Hyperliquid Price Hits $58.78 ATH as Open Interest Tops $10B

0

0

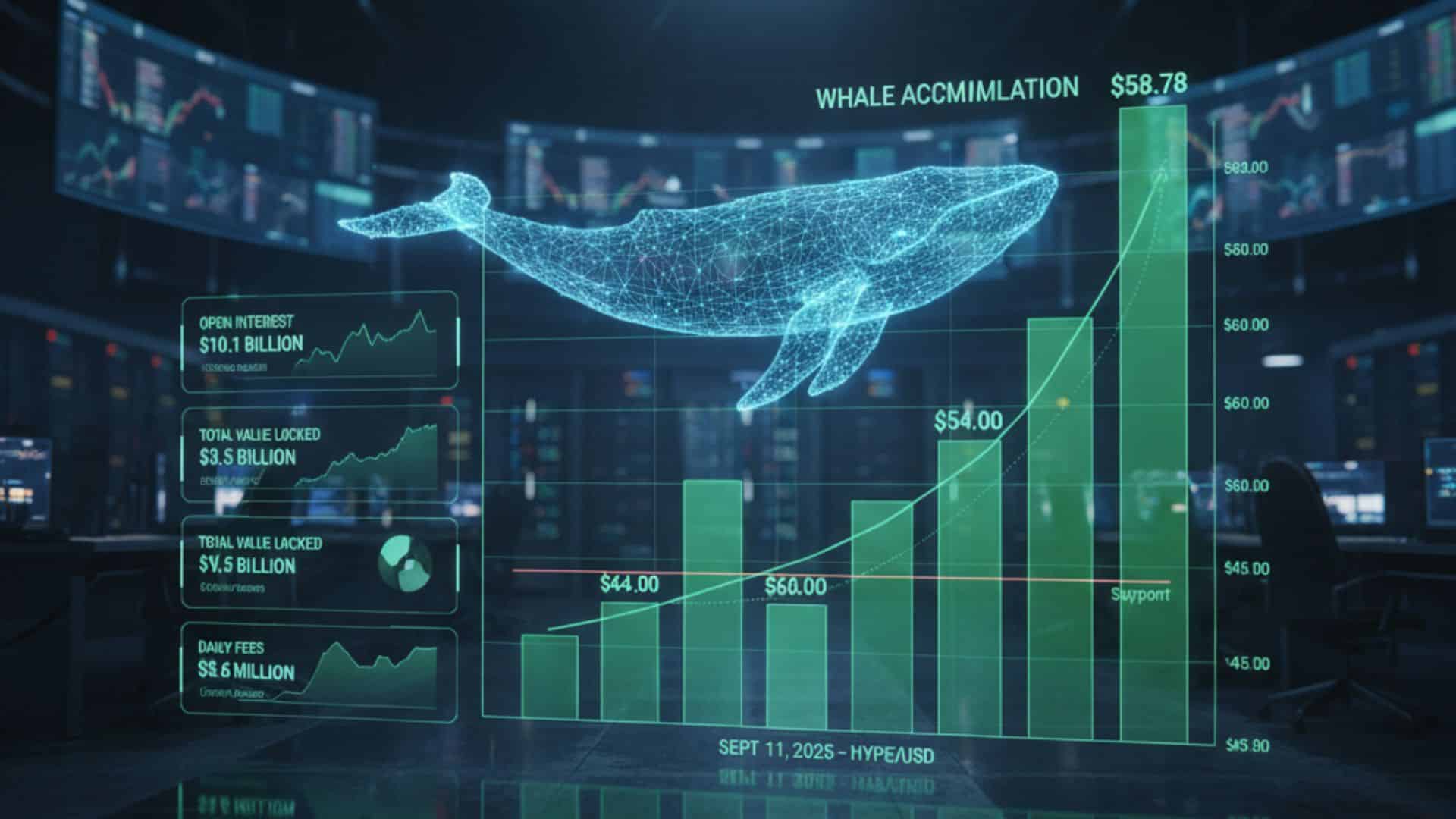

According to recent updates, HYPE price surged to a fresh high of $58.78 on September 11, 2025. The rally has been fueled by rising trading volumes, larger open interest, and record fees generated by the protocol.

While the token has since cooled to around $54, the move shows growing confidence in Hyperliquid’s role in the derivatives sector and highlights key factors shaping its price action.

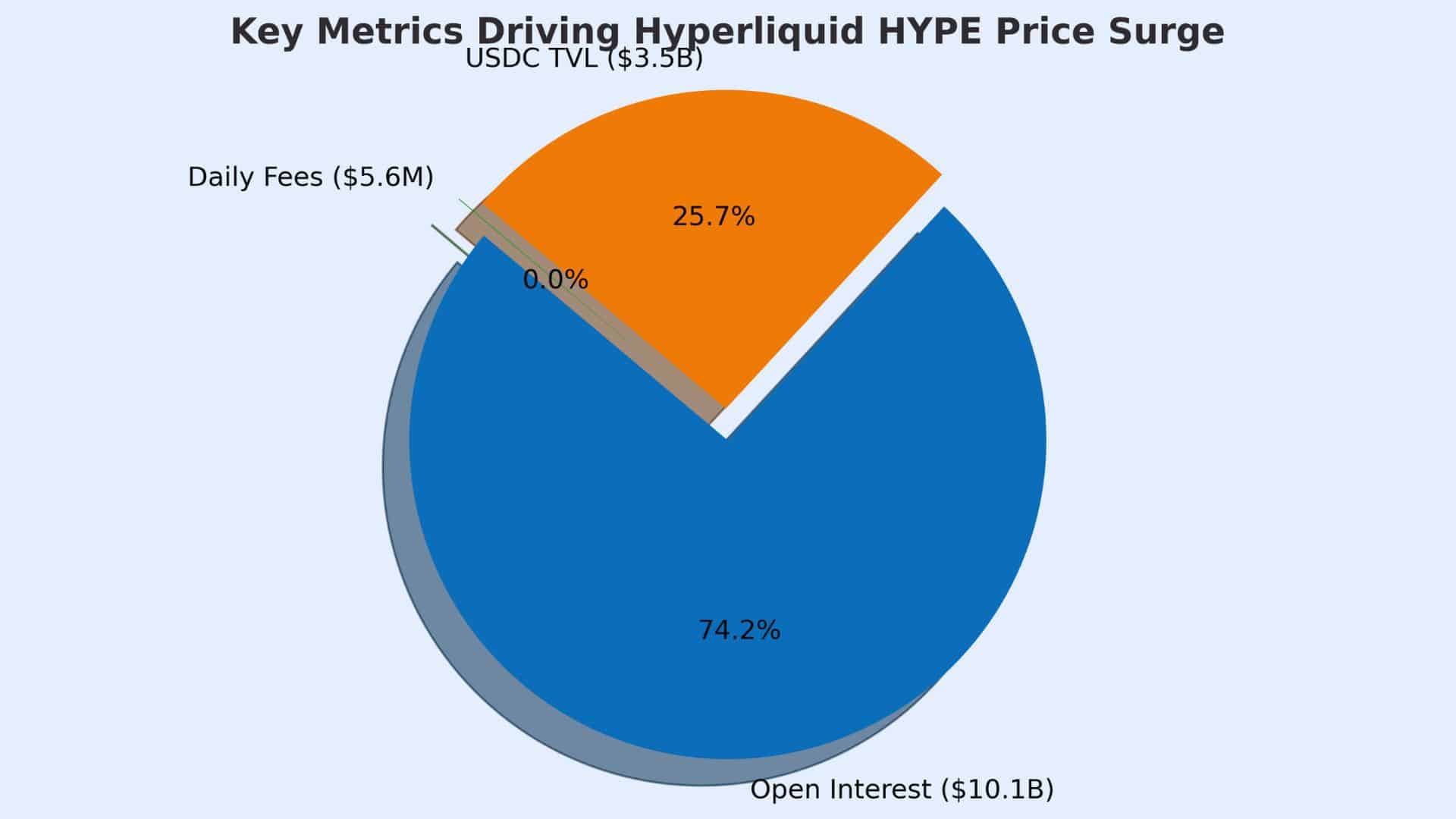

Record Metrics Driving the Move

The latest numbers support why traders have piled into Hyperliquid. Open interest climbed to about $10.1 billion, the highest ever for the exchange. At the same time, total value locked (TVL) in USDC touched $3.5 billion, showing that capital continues to flow into the platform. Daily trading fees also reached $5.6 million, proving that usage is not only rising but sustaining record levels.

These data points confirm that the rise in HYPE price is backed by more than speculation. A growing share of users are engaging in perpetual futures and derivatives, locking liquidity and generating revenue.

Also Read: Crypto Price Prediction Today: XRP Gains Momentum, Hyperliquid and Pump Tokens Eye Breakouts

Current Price and Resistance

At its peak this month, HYPE token ATH stood at $58.78. Since then, the token has corrected modestly, trading around $54 in several markets. Analysts note that the next resistance zone lies at $60, a psychological barrier that could determine whether the uptrend extends toward higher targets such as $70 or even $100.

Support levels appear near the mid-$40s, where previous buying activity stabilized the token.

Key Drivers of Growth

Institutional signals and growing whale activity have added strength to the rally. Bigger players just keep holding, unwilling to sell, thereby reducing the quantity of supply to hold the momentum. Technical indicators like RSI and moving averages, even today, remain hugely promising, suggesting further upside.

Automated token buybacks and a well-considered user ramp between August and now have played a significant role in the upward movement, pushing priced HYPE tokens into new ranges.

However, risks still loom. Profit-taking after intense price action tends to trigger steep retracements. An imminent token unlock could serve to increase the circulating supply, while external factors such as news affecting regulations or a fall in DeFi sentiment could trigger further volatility.

Conclusion

Based on the latest research, HYPE price has proven resilient, with open interest above $10 billion, USDC TVL around $3.5 billion, and fees surpassing $5 million daily. These numbers point to real activity backing the token’s rise, not only hype. Yet the resistance zone between $58 and $60 remains critical.

Breaking it could set the stage for the next major rally, while failure may signal a period of consolidation or correction.

Also Read: Hyperliquid Price Prediction: Analysts See $HYPE Targeting $185 by 2030

Summary

HYPE price recently touched $58.78, marking a new all-time high before pulling back near $54. Record metrics in open interest (~$10.1 billion), USDC TVL (~$3.5 billion), and daily fees (~$5.6 million) show strong demand.

Institutional attention and whale accumulation added fuel, though resistance at $60 remains crucial. Risks such as profit-taking and token unlocks still matter, making the next breakout or correction an important test for traders and investors.

Glossary of Key Terms

ATH (All-Time High): The highest price a token has reached.

TVL (Total Value Locked): The sum of all assets locked in a protocol.

Open Interest: The total value of active futures contracts not yet settled.

Resistance / Support: Price points where selling or buying pressure clusters.

RSI: Relative Strength Index, a momentum indicator used in technical analysis.

FAQs about HYPE Price

Q1: Why did HYPE price surge recently?

The rally came from record open interest, growing TVL, high trading fees, and strong whale accumulation.

Q2: What is the latest HYPE token ATH?

The most recent all-time high was $58.78 on September 11, 2025.

Q3: Is $60 the key resistance level?

Yes. Analysts expect $60 to be the immediate barrier. If it breaks, upside toward $70 or $100 becomes possible.

Q4: What risks could pull the price back?

Profit-taking, token unlocks, and external market shifts are key risks that could slow momentum.

Read More: Hyperliquid Price Hits $58.78 ATH as Open Interest Tops $10B">Hyperliquid Price Hits $58.78 ATH as Open Interest Tops $10B

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.