Massive $725M Crypto Liquidation Sparks Panic But Some See Opportunity

0

0

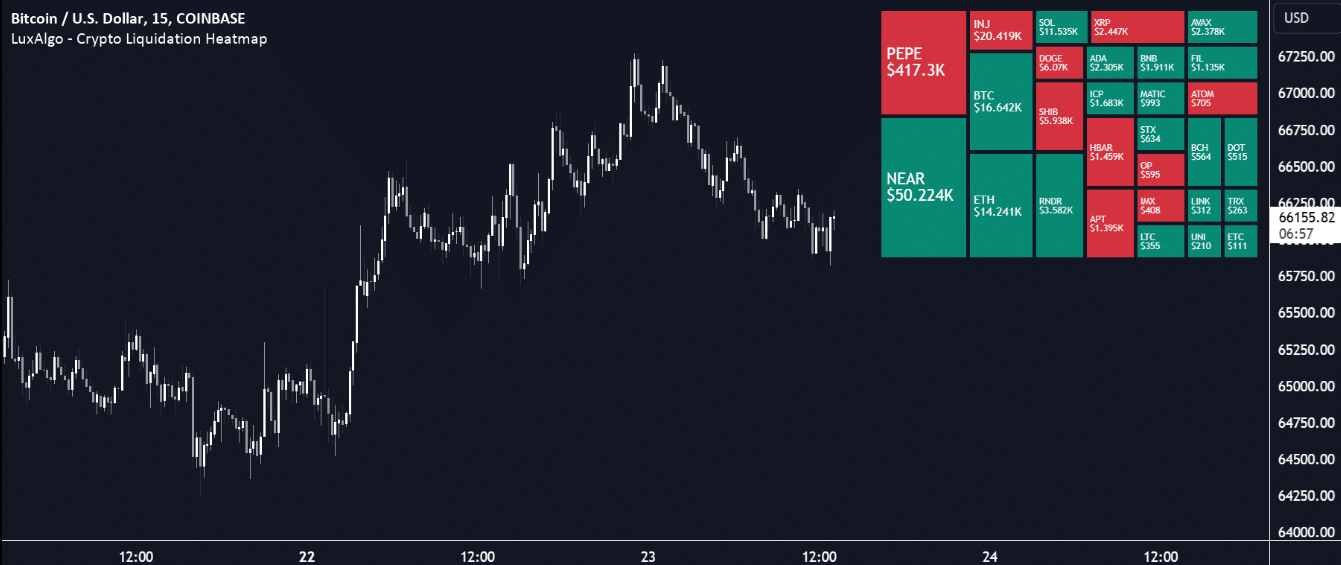

The crypto market faced one of its sharpest corrections this week as more than $725 million in leveraged positions were liquidated within 24 hours. Most of the damage came from long traders betting on a continued rally. The sudden reversal sent shockwaves through futures exchanges and left many wondering if the bull cycle had hit a wall.

A Massive Crypto Liquidation Wave Hits the Market

The crypto liquidation wave started after major tokens, led by Bitcoin and Ethereum, tumbled in response to a broad market sell-off. Bitcoin briefly slipped below $105,000, while Ethereum fell under $2,800, marking double-digit declines in just a few hours.

According to derivatives data, over 70 percent of liquidations came from long positions, as traders overextended their leverage during the recent rally. This forced liquidation cascade not only wiped out billions in open interest but also triggered a chain reaction across multiple exchanges.

Analysts Point to Global Macro Pressures

Market observers pointed to a mix of macroeconomic and geopolitical triggers. A recent announcement of new trade tariffs between the United States and China rattled global risk markets, including crypto. Equities slumped, the dollar surged, and digital assets quickly followed suit.

Crypto analyst Adam Cochran commented on X,

“When global risk sentiment flips, leveraged crypto positions are the first domino to fall. It’s a reminder that crypto doesn’t live in a vacuum.”

This round of liquidations came shortly after a period of record institutional inflows, signaling that speculative leverage had reached unsustainable levels. Funding rates across major derivatives platforms dropped to their lowest levels in months, indicating traders’ reluctance to reopen long bets too soon.

Institutional Inflows Continue Despite the Crash

Interestingly, despite the turmoil, institutional investment products tied to cryptocurrencies continued to record net inflows. This suggests that while retail traders faced heavy losses, professional investors may have viewed the dip as a buying opportunity.

Market strategists noted that many funds have been positioning for long-term accumulation, especially after recent approvals of new crypto-based financial products.

“The sell-off was brutal but not unexpected,” said market strategist Michael van de Poppe. “Leverage was excessive, and history shows these shakeouts are part of every cycle. What matters is how quickly liquidity returns.”

How Liquidations Affect Market Stability

Liquidation events occur when traders using borrowed funds fail to meet margin requirements, forcing exchanges to close their positions. These cascades can amplify market volatility by triggering a domino effect, each forced closure adds downward pressure on prices.

As seen in past cycles, large crypto liquidation waves often reset market leverage and create room for more stable price discovery. Some traders view these events as “cleansing moments” that remove speculative excess and pave the way for healthier growth.

Sentiment Turns Fearful but Opportunity Looms

Crypto fear and greed indexes dropped sharply after the liquidation, moving from “Greed” to “Extreme Fear.” This swing reflects a cautious market mood. However, analysts argue that such corrections often set the foundation for new accumulation phases.

Bitcoin’s on-chain data still shows strong long-term holder activity, suggesting that while leverage traders exit, holders continue to accumulate quietly.

Conclusion

The $725 million crypto liquidation may seem alarming, but it represents part of the cyclical nature of crypto markets. Leveraged speculation tends to stretch valuations, and each correction reminds traders of the market’s unforgiving mechanics. For long-term investors, the reset could mark the beginning of a more sustainable climb, one driven by organic demand rather than borrowed momentum.

FAQ

What caused the $725 million liquidation?

The liquidation was driven by sudden price drops in Bitcoin and Ethereum, which triggered margin calls on leveraged positions.

Are liquidations common in crypto trading?

Yes. Due to high volatility and leverage, liquidation events are frequent. However, such large-scale liquidations happen only during major market corrections.

Did institutional investors also lose money?

Most liquidations affected retail and high-leverage traders. Institutional investors typically manage risk with lower leverage and hedging strategies.

Is this the end of the bull market?

Not necessarily. While sentiment turned cautious, long-term metrics suggest continued institutional accumulation and network activity.

Glossary of Key Terms

Liquidation: The forced closure of a leveraged position when a trader’s margin falls below the required threshold.

Leverage: Borrowed capital used to amplify trading exposure. High leverage increases both potential gains and losses.

Funding Rate: The periodic fee paid between long and short traders in perpetual futures to keep contract prices aligned with spot prices.

Open Interest: The total number of outstanding derivative contracts, indicating market participation and liquidity.

On-Chain Data: Information derived directly from blockchain activity, used to analyze trends like accumulation, transfers, and investor behavior.

Fear and Greed Index: A sentiment indicator showing whether investors are too fearful or too greedy, often used to time market reversals.

Read More: Massive $725M Crypto Liquidation Sparks Panic But Some See Opportunity">Massive $725M Crypto Liquidation Sparks Panic But Some See Opportunity

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.