Civic Price Outlook – CVC Surges 20% as Analyst Highlights a 60% Rally

0

0

Highlights:

- The price of Civic is currently $0.1462, which is a 21% rise, and the number of trades has gone up by 374%.

- Crypto analyst estimates that forming a head-and-shoulder formation can increase Civic’s value by 60% over the next few days.

- As per CVC technical indicators, the current rise in the market means it is now considered overbought, so a shift away from its upward trend may happen soon.

Civic’s price went up by 20%, setting it at $0.1462 now, as its daily trading volume also rose to $160M. CVC is doing well so far, as over the past week, it has climbed 36%, and over the past 30 days, it has gone up 31%. Consequently, investors feel better about the market, causing the bull trend to continue.

Civic Inverse H&S Pattern

The upward pressure from bulls has pushed the price up to $0.015, so there is not much more to go before reaching the neckline. Even though it is only valued at $0.14, it has increased by 20% over what it was before. Civic is now rising due to the increased buying power of the bulls after flipping 0.1054. Besides, the formation involving the head and shoulders strengthens buyers and gives them momentum. If the market-favouring buyers remain, the price might exceed the neckline and achieve $0.1658.

Because of this, investors are feeling more confident about Civic’s prospects. As reported by Alice Crypto from X’s Alice Crypto, the inverse head-and-shoulder pattern may lead to a 60% increase.

UPDATE#CVC is making the inverse head and shoulder pattern. Expecting 60%+ gain here

#CVCUSDT #CVCBTC #BTC #Bitcoin #Crypto pic.twitter.com/ucgGPl5uJX

— Alice Crypto (@Allice_Crypto) May 15, 2025

The indicators from CVC suggest that the price could go down a little since it is approaching a point where it becomes too valuable. To start with, the RSI value of 74.35 reflects a lot of purchases. For this reason, traders and investors should look out for risks since the index is now above 70 points.

On the other hand, the MACD has moved above the signal line. The increase in the amount of CVC being issued allows traders to purchase more of the currency on the market. Also, the fact that the chart’s values are mostly above zero tells us the market is in an uptrend.

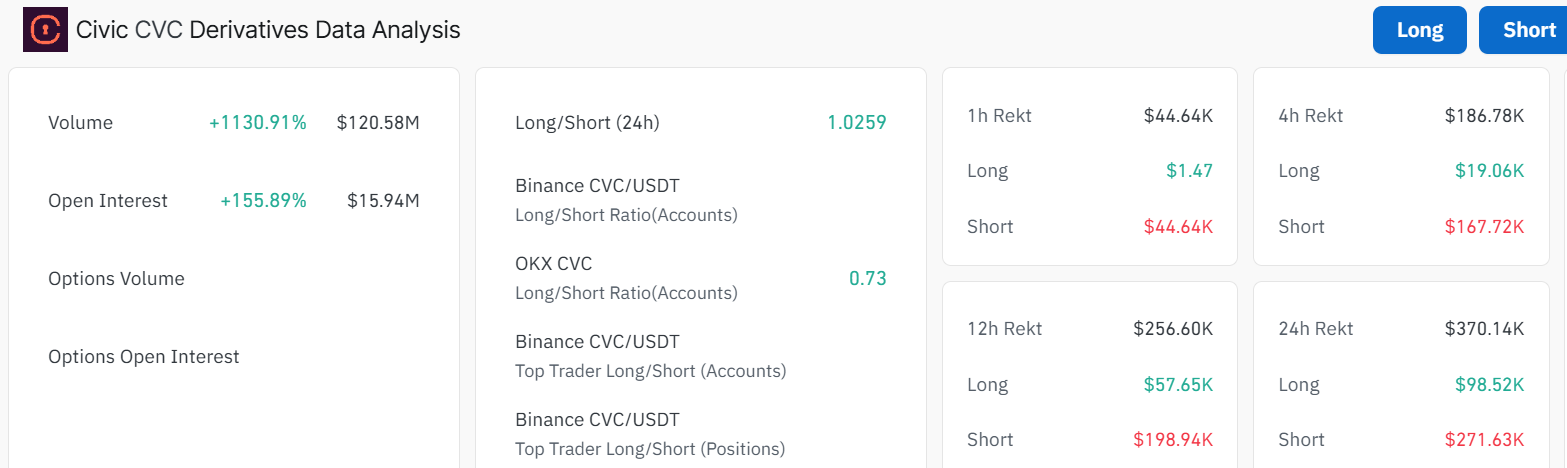

CVC Derivatives Analysis

Civic derivatives have produced very positive results when analyzed. The amount of volume has grown to $120M, a massive 1130% increase. Because of higher demand in the Civic segment, the price has increased. Besides, traders might start taking new positions due to the open interest increasing by 155% to $15M. The rise in Civic’s value is caused by an influx of money into the market lately. Besides, the long-to-short ratio in the CVC market is currently 1.02, which implies the market is still in favor of rising prices.

Because of the market conditions, putting your money into something big may not be wise at this moment. A market fall could drive Civic’s price toward $0.1338 as support. If a lot of selling takes place, the price of the cryptocurrency could drop to $0.1184.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.