SEC vs. CFTC: CLARITY Act Aims to Finally Settle U.S. Crypto Turf War

0

0

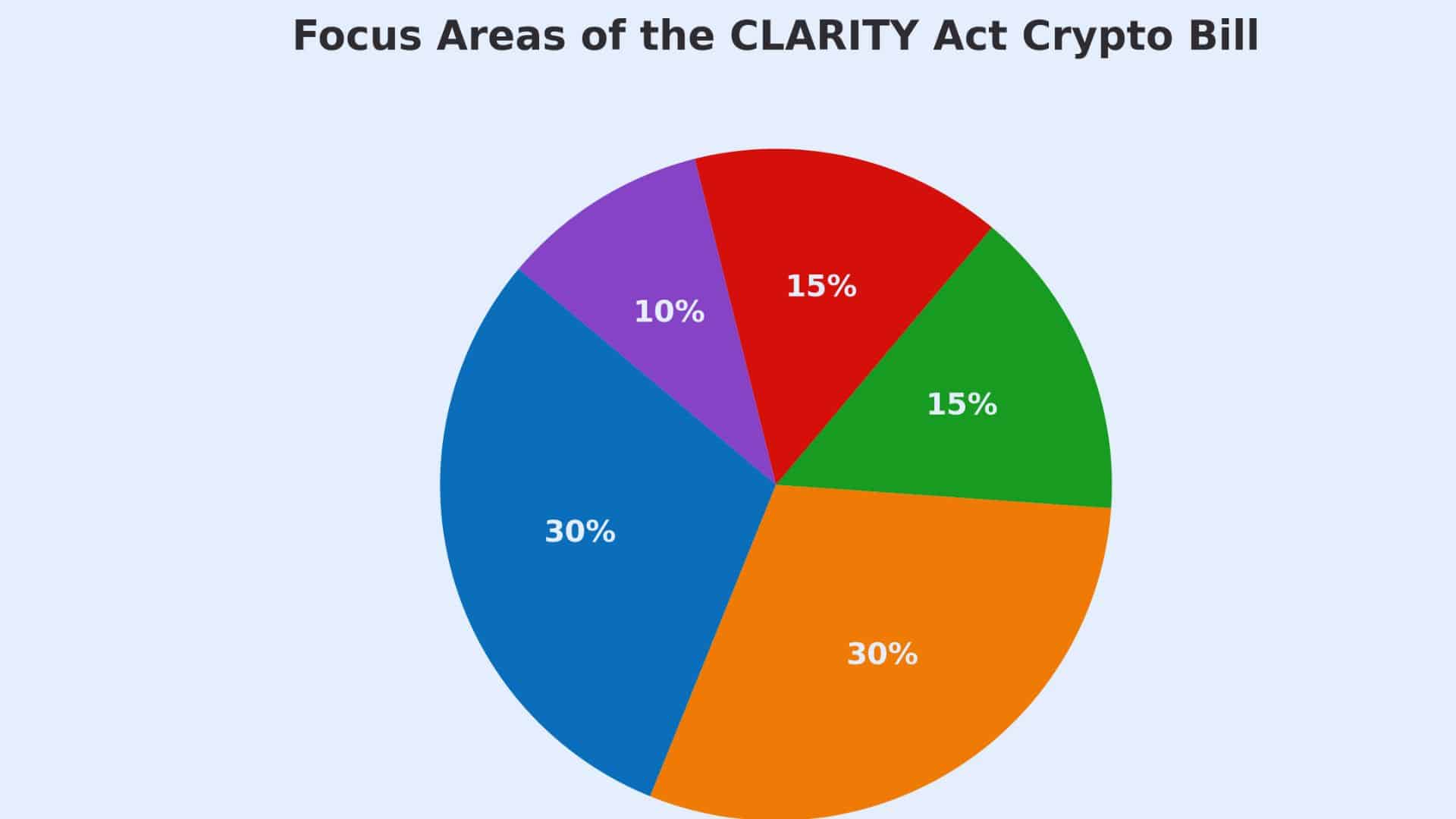

The CLARITY Act crypto bill has gained strong momentum after passing the House of Representatives in July 2025. The Act aims to settle one of the most debated issues in the sector: who regulates digital assets in the United States.

With the Senate set to review it, industry leaders, lawmakers, and investors are watching closely as the future of U.S. crypto regulation takes shape.

What the CLARITY Act Crypto Covers

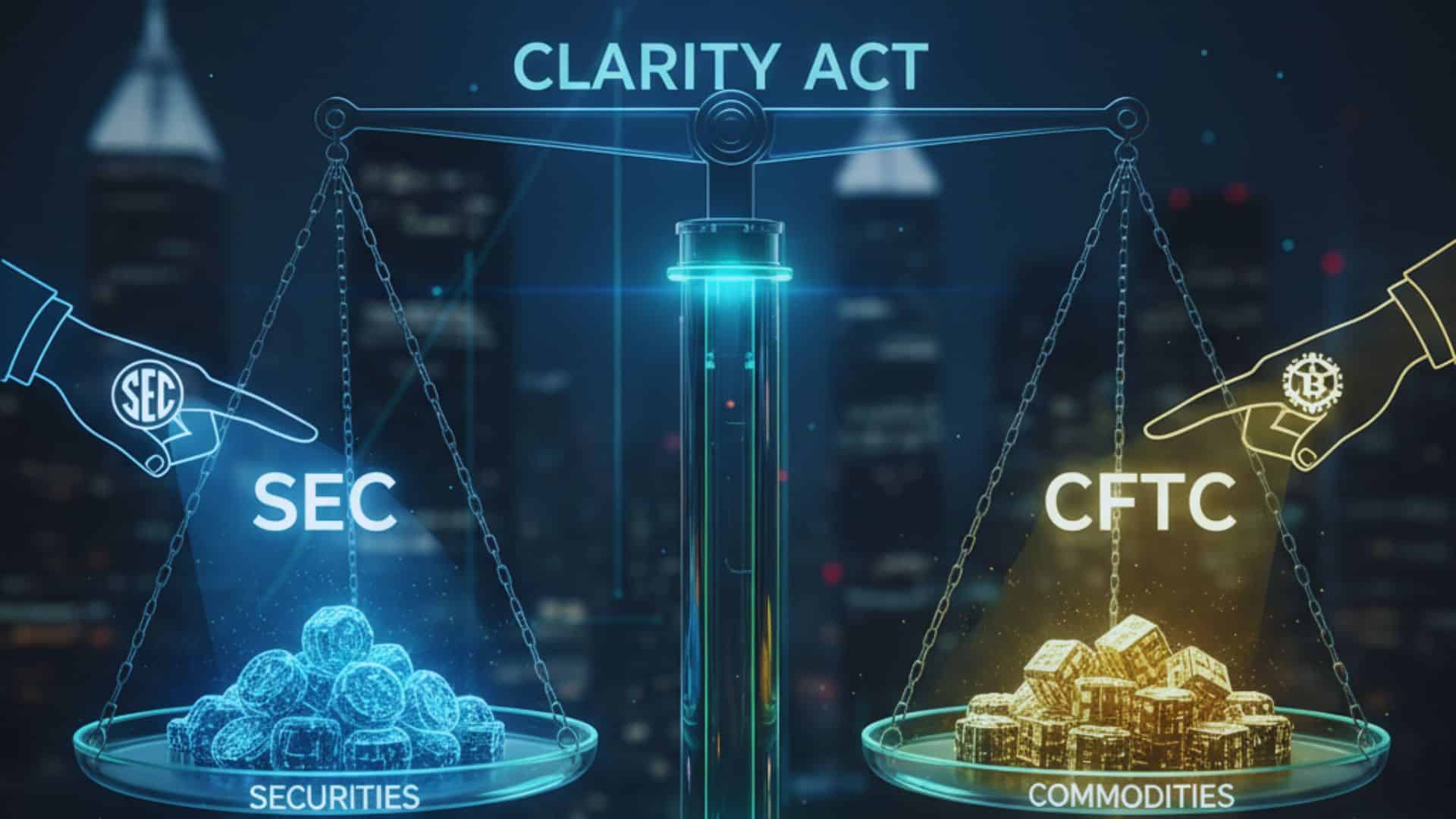

The CLARITY Act crypto bill creates a legal line between digital assets that should be treated as securities and those that fall under commodities. The Securities and Exchange Commission (SEC) would continue to oversee securities, while the Commodity Futures Trading Commission (CFTC) would supervise commodity-like tokens.

The proposed legislation will also recognize the individual’s right to keep crypto assets in a self-custody wallet. This is an additional shield for users in the event of failure on the part of the exchanges.

Token issuers must also publicly publish all information relevant to the tokens in order to reduce possible occurrences of fraud and increase market trust. This is where the proposal rests to give long-term certainty in U.S. crypto regulation.

Also Read: Crypto Week Breakthrough: U.S. House Clears Path for GENIUS and CLARITY Acts

Recent Developments and Senate Role

The House approval marked a major step, but the process is far from over. The Senate Banking Committee has released its own draft with added conditions for token issuers and stronger disclosure standards. That version also re-attached a measure to block a central bank digital currency (CBDC), making the debate more political.

Industry figures, including major exchange leaders, have described the CLARITY Act crypto as a “freight train” that cannot be stopped. They argue that without it, the U.S. risks losing ground to countries that already have clear rules. Supporters in Congress have echoed this concern, stressing that U.S. crypto regulation must keep pace with global competition.

Benefits and Challenges Ahead

If the law is passed, those undergoing training would have exchanges, custodians, and developers at their disposal to guide them. New projects may be more confident about launching in the U.S., whereas investors would know precisely which agency is in charge.

Yet the road ahead is not a simple one. Certain critics warn that more authority given to CFTC may lower protections. The rift between the House and Senate versions may also hinder progress, with any complete rules remaining unlikely until about 2026.

Conclusion

Based on the latest research, CLARITY Act crypto could reshape how digital assets are handled in the U.S. Its mix of custody rights, disclosure rules, and agency roles points to a more stable market.

The Senate’s decision and later rulemaking will decide the final shape, but it marks real progress in U.S. crypto regulation and a turning point for investors and builders.

Also Read: Tether’s Next Big Move? U.S. Stablecoin to Launch Pending GENIUS Act Clarity

Summary

The CLARITY Act crypto bill, introduced in the House and passed in July 2025, lays the foundation for how the digital assets are regulated in the U.S. It divides the supervision of the assets between the SEC and CFTC, secures self-custody, and requires clear disclosures.

Supporters claim it is indispensable for competitiveness in the world markets; opponents say that it could endanger investors’ safety. The Senate’s role will decide how this landmark step in U.S. crypto regulation moves forward.

Glossary of Key Terms

Digital asset: Token recorded on a blockchain, like Bitcoin or Ethereum.

SEC: Securities and Exchange Commission regulates securities.

CFTC: Commodity Futures Trading Commission, regulates commodities and futures.

Self-custody: Holding crypto in a personal wallet.

CBDC: Central bank digital currency, a digital form of national money.

FAQs about CLARITY Act Crypto

What is the CLARITY Act crypto bill?

It is a U.S. bill that divides oversight of digital assets between the SEC and CFTC, while securing rights like self-custody.

How does it compare with the GENIUS Act?

The GENIUS Act, now law, regulates stablecoins. The CLARITY Act crypto focuses on the wider market structure.

When might it take effect?

If the Senate passes it soon, rulemaking could begin in 2026.

Why does it matter?

It could lower risks for investors, attract projects to the U.S., and give clarity in U.S. crypto regulation.

Read More: SEC vs. CFTC: CLARITY Act Aims to Finally Settle U.S. Crypto Turf War">SEC vs. CFTC: CLARITY Act Aims to Finally Settle U.S. Crypto Turf War

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.