DOGE and XRP ETFs Approved: NYSE Opens New Door for Crypto Exposure in 2025

0

0

This Article was first published on The Bit Journal.

Today, the New York Stock Exchange has officially approved Grayscale Dogecoin and XRP ETFs, opening a legal channel of entry into cryptocurrencies. According to the source, NYSE Arca filed certification documents with the SEC in November, approving Grayscale’s spot ETFs for both XRP and Dogecoin.

For investors, the green light means that they will soon be able to trade shares in these ETFs just like any regular stock or fund, only with direct DOGE and XRP exposure.

Real-World Exposure Through Regulated Products

By launching spot ETFs, Grayscale gives investors a way to own real Dogecoin and XRP without dealing with private wallets, seed phrases, or the risks of self-custody. The Grayscale Dogecoin and XRP ETFs will each hold the actual assets in custody. This structure bridges a gap between traditional finance and crypto.

Investors have been watching this move for months. With regulatory changes earlier in 2025, the door opened for altcoin ETFs, and now, Grayscale has walked through it. Many now see this as part of a growing wave of regulated altcoin investment vehicles.

What the Market Looks Like Right Now

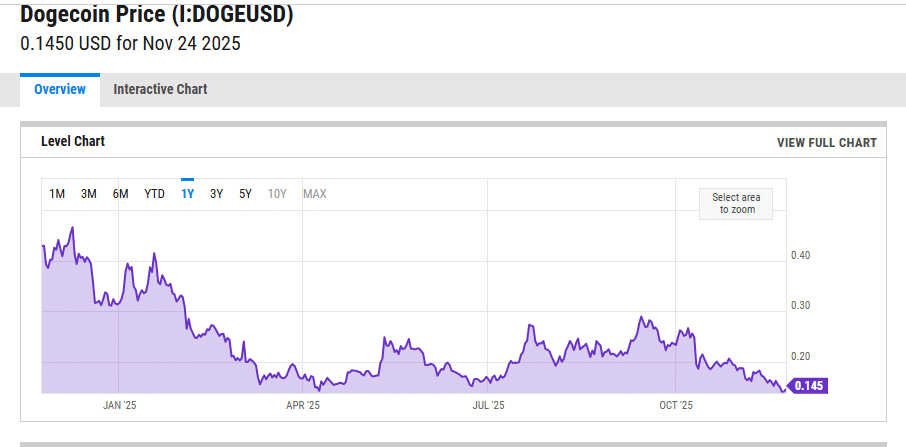

Here is a snapshot of current pricing:

| Asset | Price (as of Nov 22–24, 2025) |

|---|---|

| Dogecoin (DOGE) | ~ $0.14 |

| XRP | ~ $1.95–$2.04, according to recent data |

Those levels suggest that both tokens are trading in relatively stable territory heading into the ETF debut.

Analyst Views and Possible Market Impact

ETF analyst Eric Balchunas said publicly he thinks there will be good initial trading volume for GDOG and GXRP. And in fact he got good responses predicting that Grayscale ‘s next ETF will be same concept, a spot ETF for Chainlink.

If Grayscale’s Dogecoin and XRP ETFs attract sufficient money, that could push up demand for the underlying assets. On the other hand, if trading collapses, traders may flip ETFs more than they would with a buy-and-hold approach.

Recent ETF products often begin trading at a premium or discount to their net asset value (NAV). The once again boiled distribution of spreads depends on how many market makers step up, and creations/free redemptions occur.

Risks to Watch

-

Volatility: Just because the ETFs are regulated doesn’t mean DOGE and XRP aren’t volatile. Holders in the ETFs will still be affected by this.

-

Liquidity risk: In the beginning, spreads might be huge. If the authorized participants don’t create many shares, NAV tracking will be less precise.

-

Regulatory risk: Rules could change yet again. While this is a success, the regulatory path for altcoin ETFs is still young.

What Comes Next

-

Oversee AUM and trading volume over the next few days: Strong numbers would help to cement confidence in these altcoin ETFs.

-

Monitor premium vs. NAV: The close ETF price tracks its NAV the more efficient creation/redemption mechanism used by the issuer is likely to be.

-

Expect more altcoin ETF filings: If Grayscale’s launch succeeds, other funds may follow-some of which could include different altcoins like Chainlink or Solana among others.

Final Thoughts

The approval of Grayscale Dogecoin and XRP ETFs could alter how retail investors get into altcoins even further. These products offer safe, listed exposure to DOGE and XRP. For that reason, both retail customers and even other types of institutional players are likely to be drawn in. But this is not a free ride.

Crypto volatility, liquidity constraints and regulatory uncertainty remain large. Now trading partners and long-term investors will both be watching closely as the ‘landing’ likely marks a new chapter in altcoin investing.

Glossary

- ETF (Exchange-Traded Fund): A fund that trades on an exchange and holds assets like crypto.

- Spot ETF: An ETF that holds the actual underlying asset instead of derivatives.

- NAV (Net Asset Value): The total value of assets in the fund divided by the number of shares.

- Creation/Redemption: The process by which authorized participants create or redeem ETF shares.

- Custody: Secure storage of crypto by a third party (e.g., a custodian).

FAQs Regarding Grayscale Dogecoin and XRP ETFs

1: When will the Grayscale Dogecoin and XRP ETFs start trading?

They are approved for listing on the NYSE Arca as of November 24, 2025, so trading may begin soon after certification.

2: Can I buy these ETFs via my regular brokerage account?

Yes, if your broker supports ETF trading on NYSE Arca.

3: Do these ETFs hold real DOGE and XRP?

Yes, they are spot ETFs so that Grayscale will hold the actual coins in custody.

4: Are these safer than owning the coins directly?

They add regulatory and custody protections, but you still face crypto price risk.

References

Read More: DOGE and XRP ETFs Approved: NYSE Opens New Door for Crypto Exposure in 2025">DOGE and XRP ETFs Approved: NYSE Opens New Door for Crypto Exposure in 2025

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.