Stablecoin Regulation: Why Custodia CEO Caitlin Long Sees Persistent Uncertainty Despite GENIUS Act

0

0

BitcoinWorld

Stablecoin Regulation: Why Custodia CEO Caitlin Long Sees Persistent Uncertainty Despite GENIUS Act

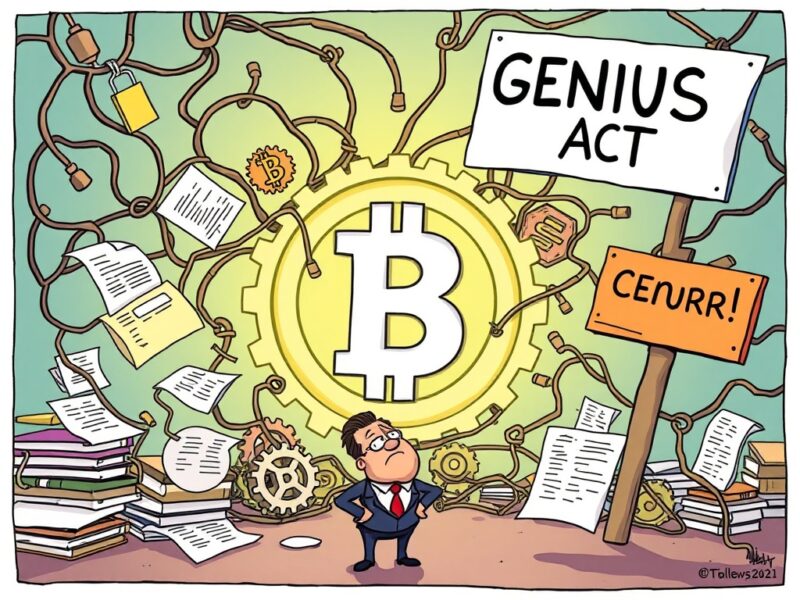

The world of digital finance is constantly evolving, yet one critical area continues to grapple with unresolved questions: stablecoin regulation. Despite legislative efforts like the U.S. GENIUS Act, a leading voice in the banking sector, Custodia Bank CEO Caitlin Long, suggests that significant uncertainty still looms. Her recent remarks underscore the complex landscape financial institutions and fintechs face when dealing with stablecoins.

What’s Stirring the Waters in Stablecoin Regulation?

Caitlin Long, a respected figure in the digital asset space, recently shared her insights on CNBC, as reported by Wu Blockchain. She pointed out that the GENIUS Act, while a step forward, has not fully addressed several fundamental issues. These unresolved questions are crucial for the seamless integration of stablecoins into the traditional financial system.

Specifically, Long highlighted the ongoing debate around whether traditional banks can issue tokenized deposits. Tokenized deposits are essentially digital representations of traditional bank deposits on a blockchain, offering potential for faster, more efficient transactions. However, the regulatory framework for these is still unclear.

Moreover, the level of capital banks must hold when dealing with stablecoins remains ambiguous. This uncertainty creates hesitation and impacts how financial institutions approach these digital assets. Long also noted compliance shortfalls among crypto-focused fintech firms, indicating a need for clearer guidelines across the board.

Unpacking the GENIUS Act: A Step Towards Stablecoin Regulation?

Enacted in mid-July, the GENIUS Act was indeed designed to bring more structure to the stablecoin industry. Its provisions aim to enhance transparency and stability, which are vital for investor confidence. Here are some key requirements introduced by the Act:

- Federal Licensing: Stablecoin issuers must obtain federal licenses, ensuring they operate under specific legal frameworks.

- 1-to-1 Reserve Backing: Issuers are mandated to maintain full 1-to-1 reserve backing for their stablecoins, meaning each digital coin is fully collateralized by an equivalent amount of fiat currency or other liquid assets.

- Annual Audits: Issuers with a market capitalization exceeding $50 billion must undergo annual audits, adding a layer of scrutiny and accountability.

- Oversight for Foreign Entities: The Act includes compliance and oversight rules for foreign entities involved in stablecoin issuance, extending its reach beyond domestic players.

While these measures are commendable for establishing a baseline for stablecoin regulation, Long’s perspective suggests they haven’t entirely resolved the underlying complexities.

Persistent Hurdles in Effective Stablecoin Regulation

Despite the GENIUS Act’s introduction, critical areas of uncertainty persist. Caitlin Long emphasized the need for regulators to clarify liability for interbank transfers of tokenized deposits. Currently, banks face restrictions on sharing customer information, which complicates these transfers.

Enabling secure information sharing could significantly reduce compliance costs, especially for regional lenders. This is a crucial point because lower compliance burdens can foster greater adoption and innovation. The lack of clear guidance on these operational aspects continues to be a major hurdle for effective stablecoin regulation and broader acceptance.

Without definitive answers on issues like capital requirements and interbank liability, financial institutions find it challenging to fully embrace stablecoins. This hesitation, in turn, slows down the potential for growth and innovation within the digital asset ecosystem.

Why Clear Stablecoin Regulation is Crucial for Growth

Achieving comprehensive and clear stablecoin regulation is not just about compliance; it’s about unlocking immense potential. When regulations are unambiguous, it:

- Reduces Costs: Banks and fintechs can operate with greater certainty, lowering legal and operational expenses.

- Boosts Innovation: Clear rules provide a stable environment for developing new products and services around stablecoins.

- Enhances Trust: Robust regulation protects consumers and fosters confidence in digital assets, encouraging wider adoption.

- Promotes Stability: A well-regulated market is less prone to volatility and systemic risks, benefiting the entire financial system.

Ultimately, addressing these lingering questions will pave the way for stablecoins to fulfill their promise as a stable, efficient, and integral part of the future financial landscape.

In conclusion, while the GENIUS Act represents a significant step in establishing a framework for stablecoin regulation, the insights from industry leaders like Custodia Bank’s Caitlin Long highlight that the journey towards comprehensive clarity is far from over. Addressing the nuanced challenges of tokenized deposits, capital requirements, and interbank liability will be crucial for the stablecoin industry to truly flourish and integrate seamlessly into the global financial system.

Frequently Asked Questions (FAQs)

Q1: What is the GENIUS Act?

A1: The GENIUS Act, enacted in mid-July, is a U.S. law requiring stablecoin issuers to obtain federal licenses, maintain full 1-to-1 reserve backing, undergo annual audits for larger issuers, and comply with oversight rules for foreign entities.

Q2: Who is Caitlin Long and what is Custodia Bank?

A2: Caitlin Long is the CEO of Custodia Bank, a Wyoming-based special purpose depository institution (SPDI) focused on serving the digital asset industry. She is a prominent advocate for clear cryptocurrency regulation.

Q3: What are tokenized deposits?

A3: Tokenized deposits are digital representations of traditional bank deposits recorded on a blockchain. They aim to combine the stability of bank deposits with the efficiency and programmability of blockchain technology.

Q4: Why is regulatory clarity for stablecoins important?

A4: Clear stablecoin regulation is crucial because it reduces compliance costs, encourages institutional adoption, fosters innovation, enhances market stability, and protects consumers, ultimately enabling the industry’s growth.

Q5: What are the main unresolved issues concerning stablecoin regulation, according to Caitlin Long?

A5: According to Caitlin Long, key unresolved issues include whether banks can issue tokenized deposits, the specific capital requirements for holding stablecoins, compliance shortfalls among crypto fintechs, and clarifying liability for interbank transfers of tokenized deposits.

If you found this article insightful, please share it with your network! Your support helps us continue to provide valuable analysis on the evolving world of cryptocurrency and blockchain technology.

To learn more about the latest stablecoin regulation trends, explore our article on key developments shaping stablecoin regulation institutional adoption.

This post Stablecoin Regulation: Why Custodia CEO Caitlin Long Sees Persistent Uncertainty Despite GENIUS Act first appeared on BitcoinWorld and is written by Editorial Team

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.