0

0

Crypto markets regained momentum over the past 24 hours, with the market cap of ‘made in USA’ coins growing 7%. The rebound followed Jerome Powell’s Jackson Hole remarks. The Fed Chair struck a notably dovish stance, acknowledging increasing risks in the labor market and signaling openness to September rate cuts.

While no firm commitments were made, the prospect of easing has already lifted major assets, though not every token has reacted equally. Against this backdrop, there are three made in USA coins to watch before September rate cuts potentially unlock the next wave of liquidity.

XRP is trading near $3, up 6.5% in the past 24 hours, but its rally remains subdued compared to Ethereum and Solana. That underperformance suggests that September rate cuts may not be fully priced in, making XRP one of the coins to watch before September rate cuts materialize.

XRP price analysis: TradingView

XRP price analysis: TradingView

On the daily chart, the Chaikin Money Flow (CMF) has been pushing higher. This reflects stronger inflows, while the Relative Strength Index (RSI) sits around 49 — a neutral reading that shows the token is far from overbought.

Chaikin Money Flow (CMF) measures buying and selling pressure by combining price and volume, with higher readings signaling stronger inflows.

Relative Strength Index (RSI), on the other hand, tracks the speed and change of price moves to gauge momentum, with values above 70 seen as overbought and below 30 as oversold.Technically, holding above $3.10 would improve chances of a move to $3.34. And breaking through that resistance could ignite a stronger rally to the north of $3.65. A dip under $2.78, however, risks deeper losses.

Beyond price, fundamentals are in play. Ripple secured a legal victory with the dismissal of its SEC appeal, and a cluster of amended XRP ETF filings has revived speculation around institutional inflows.

Together, these factors set the stage for XRP to respond sharply if September rate cuts are confirmed.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

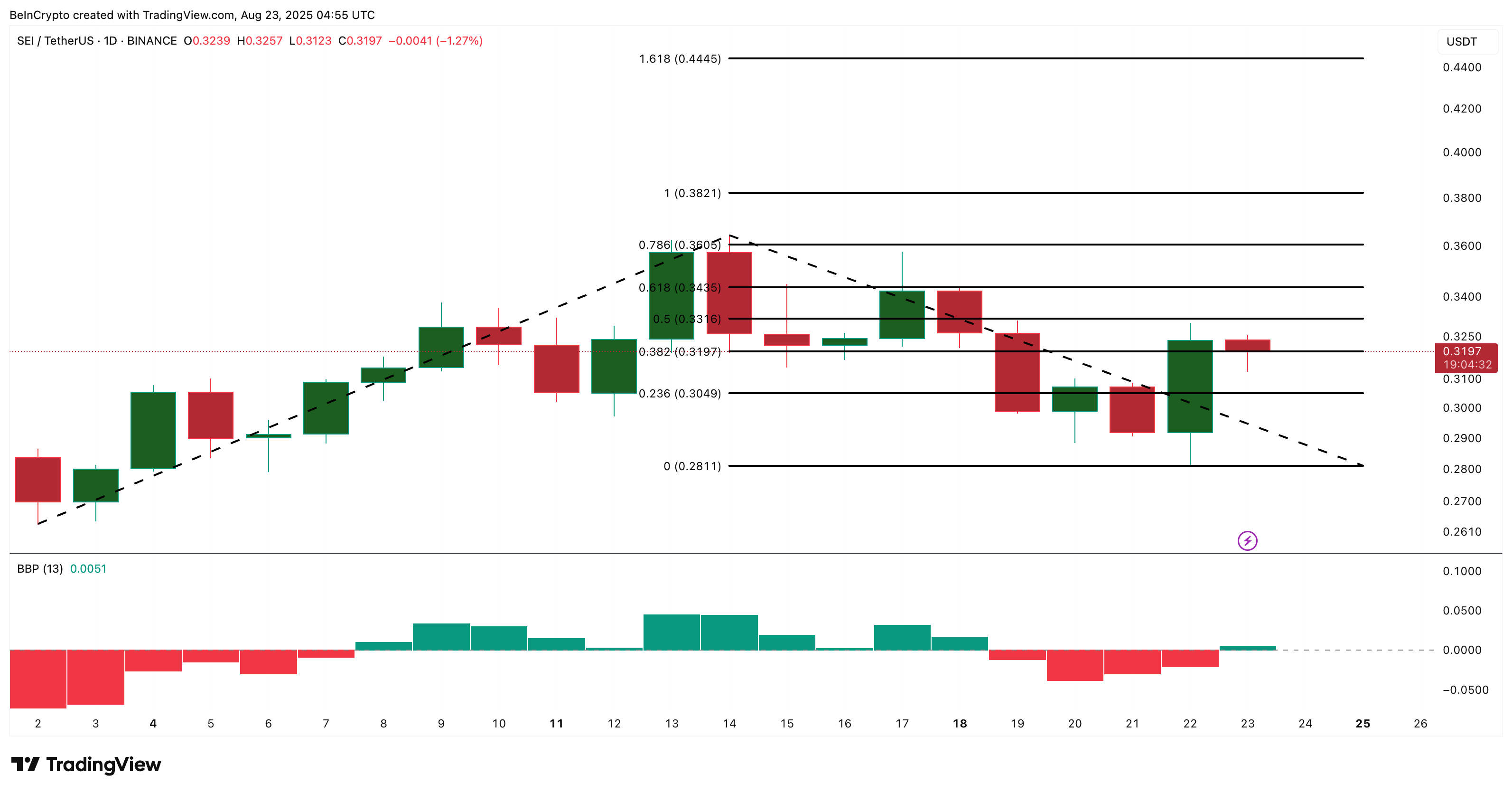

SEI Network, a US-developed Layer-1 built for trading applications, has quietly gained traction in recent months. Ondo Finance’s decision to launch tokenized treasuries on SEI highlights its relevance in the real-world assets narrative.

The token has climbed nearly 10% in the past day, now trading at $0.31. It seems the bulls might have finally regained control after four sessions of fading momentum.

This shift was confirmed by the bull-bear power indicator flipping green. And that too reinforces SEI’s inclusion among coins to watch before September rate cuts.

Bull Bear Power (BBP) highlights the balance between bullish and bearish momentum, with rising green bars showing bulls gaining control

SEI price analysis: TradingView

SEI price analysis: TradingView

Over a three-month span, SEI has delivered 44% gains, supported by an intact uptrend. Fibonacci projections show resistance between $0.33 and $0.36, with a breakout opening the door to $0.44.

On the downside, slipping below $0.30 and $0.28 would weaken the setup. With broader sentiment leaning dovish, SEI’s muted rally leaves scope for acceleration if liquidity expands in September.

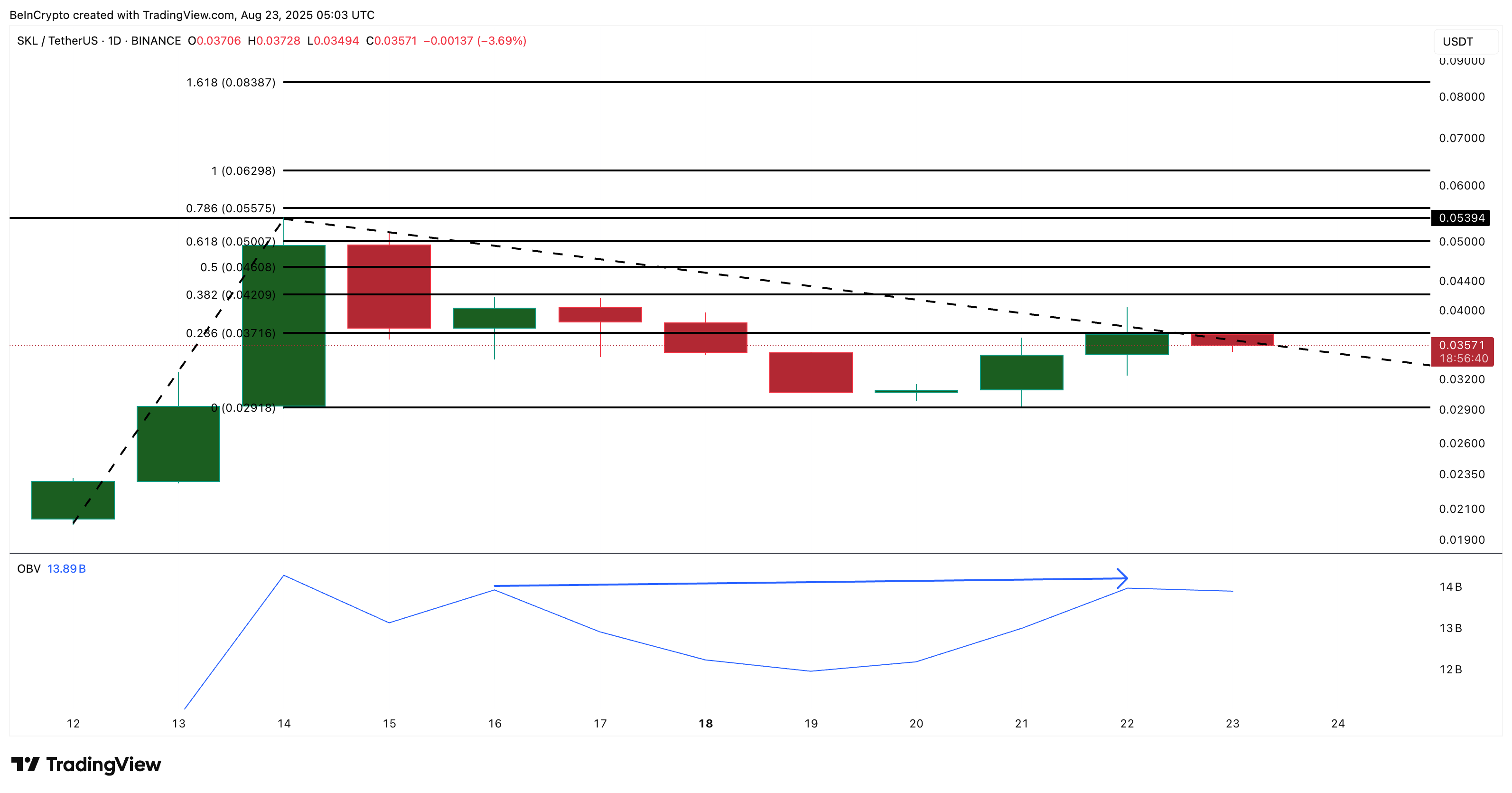

SKALE, a US-based Ethereum scaling solution, has drawn attention after a 50% rally earlier this month driven by whale activity and speculation of a Google link-up.

While the price has since cooled, it trades steadily near $0.035, with gains under 5% in the past 24 hours. The broader structure shows buyers are quietly re-emerging.

SKL price analysis: TradingView

SKL price analysis: TradingView

On-balance volume rose from 13.93 billion on August 16 to 19.98 billion on August 22, even as prices made a lower high. This is a sign that accumulation is underway. Netflow data also shows steady outflows, suggesting sell-side pressure is easing.

On-Balance Volume (OBV) adds volume on up days and subtracts on down days to show whether buying or selling pressure is driving the trend.

SKL buyers make it one of the top coins to watch before September rate cuts: Coinglass

SKL buyers make it one of the top coins to watch before September rate cuts: Coinglass

Key levels lie at $0.037 and $0.055, with a confirmed breakout above $0.055 leaving little resistance up to $0.083.

With September rate cuts likely to inject liquidity into risk assets, SKALE’s improving technicals and project relevance in Ethereum scaling make it one of the most compelling coins to watch before September rate cuts.

However, a dip under $0.029 could invalidate the bullish outlook, priming the SKL price for new lows.

Overall, these three ‘made in USA coins’ show notable volatility in anticipation of the potential September rate cuts.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.