0

0

After falling to $3,150 on Dec. 11, in post-FOMC volatility, Ethereum ETH $3 235 24h volatility: 1.2% Market cap: $390.24 B Vol. 24h: $24.60 B is once again showing signs of reversal. The ETH price is trading over 1% up at $3,250, with momentum building up once again. However, after a strong start to the week, Ethereum ETF flows turned negative once again.

Ethereum price has shown a strong bounce back from the lows of under $3,000, and is moving all the way to $3,400. However, it faced rejection during the FOMC volatility after the 25 bps Fed rate cut on Dec. 10.

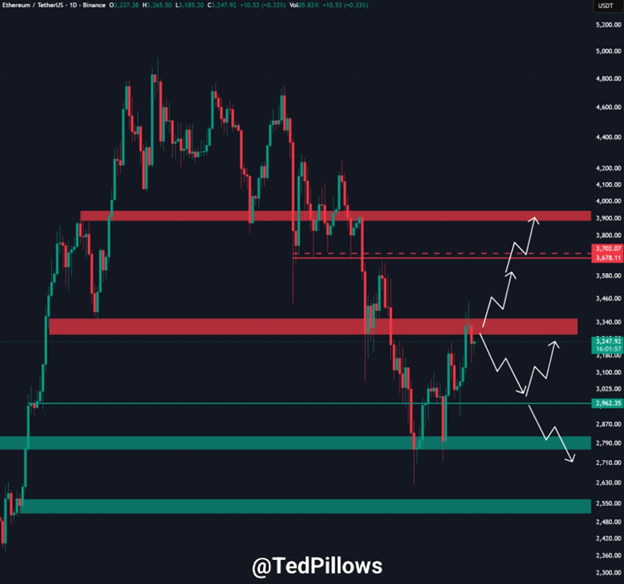

Following today’s reversal, ETH price is moving once again towards the key resistance level of $3,400. Crypto analyst Ted Pillows stated that a daily close above $3,400 could open the path for a move toward the $3,700–$3,800 range. But failing to break past this resistance could push it back to $3,000.

ETH price shows signs of reversal | Source: Ted Pillows

While speaking at the Binance Blockchain Week on December 4, BitMine Technologies Chairman Tom Lee said that ETH price at $3,000 is largely undervalued. Talking about BitMine’s over 100K ETH purchases recently, Lee stated that Ethereum has already formed the bottom at $3,000.

If Bitcoin touches $22,000, Lee expects an Ethereum mega rally to $22,000. “Bitcoin will reach $250,000 within a few months, and if the Ethereum-to-Bitcoin ratio returns to its average level, its price could reach $12,000 or even $22,000,” wrote Lee.

After a strong start to the week, Ethereum ETF flows flipped into the negative territory on Thursday, Dec. 11. According to data from Farside Investors, the ETFs saw $42.3 million in net outflows.

The two Grayscale Ether ETFs, ETHE and ETH, contributed to the most outflows. 21Shares Ether ETF (TETH) was the only one to report positive flows, while the rest showed zero or negative flows.

On the other hand, the whale activity around Ethereum remains formidable. On-chain data shows thatthe BitcoinOG whale, identified as “1011short” now holds 150,466 ETH valued at approximately $491 million. The whale has also placed additional limit orders to accumulate a further 40,000 ETH within the $3,030 to $3,258 price range.

Absolutely wild — this #BitcoinOG(1011short) is still adding more to his longs.

Current position:

150,466 $ETH ($491M)

1,000 $BTC ($92.6M)

212,907 $SOL ($27.8M)He also placed limit orders to add 40,000 $ETH in the $3,030-$3,258 price range and 50,000 $SOL at $138.6.… pic.twitter.com/QRRsLtuFXz

— Lookonchain (@lookonchain) December 12, 2025

Furthermore, data from CryptoQuant shows that the ETH realized price of whales holding more than 100K ETF. It is only the fourth time in the last five years that ETH price has traded close to this region. As per the image below, Ethereum has seen a strong bounce everytime, after this formation.

Whales (≥100k ETH) – Realized Price

“Only four times in the last five years has ETH traded very close to the Realized Price of whales holding at least 100k ETH.” – By @_onchain pic.twitter.com/BcQ5kwANk9

— CryptoQuant.com (@cryptoquant_com) December 12, 2025

Tokenized fan economy platform SUBBD is reaching a major milestone of hitting $1.5 million in presale. It is set to capture a major share of the creator economy by offering a Web2-friendly user experience. Its native token is used for payments, tipping, AI-driven creator tools, and staking rewards, as well as granting access to exclusive content.

The SUBBD project seeks to enable influencers and AI-driven personalities to develop communities through on-chain loyalty systems and collaborative content creation.

Want to learn more? Read our SUBBD price prediction on Coinspeaker.

The post ETH Price Shows Signs of Reversal Despite Ethereum ETF Outflows appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.