$645 Million Wiped Out As BTC Drops To $88K: What The Latest Wave Of Crypto Liquidations Means

0

0

The article was first posted on The Bit Journal.

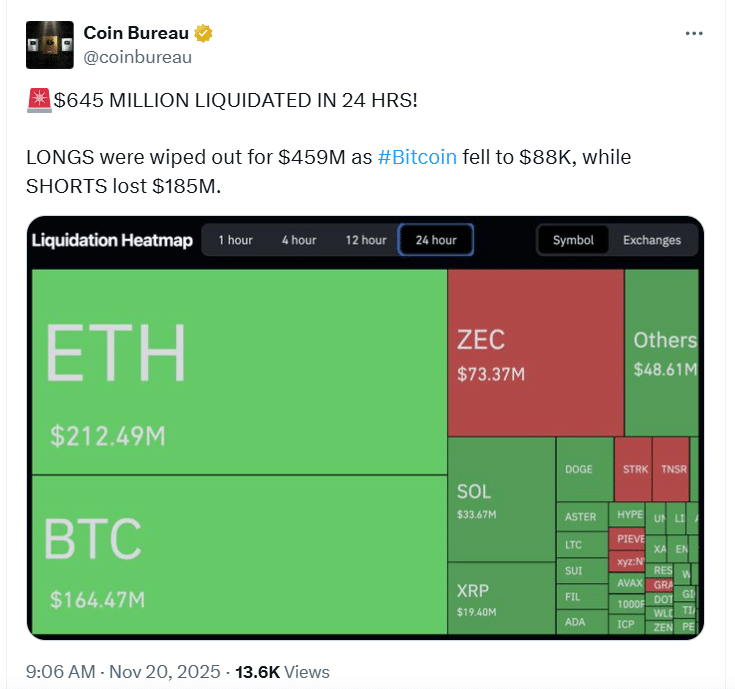

Bitcoin’s slide into the 88,000 dollar range has turned into one of those market moments that make traders sit up straight. Roughly 645 million dollars vanished in forced closures within a single day, and it happened fast enough that many barely had time to blink. Anyone watching the tape could see how quickly confidence turned into a scramble, and how crypto liquidations can flip the mood of the entire market almost instantly.

In the days before the drop, things looked almost too steady. Funding rates kept climbing, open interest was stacked near the top of the chart, and traders were piling into long positions like the rally had no real ceiling.

The pressure had been building quietly

The stretch leading up to this move felt like the kind of run where people start convincing themselves that dips no longer matter. But underneath, the imbalance was growing. Too many traders were leaning the same way. Once Bitcoin moved toward the 88,000 dollar area, collateral levels fell and the gap between healthy positions and liquidation thresholds tightened. That is when the crypto liquidations began flowing through trading screens.

Long positions were hit first. Many of them were stacked with high leverage, built on the belief that the trend would keep pushing higher. That optimism evaporated the moment prices slipped hard enough to trigger margin calls. It felt almost like dominoes tipping across exchanges, each liquidation feeding the next.

Shorts weren’t exactly celebrating

Short traders sometimes enjoy these moments, but this time the bounce caught plenty of late bears by surprise. After the first sweep of liquidations, a quick price spike forced some short positions into the same problem long traders had just faced. More crypto liquidations followed, although not nearly the same size as the long side. It showed how choppy and unpredictable the market becomes when volatility stretches thin.

Signs of stress are now turning into signs of reset

A wipeout of this size usually leaves clues about the next phase. Open interest fell sharply right after the 645 million dollars in crypto liquidations, and that kind of drop often signals that the market has flushed out its riskiest positions. If open interest rebuilds slowly rather than in a rush, it usually means traders are approaching the market with a bit more caution.

Funding rates cooling down is another big hint. Before the drop, they were running hot. After the flush, they drifted back toward neutral, which tells traders that the speculative pressure behind the rally has eased. More spot volume also started showing up, which is normally a healthier sign. Spot buyers tend to bring quieter, steadier demand.

Volatility still shaping the mood

Implied volatility remains elevated, which means traders are bracing for wider price swings. That kind of environment keeps people alert and forces them to think twice before stacking leverage again. Yet these periods also offer opportunities for patient buyers who prefer cleaner charts and less noise.

A familiar lesson resurfacing again

The big picture hasn’t changed because of one day. But the market did get a reminder that leverage cuts both ways. Crypto liquidations are not just numbers at the bottom of a chart; they show where excess risk was hiding and where traders pushed too far. No matter how strong a rally looks, the market always finds a way to reset itself.

For long term investors, this episode is just another checkpoint. They tend to zoom out, look at adoption, liquidity, and broader macro conditions rather than fixating on short bursts of noise. The cycle will tell its own story over time, but this was one of those moments that clears the air and shows who was riding too close to the edge.

Frequently Asked Questions

Why did so many positions get liquidated so quickly?

Leverage was stacked heavily on the long side, and once Bitcoin slipped into the 88,000 dollar range, margin levels fell fast. Automated systems closed positions to prevent bad debt, which created a rapid chain of crypto liquidations.

Did both long and short traders take damage?

Yes. Longs suffered the biggest hit, but some short traders were liquidated during sharp intraday bounces after the initial drop. Both sides felt the volatility.

Does this wipeout change the larger Bitcoin trend?

Not by itself. It resets leverage and cools sentiment, but the broader direction still depends on market demand, liquidity, and macro conditions.

Glossary of Key Terms

Crypto liquidations

Forced closure of leveraged positions when account equity falls below required levels.

Leverage

Borrowed funds used to increase position size.

Open interest

Total number of active futures or perpetual contracts still open.

Funding rate

A recurring payment between traders to keep perpetual futures aligned with the spot market.

Implied volatility

A forward looking estimate of expected future price swings.

References

Read More: $645 Million Wiped Out As BTC Drops To $88K: What The Latest Wave Of Crypto Liquidations Means">$645 Million Wiped Out As BTC Drops To $88K: What The Latest Wave Of Crypto Liquidations Means

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.