Dogecoin Price Retraces 8% as US CPI Data Drops to 2.3% – Is a Rally to $0.33 Plausible

0

0

Highlights:

- Dogecoin price retraces 8% to $0.22, as trading volume drops 9%.

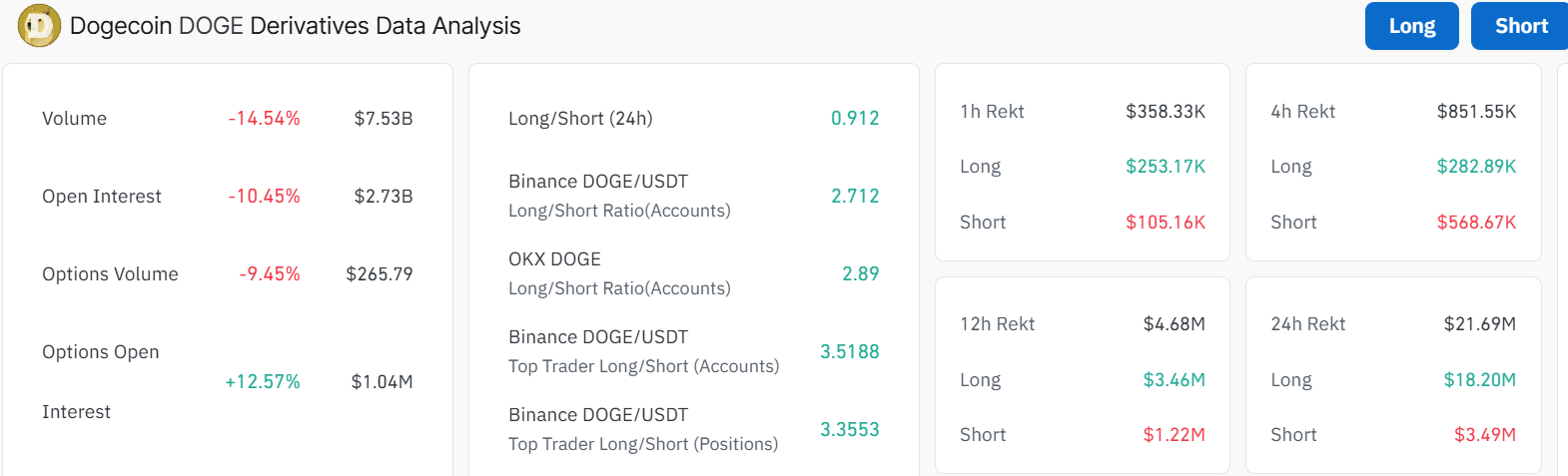

- CoinGlass data shows a drop in volume and open interest, indicating a potential consolidation phase.

- The April CPI data drops below expectations to 2.3%, igniting some bullish prospects in the crypto market.

The Dogecoin price has retraced a whopping 8% to $0.22, after reaching a crucial $0.26. However, the slight correction in the DOGE market is essential to allow the bulls to sweep through liquidity before a potential leg up. Meanwhile, its daily trading volume has dwindled like a dead weight in the air, down 9% to $3.32B. Moreover, the crypto market has also corrected, led by Bitcoin, which has retraced to $102K. However, the market looks cautious, positioning ahead of the April US CPI report.

Dogecoin Price Outlook

On May 12, the meme market saw a ballistic surge, which propelled the Dogecoin price towards the $0.26 resistance level. However, due to the overbought conditions, the meme coin has corrected, currently at $0.22, above the 50-day MA. If this support zone holds, the bulls could spike up, reclaiming the $0.26 mark. Moreover, the rounded bottom pattern often signals a potential further upside in the DOGE market.

#Dogecoin $DOGE has reached a crucial area of resistance! pic.twitter.com/RSEnfpqttO

— Ali (@ali_charts) May 12, 2025

Further, DOGE’s Relative Strength Index signals some bullish prospects. The RSI currency is 67.03, indicating that the meme coin is still in the bullish thesis. The recent correction from the 82 overbought region enables the bulls to restructure before another upswing.

If the buying activities surge, the Dogecoin price could obliterate the $0.26 resistance. In a highly bullish scenario, the bulls could target the $0.28, $0.31, and $0.33.

DOGE Derivatives Data

According to Coinglass data, the dog-themed meme coin has notably seen a decrease in volume and open interest. The volume has dropped 14% to $7.53B, indicating a drop in market activity. Moreover, the open interest has dropped 10% to $2.73B. This recent decrease indicates a period of consolidation as the market awaits new information.

The DOGE long-to-short ratio has dwindled below the one mark, currently at 0.91. This also indicates some bearish prospects calling for the bulls to show strength in the market. However, the CPI report showing a drop to 2.3% below the expectation of 2.4% ignites some bullish prospects in the crypto market.

BREAKING: April CPI inflation FALLS to 2.3%, below expectations of 2.4%.

Core CPI inflation was 2.8%, in-line with expectations of 2.8%.

This marks the 3rd straight monthly decline in headline inflation.

Inflation continues to cool down despite the trade war.

— The Kobeissi Letter (@KobeissiLetter) May 13, 2025

The lower-than-expected CPI on May 13, could boost the market, more so the cryptocurrencies and stocks. Decelerated inflation neutralizes hopes for rate hikes to the aggressive level, but benefits risk-oriented assets such as Bitcoin. Traditionally, it has grown in tune with the positive CPI, which was the case in March, when it had a $98,500 price. However, long-term effects can be different, considering potential concerns about an economic slowdown that may hamper consumer demand and market confidence.

Meanwhile, the $0.21 support area will absorb the potential selling pressure if the Dogecoin price doesn’t gain stamina. Increased selling appetite may cause further correction towards the $0.16 area. A breach below this level will invalidate the bullish thesis, spiking a panic sell-off. In the meantime, a closer look at the resistance and support zones will enable traders to monitor the next price movement in the DOGE market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.