El Salvador Acquires 7 More Bitcoin Last Week Despite IMF Pressure

0

0

Highlights:

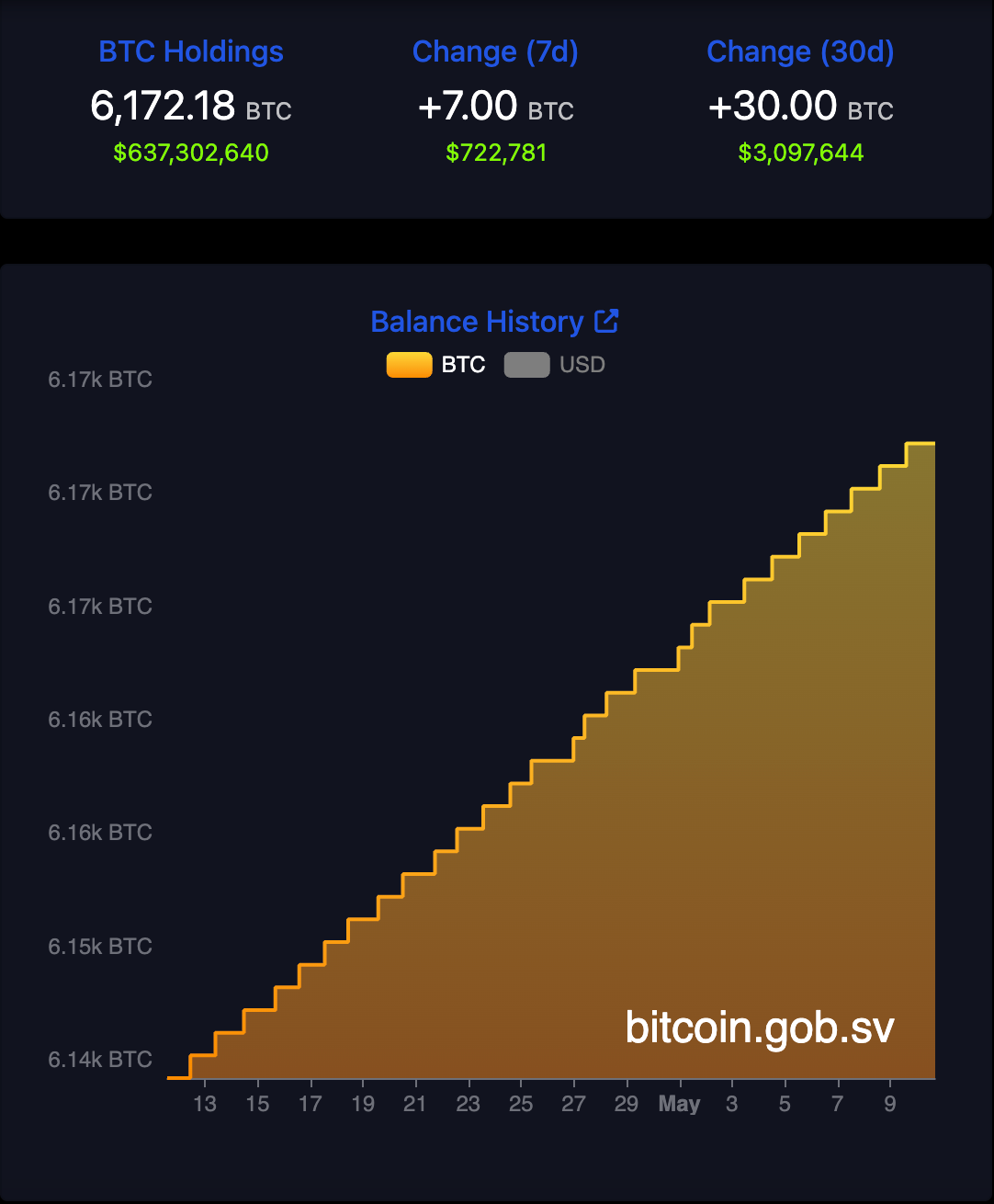

- El Salvador boosts reserves with 7 new BTC, totaling 6,173 BTC in holdings.

- Bukele rejects IMF push, says Bitcoin buying will not stop anytime soon.

- Max Keiser says El Salvador’s Bitcoin reserve strategy may inspire other nations to follow suit.

El Salvador’s government is still acquiring Bitcoin for its national reserve. This continues despite a $1.4 billion loan agreement with the International Monetary Fund (IMF), which restricts the government from engaging with BTC. El Salvador purchased seven more BTC last week, according to its national Bitcoin Office. This brings its total holdings to 6,173 BTC, worth over $637 million.

El Salvador is one of the few countries buying Bitcoin through open market operations. Its Bitcoin reserve strategy may inspire other nations to consider similar plans. In December last year, El Salvador signed a $1.4 billion loan agreement with the IMF. The deal required the country to cancel its Bitcoin legal tender law and make Bitcoin payments voluntary. The agreement also stated that El Salvador must reduce its Bitcoin purchases and stop using public funds for them.

The country agreed to stop any voluntary Bitcoin accumulation by the public sector, as outlined in a technical memorandum of understanding. However, the agreement specified that Bitcoin acquired through forfeiture, seizure, or legal actions against individuals or companies would not be subject to this restriction.

The memorandum clarified that government-owned entities managed all hot and cold wallets in the public sector. This included entities like the Chivo Wallet, Oficina Nacional del Bitcoin, Comision Ejecutiva Hidroelectrica del Rio Lempa, and La Agencia Administradora de Fondos Bitcoin. While Bitcoin remained legal, it was no longer required for transactions.

The IMF said El Salvador remains in compliance with its pledge to stop Bitcoin accumulation in the public sector, a key performance target. It added that broader reforms in areas like governance, fiscal transparency, and structural changes are also progressing.…

— Wu Blockchain (@WuBlockchain) April 27, 2025

El Salvador Rejects IMF Request and Keeps Buying Bitcoin

In March 2025, the IMF again asked El Salvador to stop buying Bitcoin, repeating the original terms of the agreement. However, President Nayib Bukele rejected the request. Bukele stressed that the country would continue its Bitcoin purchases and not reduce its BTC holdings, despite pressure from the IMF. “No, it’s not stopping. If it didn’t stop when the world ostracized us and most ‘Bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future,” Nayib Bukele wrote in a March 4 X post.

This defiance has raised concerns among international economists and investors. Many believe El Salvador is taking unnecessary financial risks. The IMF has warned that continued Bitcoin purchases with public funds could make the country’s financial situation more unstable.

Max Keiser Highlights El Salvador’s Leadership in BTC Reserve Strategy

Max Keiser, a well-known Bitcoin supporter, highlights El Salvador’s leading role in creating a legal framework for Bitcoin reserves. Keiser believes that under President Bukele, El Salvador has set an example for using Bitcoin in national financial strategies. He said that other countries, including the United States, are trying to follow suit but are lagging behind El Salvador’s efforts.

The only country with the oldest, most successful legal framework for a Bitcoin Reserve Strategy is EL SALVADOR

The US trying to catch up to President Bukele.

Come here; learn how we did it and why other countries are missing the boat. @TheNotoriousMMA @nayibbukele https://t.co/rxhmYFv0xF

— Max Keiser (@maxkeiser) May 10, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.