Chainlink tops Ethereum in GitHub activity as RWA integration fuels 8% LINK rally

0

0

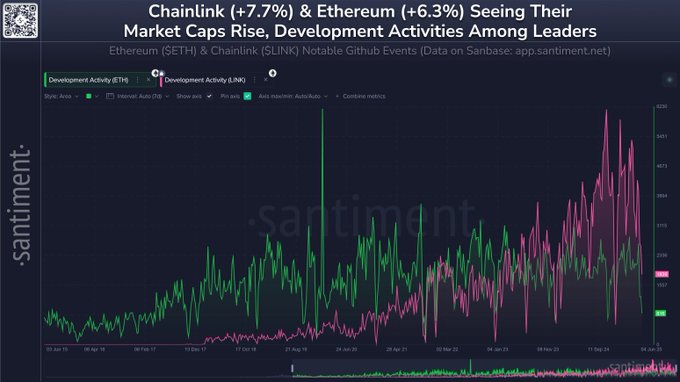

Chainlink (LINK) has overtaken Ethereum (ETH) in development activity, emerging as the second-most active project on GitHub over the last 30 days.

The rise reflects the network’s growing focus on real-world asset (RWA) tokenisation and its expanding involvement in institutional finance.

From its participation in Hong Kong’s e-HKD+ CBDC pilot to high-profile collaborations with firms like Visa, ANZ, and Fidelity, Chainlink is strengthening its claim as a critical infrastructure provider for enterprise blockchain adoption.

The momentum has helped propel LINK’s price up more than 8%, with short-term technical indicators suggesting bullish continuation.

Chainlink gains ground in enterprise blockchain space

According to on-chain analytics platform Santiment, Chainlink now ranks second in total GitHub activity, surpassing Ethereum, which sits in eighth place.

This surge in developer engagement underlines Chainlink’s rising importance in the blockchain space, especially as institutions explore tokenisation strategies.

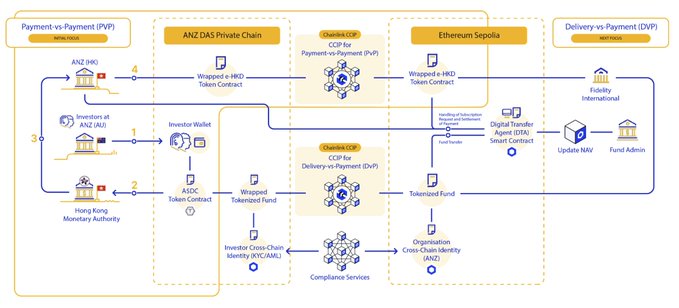

The network’s Cross-Chain Interoperability Protocol (CCIP) is at the centre of this push, enabling seamless communication between blockchains and financial systems.

On June 9, Chainlink’s CCIP was deployed in the e-HKD+ CBDC pilot conducted by the Hong Kong Monetary Authority (HKMA).

The test involved a transaction between a Hong Kong digital dollar and an Australian dollar stablecoin, facilitated by Chainlink’s infrastructure.

Notably, the transaction included participation from Visa, ANZ, Fidelity International, and China AMC, adding significant credibility to Chainlink’s technological capabilities.

In a post on X, Chainlink co-founder Sergey Nazarov reacted to Visa’s report on blockchain-based settlement infrastructure, emphasising how the network addresses three core needs: secure data feeds, cross-chain functionality, and compliance.

He cited a recent example involving ANZ and Fidelity, executed within HKMA’s regulatory framework, as evidence of Chainlink’s institutional appeal.

LINK price surges 8% on RWA use case traction

Chainlink’s integration in the CBDC pilot had an immediate effect on its market performance. The token jumped from $13.90 to $14.60 shortly after the announcement, and was trading at $15.28 at the time of writing—an 8% gain in under 24 hours.

This price action aligns with broader confidence in the network’s expanding use case in real-world finance. Technical indicators also show positive signs.

The 50-day Simple Moving Average (SMA) flipped to support at $15.07, and the 100-day SMA at $14.35 provides a safety net below. The Relative Strength Index (RSI) has moved above the 50 level, indicating bullish momentum.

Analysts also highlight that LINK is approaching a critical resistance zone between $16.04 and $17.43. A break above this range could trigger a potential 57% rally based on the falling wedge formation visible on the one-day chart.

This pattern is often associated with bullish reversals and is considered more reliable when supported by rising RSI and moving averages.

Development momentum adds to RWA leadership narrative

The rise in GitHub activity does more than reflect developer interest—it supports Chainlink’s position as the de facto infrastructure provider for RWA tokenisation.

By leading in smart contract tooling and interoperability, the network is becoming an indispensable bridge between traditional finance and public blockchains.

Chainlink’s development team has consistently ranked among the most active in the space.

Importantly, Chainlink’s value proposition lies in standardising institutional blockchain interactions.

As more financial entities adopt its infrastructure, the feedback loop increases its network effect and boosts long-term value.

Resistance could limit LINK gains if trendline holds

Despite the bullish outlook, LINK must overcome resistance at the top of its wedge formation. If the token fails to close above $16.70 in the coming sessions, it risks a reversal that could take it back to the $14.35 level.

A deeper correction could see LINK drop to its demand zone between $10.78 and $11.46.

This risk is compounded by profit-taking around the $15 to $17 range, where historical volume has often triggered corrections.

A break below the 100-day SMA would weaken short-term momentum, and LINK holders may look for re-entry points in the lower support region if bearish pressure mounts.

Still, for now, the technical setup, institutional news, and development pace all suggest continued upside for Chainlink as it pushes forward with RWA integrations.

The post Chainlink tops Ethereum in GitHub activity as RWA integration fuels 8% LINK rally appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.