SharpLink’s $1B Ethereum Bet Shocks Market Despite $18M Valuation Filing

0

0

Ethereum has drawn fresh attention following a recent SEC filing from SharpLink Gaming. The document outlines plans for a $1 billion Ethereum purchase intended for the company’s treasury.

This figure stands in stark contrast to SharpLink’s valuation of just $18 million. The announcement has raised serious questions about the practicality and motive behind such a move.

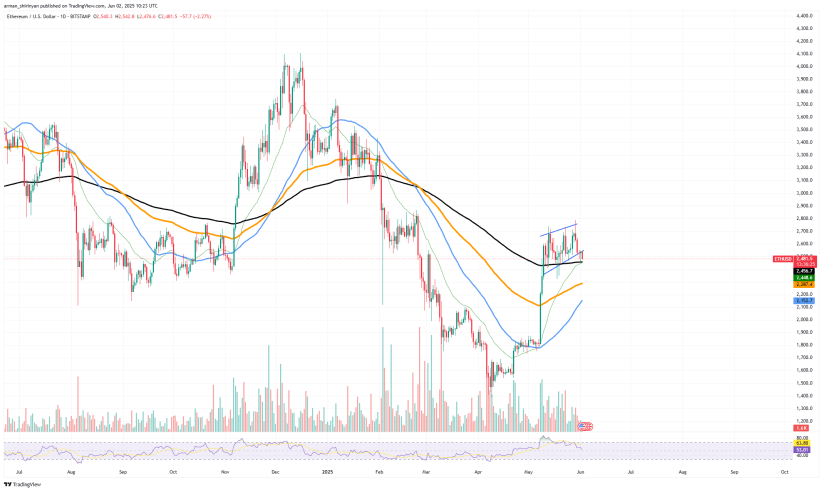

Ethereum, meanwhile, is locked in a tight consolidation zone as it continues to test its 200-day exponential moving average amid steadily declining volume.

Short-term signals suggest mild bullishness, but weakening activity could lead to further downside pressure. If ETH’s support fails, it might move toward the 50 EMA at $2,200.

Source: Tradingview

If the acquisition goes through, it would be an unusually bold treasury move in crypto. However, there are still doubts about how SharpLink would finance such an expansive purchase.

Also Read: Ripple CTO Sparks XRP Frenzy With Mysterious “$11,106” Jackpot Tweet

Concerns Grow Over SharpLink’s Financial Capacity to Back the Plan

Ethereum trades tens of billions of dollars daily, and a $1 billion purchase equals only 0.3% of that volume. While notable, the move may have minimal impact on the overall market price.

Experts are careful, saying confirmation of where the money is coming from is needed. When there is no support from outside or a key partner, the filing seems like a speculative idea.

The market reaction has been quiet because many consider the filing a mere publicity attempt. People involved in trading continue to watch Ethereum’s price and important technical points.

ETH must breach $2,900 to get out of the current range and cause a short boost in price. Should this scenario occur, consolidation or another downward move may continue for a bit.

Caution is advised as headlines may not reflect true market impact. Ethereum’s next move is likely to depend on price behavior, not corporate filings.

SharpLink’s plans for $1 billion on Ethereum have created much speculation. While more details are not clear, traders are focused on ETH’s essential technical markers.

Also Read: Scam Alert: Fake Shiba Inu Profiles Target 1.5M Holders With Phishing Traps

The post SharpLink’s $1B Ethereum Bet Shocks Market Despite $18M Valuation Filing appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.