization fund could be used.

2. Is Bitcoin the only crypto allowed under the proposed bill?

No. The text does not limit the reserve to Bitcoin. Other cryptocurrencies could qualify.

3. What is Bitcoin trading at currently?

Around U.S. $116,700 per BTC, with a market cap of over U.S. $2.32 trillion.

4. What must happen for the Michigan Bitcoin reserve bill to become law?

It needs to pass through the committee, then the House and Senate, and receive the governor’s signature.

Read More: Michigan Moves Closer to Building a State Bitcoin Reserve With New Bill Progress">Michigan Moves Closer to Building a State Bitcoin Reserve With New Bill Progress

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.