Bitcoin ETF: A Decisive Turning Point With The Stabilization Of Flows

0

0

Like a tightrope walker swaying between two cliffs, Bitcoin ETFs evoke as much hope as chills. In recent weeks, a timid recovery of positive flows has given the market a semblance of breath. But behind this surge lies a darker reality, highlighted by CryptoQuant: Bitcoin exchange-traded funds (ETFs) are navigating a critical turbulence zone. Between deceptive stabilization and macroeconomic threats, BTC is walking a tightrope.

Bitcoin ETFs at the Crossroads: precarious balance or prelude to a fall?

Since their launch, Bitcoin ETFs have embodied a revolution for institutional adoption. However, data from CryptoQuant reveals a mixed picture.

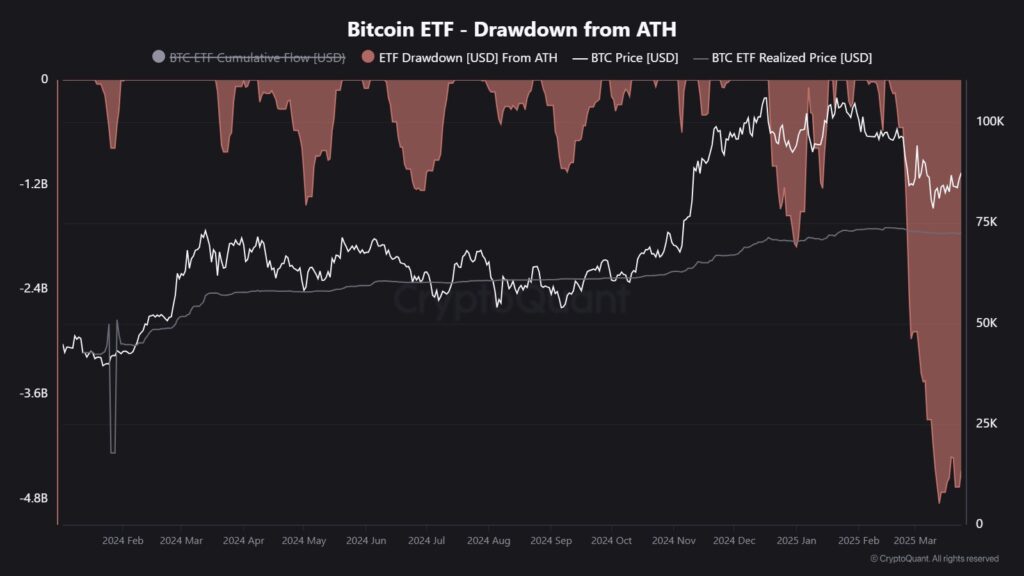

The first chart shows a drop of 12% from the historic high (ATH) reached in early 2025, amounting to nearly $5 billion evaporated.

Source: CryptoQuant

A painful decline contrasting with the euphoria of the preceding months, marked by aggressive accumulation of bitcoin. Investors, once conquerors, now seem hesitant to nourish the giant.

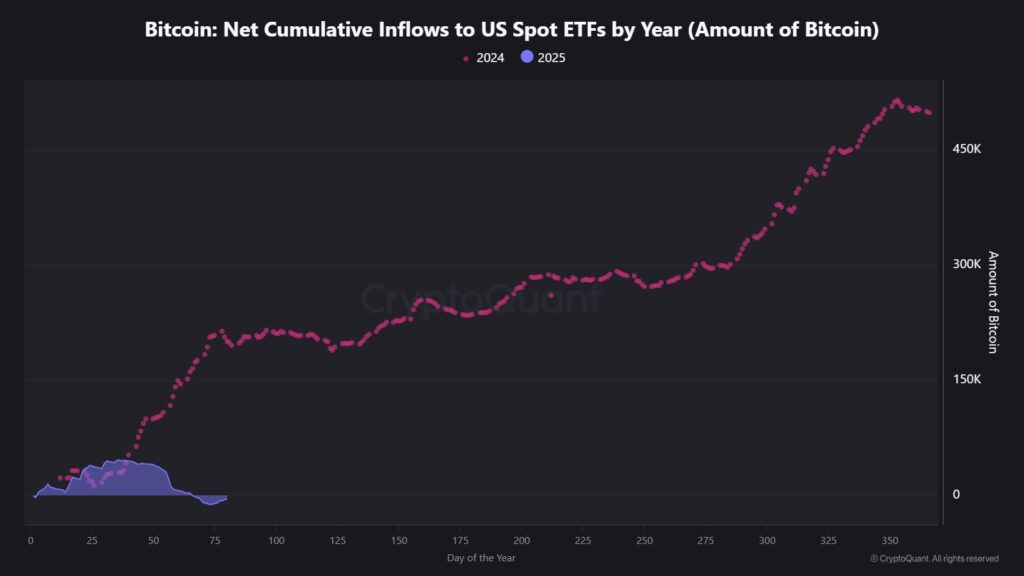

The second chart drives the point home: while 2024 propelled net inflows to $30 billion, 2025 starts in troubled waters. Flows have reversed, plunging into negative territory.

A turnaround reminiscent of the upheavals in traditional markets facing persistent inflation or capricious interest rates. Institutions, caught between the desire for yield and risk aversion, are now playing for time.

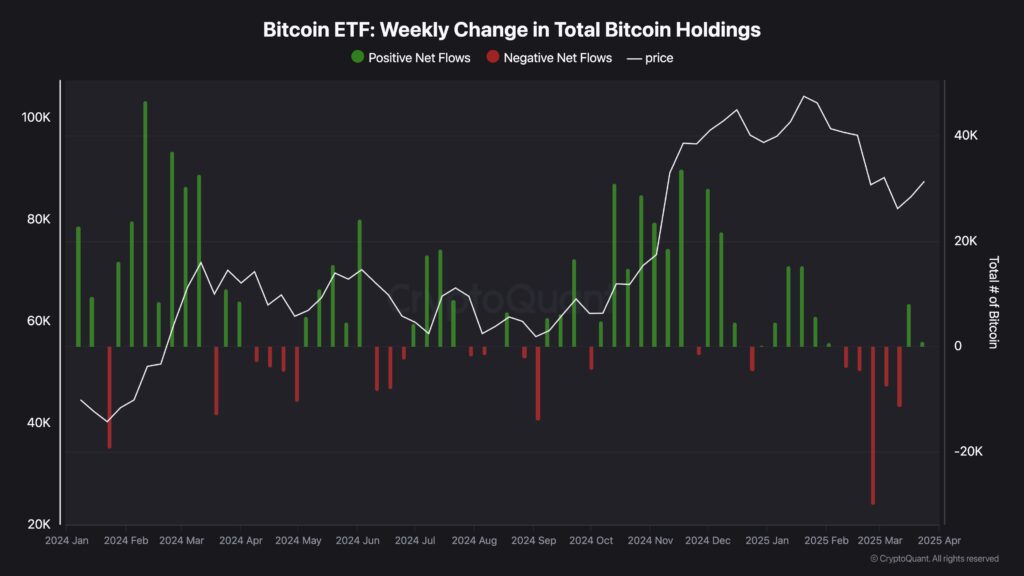

Finally, the third chart offers an ambiguous glimmer: daily flows of Bitcoin ETFs are stabilizing, but in a fragile balance. Supply and demand remain lethargic, hanging by a thread.

“It’s the calm before the storm or the saving lull,” summarizes an analyst. In this context, every capital movement takes on the appearance of a roll of the dice.

Stabilization of flows: mirage or glimmer of hope?

Despite massive withdrawals, one detail intrigues: Bitcoin ETF holders remain predominantly profitable. The average breakeven price ($72,546) contrasts with the current $87,000 price of bitcoin, providing a latent margin of 17%.

A paradoxical situation: even in the event of panicked sales, most investors would come out winners. However, this profitability could also fuel an illusion of security, masking the market’s vulnerability.

The recent inflows of $800 million in eight days, however, shake up the forecasts. A resurgence that raises questions: is it a return of confidence or a final gasp before a retreat? Bitcoin, on its part, is struggling to gain a measly 2.4% over a week, moving within a narrow corridor. Like a sleeping volcano, its latent energy could explode… or extinguish.

Still, there is the macroeconomic variable, a sword of Damocles hanging over the ETFs. Amid geopolitical tensions and monetary uncertainties, institutional investors adjust their positions in real-time. Flows, now more responsive than ever, reflect this dance with the unpredictable.

Bitcoin ETFs today embody the paradox of a market that is both resilient and fragile. Their recent stabilization is neither a guarantee of sustainability nor a harbinger of chaos. Like a seismograph, it records the tremors of a transforming financial world.

The question is not whether a crash will occur, but how the market will digest these convulsions. Between fear and opportunity, bitcoin remains, more than ever, a mirror of our collective uncertainties. To be continued with a critical eye… and an agile portfolio.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.