ETH Likely to Fall Below $4,300 Post Consolidation

0

0

Ether ETH $4 600 24h volatility: 4.2% Market cap: $554.92 B Vol. 24h: $38.84 B is currently recovering from its recent drop to the critical support level, posting a 3.5% daily gain on Aug. 26. Popular analyst Markus Thielen noted that Ethereum is entering a decisive phase as momentum weakens.

Notably, ETH has been respecting its 21-day moving average, currently around $4,355, with multiple bounces observed through early and mid-August. Large buyers and institutions stepped in to defend this level, but the strength of dip-buying appears to be fading.

📊Today’s #Matrixport Daily Chart – August 27, 2025⬇️

Respect the Technicals: Ethereum’s Next Big Test #Matrixport #Bitcoin #Ethereum #CryptoMarkets #CryptoETF #InstitutionalFlows #BTC #ETH #MarketStrategy #TechnicalAnalysis pic.twitter.com/u0418lzsZx

— Matrixport Official (@Matrixport_EN) August 27, 2025

Thielen predicted that Ethereum is likely to oscillate between $4,355 and $4,958 in the short term. However, he also noted the risk of retesting levels below $4,355 if sellers regain control.

A Major Long Squeeze

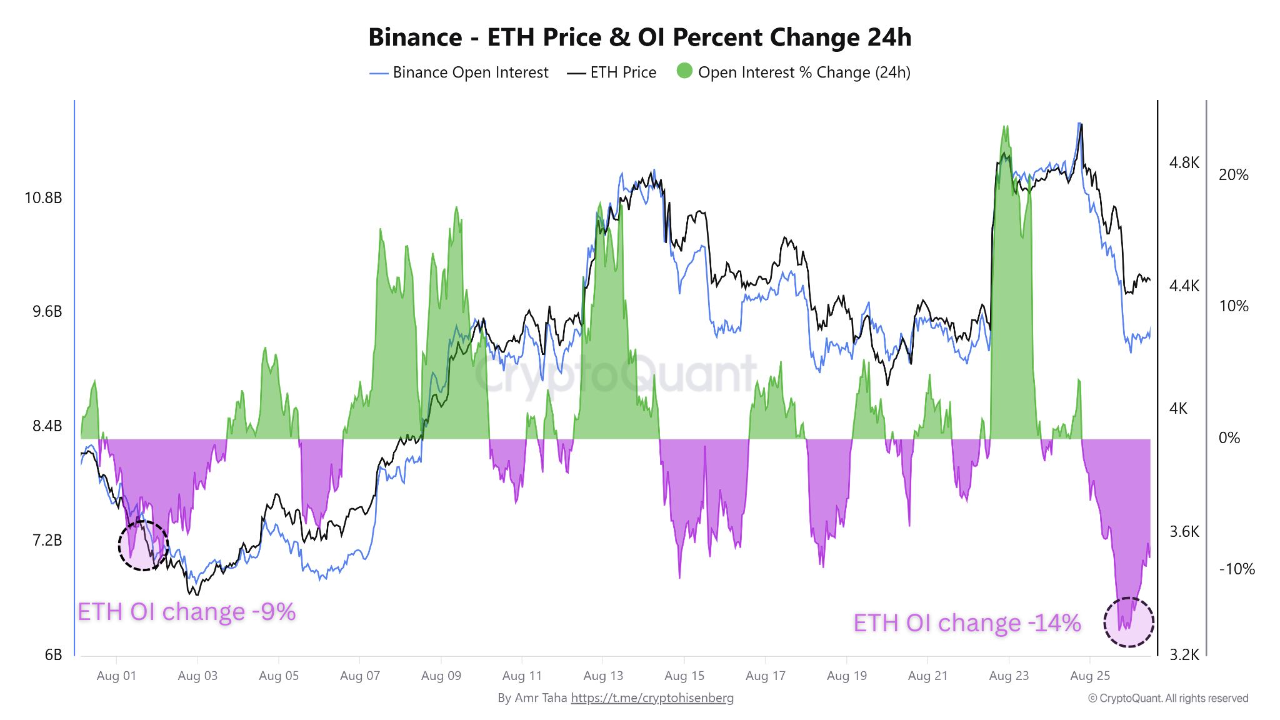

Adding pressure to Ethereum’s trajectory, the derivatives market recently witnessed one of its steepest single-day shakeouts. On Aug. 24, open interest on Binance plunged more than 14% within 24 hours as ETH slid below $4,400.

The sudden collapse triggered widespread liquidations, surpassing the early August contraction of -9%. This points to a forced deleveraging event rather than voluntary selling.

ETH price & OI percent daily change | Source: CryptoQuant

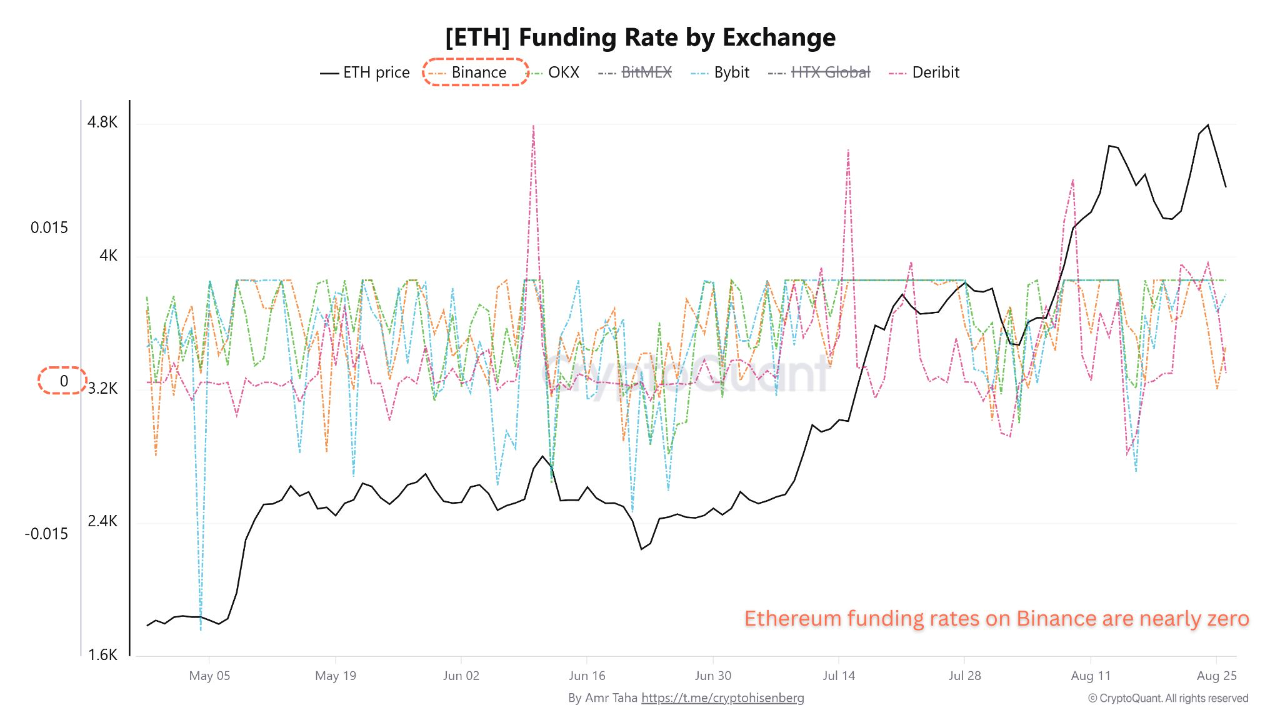

Meanwhile, ETH funding rates cooled to near-zero levels, a zone typically associated with the aftermath of long squeezes. According to on-chain insights from a CryptoQuant contributor, this reflects a collapse in bullish sentiment where late buyers are flushed out of the market.

ETH funding rate by exchange | Source: CryptoQuant

The synchronized fall suggests that leverage-driven demand is drying up quickly.

ETH Price Outlook: Bulls vs. Bears

At the time of writing, Ethereum is trading near $4,586 after briefly retesting its long-term support around $4,350. Just two days earlier, ETH had marked a new all-time high at $4,953 before sellers drove the price back down.

On the 4-hour chart, ETH is currently filling a bearish fair value gap between $4,600 and $4,450, with a possible extension toward $4,000 if selling pressure accelerates.

ETH 4-hour chart with possible price directions | Source: Trading View

For bulls to regain control, ETH must reclaim the $4,662 zone and post a daily close above $4,700. Such a move could restore bullish momentum and re-open the path toward $5,000.

Despite the near-term uncertainty, crypto analysts are optimistic. Popular trader Ted suggested ETH could hit $10,000 by year-end.

$ETH $10,000 end of year.

With a dip in September to buy. 👀

I agree with Tom Lee.

— Ted (@TedPillows) August 27, 2025

Ted predicted that before such a surge, traders could see an Ether price drop serving as a good buying opportunity.

The post ETH Likely to Fall Below $4,300 Post Consolidation appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.