Ripple vs SEC: A $125M Settlement Signals Final Chapter in Long-Running Legal War

0

0

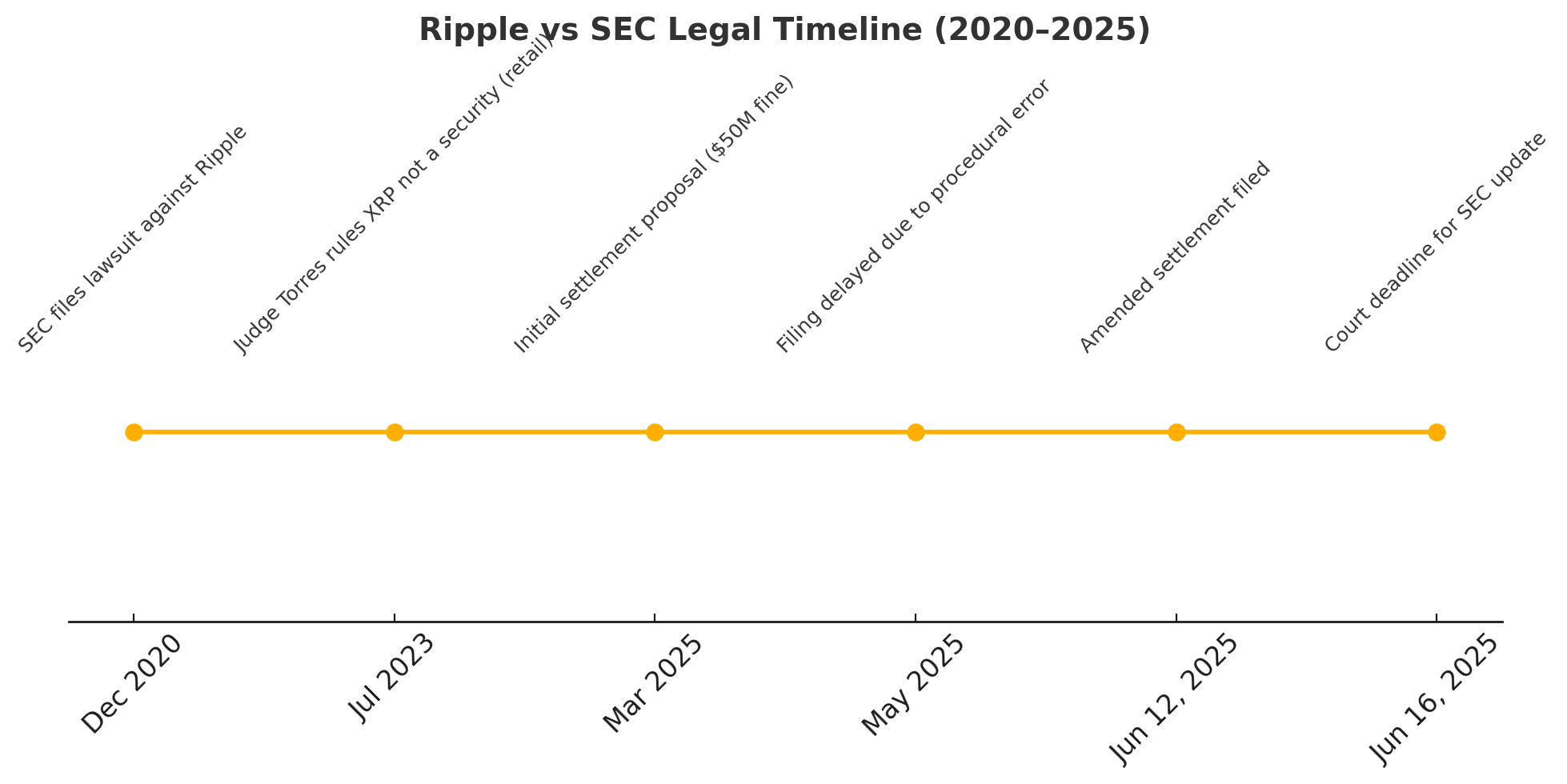

After nearly five years of courtroom drama, Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have jointly filed an amended motion to settle their historic legal conflict. The motion, filed on June 12, 2025, proposes dissolving the original injunction imposed by the court and finalizing a payment structure where Ripple pays $50 million to the SEC and reclaims $75 million of previously escrowed funds.

This latest filing, submitted under Rule 60(b)(6), marks the clearest signal yet that both parties are prepared to move on from one of the most closely watched cases in crypto legal history. It’s a pivotal moment for XRP holders, the broader crypto industry, and the regulatory climate in the U.S.

Recapping the Ripple vs. SEC Saga

The dispute began in December 2020, when the SEC sued Ripple for conducting a $1.3 billion unregistered securities offering through the institutional sale of XRP. Ripple pushed back, arguing that XRP is a currency, not a security.

In July 2023, U.S. District Judge Analisa Torres delivered a landmark summary judgment, ruling that XRP sales on exchanges and to retail users were not securities, but institutional XRP sales did violate securities law. The court imposed a $125 million penalty and required Ripple to restructure its future XRP sales.

While Ripple agreed to pay part of the penalty in March 2025, procedural missteps delayed the process until now.

What’s in the New Filing?

In the June 12 filing, Ripple and the SEC jointly request that Judge Torres approve:

-

A $50 million final penalty paid to the SEC

-

A return of $75 million to Ripple from escrow

-

Termination of the injunction originally imposed on Ripple’s XRP activities

-

Recognition that the case is fully resolved without appeal

This filing reflects a more cooperative stance from both sides. The motion emphasizes “exceptional circumstances” as a justification for modifying the final judgment and clearing procedural errors from earlier filings.

June 16: A Crucial Deadline

All eyes are now on June 16, the deadline for the SEC to submit a formal status report to the court. This update will clarify whether both parties are aligned on settlement finalization, or if additional procedural reviews lie ahead.

If the judge accepts the amended filing, the Ripple-SEC case could formally conclude this month.

Broader Market Reactions and ETF Implications

Ripple’s move toward closure has already influenced market sentiment. XRP briefly surged last week as ETF approval odds reached 98% on crypto prediction platforms. Though odds have now stabilized around 88%, investors view the settlement as a bullish signal for XRP and institutional acceptance.

Meanwhile, Ripple’s resolution may unlock stalled efforts to list XRP-based exchange-traded funds (ETFs), particularly as Ethereum ETF frameworks advance. Legal clarity could be the missing piece for issuers waiting for green lights.

Ripple’s Strategic Victory?

While Ripple will still pay a penalty, many in the crypto community view this as a strategic win. The key legal precedent, that secondary XRP sales are not securities, remains intact. Moreover, Ripple regains a substantial portion of its funds and avoids further reputational damage from prolonged litigation.

“This case was always about clarity,” Ripple CEO Brad Garlinghouse previously stated. “And while we didn’t win every battle, the industry now has more definition on where the line is drawn.”

Regulatory Signals: A Shift in SEC Strategy?

This joint filing also fits into a broader trend of the SEC shifting tactics under pressure. In recent months, the agency has softened its stance in other crypto cases, including settlements with Coinbase, Kraken, and Terraform Labs. It’s also launching a Crypto and Fintech Task Force aimed at developing proactive frameworks rather than adversarial crackdowns.

Should the Ripple deal be finalized, it may symbolize a transition from litigation-heavy oversight to a rule-based era of crypto regulation in the United States.

Conclusion

The Ripple-SEC legal saga is approaching a decisive and peaceful conclusion. With a revised $125 million deal on the table, both sides appear ready to end a battle that shaped crypto’s legal and regulatory discourse for years. As June 16 approaches, Ripple’s future and the fate of crypto securities regulation in the U.S. hang in the balance.

If the court approves this final proposal, it could open the door to XRP ETFs, renewed institutional confidence, and a clearer roadmap for digital asset compliance.

FAQs

What is the new Ripple-SEC settlement about?

Ripple and the SEC filed to finalize their case with a $50M fine and $75M returned to Ripple.

Is the XRP case officially over now?

Not yet. The final decision depends on the court’s approval, expected around June 16.

What does this mean for XRP investors?

It’s a positive sign. Legal clarity boosts confidence and increases the chances of XRP ETF approvals.

Glossary of Key Terms

Ripple Labs:

A blockchain company that created and maintains XRP Ledger and XRP cryptocurrency.

XRP:

A digital currency used for real-time cross-border payments on the Ripple network.

SEC (U.S. Securities and Exchange Commission):

The U.S. regulatory agency overseeing securities markets, including digital assets.

Summary Judgment:

A court decision made without a full trial, often used to resolve key legal questions early.

Rule 60(b)(6):

A federal legal rule allowing court judgments to be modified in exceptional situations.

Injunction:

A legal order preventing a party from certain actions—in this case, Ripple’s XRP sales.

Escrow:

A financial arrangement where funds are held by a third party until specific conditions are met.

XRP ETF:

An exchange-traded fund based on XRP, which could launch if regulatory clarity is achieved.

Sources and References

Read More: Ripple vs SEC: A $125M Settlement Signals Final Chapter in Long-Running Legal War">Ripple vs SEC: A $125M Settlement Signals Final Chapter in Long-Running Legal War

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.