Crucial Ethereum Price Prediction: Analyst Foresees September Bear Trap Before October Surge

0

0

BitcoinWorld

Crucial Ethereum Price Prediction: Analyst Foresees September Bear Trap Before October Surge

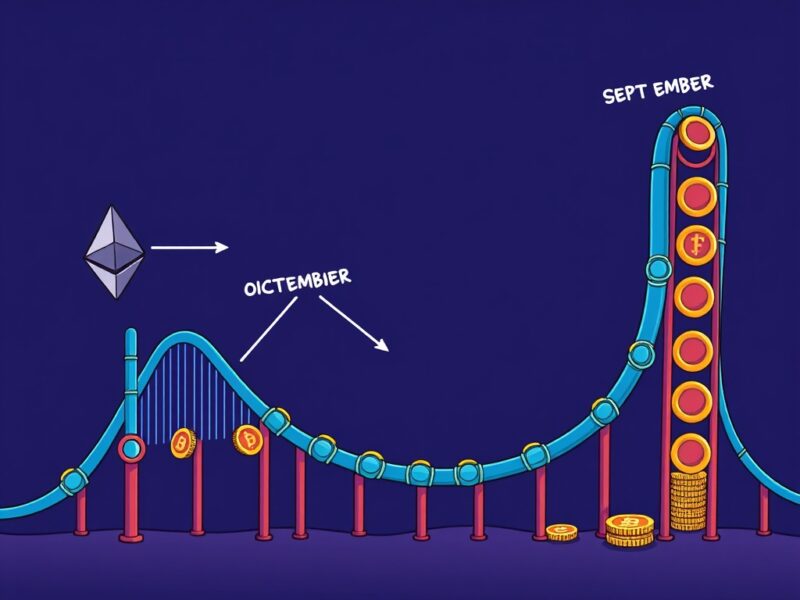

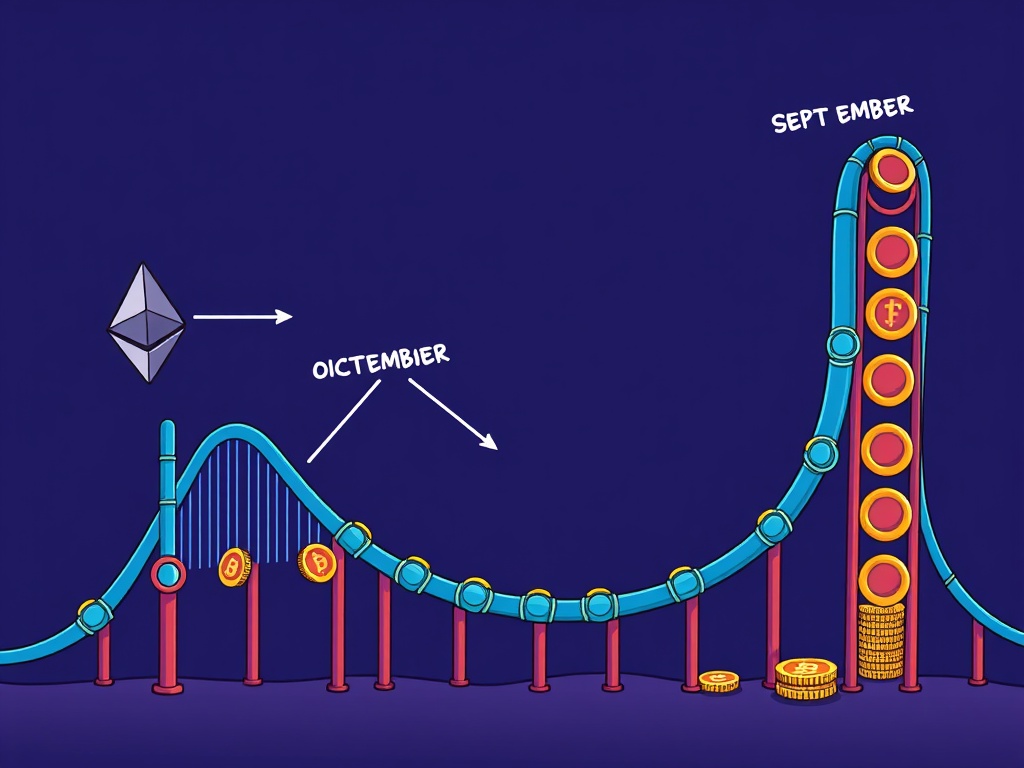

The cryptocurrency market is always buzzing with predictions, and when it comes to a major player like Ethereum, everyone pays attention. Recently, a significant Ethereum price prediction has emerged, suggesting a potential dip before a powerful comeback. Could September be a tricky month for ETH investors, only for October to bring a pleasant surprise?

What’s the Latest Ethereum Price Prediction?

Crypto analysts are closely watching Ethereum’s movements, with some anticipating a fascinating turn of events. According to Cointelegraph, Ethereum might experience a temporary setback this month, potentially dropping to its mid-$3,000 support level. This scenario is being framed as a “bear trap,” a deceptive downward move designed to shake out weaker hands before a significant reversal.

Jony Woo, a respected crypto trader and analyst, echoes this sentiment. He suggests that while September could indeed bring a deeper correction for ETH, the following month is poised for a complete reversal. This Ethereum price prediction offers a glimmer of hope amidst short-term bearish signals.

Decoding the September “Bear Trap” for ETH

Understanding the mechanics behind this potential “bear trap” is crucial for any investor. Woo points to a classic technical indicator: the head-and-shoulders chart pattern. This pattern often signals a bearish outlook, reinforcing the idea of a downward trend. However, in this specific Ethereum price prediction, the pattern might serve a different purpose.

A bear trap occurs when prices fall below a key support level, tricking traders into believing a prolonged downtrend is beginning. They might sell their assets, only for the price to quickly rebound, leaving them on the sidelines. For Ethereum, this could mean a brief visit to the mid-$3,000 range, tempting many to exit their positions.

Why is an October Rebound Expected for Ethereum?

Despite the potential September correction, the outlook for October is distinctly optimistic. This positive sentiment is largely driven by a seasonal trend known as “Uptober.” Historically, October has been a strong month for Bitcoin, often leading to broader market rallies. This “Uptober” effect could provide the necessary catalyst for a substantial Ethereum price prediction rebound.

Jony Woo emphasizes that this isn’t just wishful thinking. He notes that similar patterns of initial bearish reinforcement followed by a strong rebound have frequently occurred in the past. The market often follows cyclical trends, and the anticipated “Uptober” rally could be the force that propels Ethereum upwards, reversing any September losses.

Investors often look for these seasonal trends to guide their strategies. The confluence of a technical bear trap setup and a historically bullish month creates a compelling narrative for Ethereum’s near-term future. This could be a period where patience truly pays off.

Navigating Volatility: Actionable Insights for Ethereum Holders

Given this dynamic Ethereum price prediction, what should investors consider? Here are some actionable insights:

- Stay Informed: Keep a close eye on market news, technical analysis, and analyst opinions.

- Risk Management: Never invest more than you can afford to lose. Consider setting stop-loss orders if you’re actively trading.

- Dollar-Cost Averaging (DCA): If you believe in Ethereum’s long-term potential, consider buying smaller amounts regularly, regardless of short-term price fluctuations. This strategy can help mitigate the impact of volatility.

- Long-Term Perspective: For many, Ethereum is a long-term investment. Short-term dips, even significant ones, might be seen as buying opportunities.

- Diversification: Don’t put all your eggs in one basket. Diversifying your crypto portfolio can help spread risk.

Remember, the crypto market is inherently unpredictable. While expert analysis provides valuable insights, it’s essential to conduct your own research and make decisions that align with your personal financial goals and risk tolerance. This Ethereum price prediction is a plausible scenario, but not a guarantee.

In conclusion, the coming months could be a rollercoaster ride for Ethereum. Analysts suggest a potential “bear trap” in September, possibly seeing ETH dip to the mid-$3,000 range. However, this dip is widely anticipated to be a temporary blip before a powerful rebound in October, driven by historical market trends like “Uptober.” Understanding these dynamics can help investors prepare and potentially capitalize on the anticipated movements. As always, vigilance and thorough research are your best allies in the crypto space.

Frequently Asked Questions (FAQs) about Ethereum’s Price

Q1: What is a “bear trap” in cryptocurrency trading?

A bear trap is a false signal that tricks traders into believing a downtrend will continue, leading them to sell their assets. However, the price quickly reverses and moves upward, leaving those who sold behind. It’s a deceptive market movement.

Q2: Who is Jony Woo, and what is his Ethereum price prediction?

Jony Woo is a respected crypto trader and analyst. He predicts that Ethereum (ETH) may experience a deeper correction in September, potentially forming a bear trap around the mid-$3,000 support level, before seeing a significant rebound in October.

Q3: What is “Uptober,” and how does it relate to Ethereum?

“Uptober” is a term used in the crypto community to describe October, which has historically been a strong month for Bitcoin and, by extension, the broader cryptocurrency market. Analysts anticipate this seasonal trend could drive Ethereum’s rebound after a potential September dip.

Q4: Should I sell my ETH if it falls in September?

This article provides market analysis and not financial advice. Your decision should align with your personal investment strategy and risk tolerance. Many long-term investors view dips as potential buying opportunities, while short-term traders might employ different strategies. Always conduct your own research.

Q5: What technical pattern is mentioned for the September outlook?

The analyst mentions a head-and-shoulders chart pattern, which typically reinforces a bearish outlook. However, in this specific context, it’s suggested to be part of the bear trap setup before the anticipated October reversal.

Did this Ethereum price prediction article help you understand the market’s potential twists and turns? Share your thoughts and this article with your friends and fellow crypto enthusiasts on social media! Let’s keep the conversation going and help others stay informed about the exciting world of digital assets.

To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum price action.

This post Crucial Ethereum Price Prediction: Analyst Foresees September Bear Trap Before October Surge first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.