Celo Completes Ethereum Layer-2 Transition After 20 Months of Testing

0

0

Celo has officially transitioned from a standalone EVM-compatible Layer-1 (L1) blockchain to an Ethereum Layer-2 (L2), marking a significant milestone for the blockchain ecosystem.

The network first proposed the migration two years ago, intending to enhance security, real-world Ethereum use cases, and developer experience.

Celo’s Migration to Ethereum Layer 2

Celo finalized its migration to an Ethereum Layer-2 network on Wednesday, utilizing Optimism’s OP Stack and EigenDA for data availability.

The upgrade, which was completed at block height 31,056,500, strengthens Celo’s security. It enhances interoperability with Ethereum and maintains its hallmark features, such as low transaction fees and fast processing times.

The official Celo countdown website confirmed the transition, announcing that Celo is now live as an Ethereum Layer 2. The move follows 20 months of planning, testing, and governance discussions since its initial proposal by cLabs in July 2023.

“The Celo L2 migration has been successfully completed. Celo is now live as an Ethereum Layer 2,” read the announcement.

The migration process began with Celo validators intentionally halting block production on its L1 network. cLabs, the protocol development for Celo, officially announced the start of the hard fork on X (Twitter).

It stated that the Celo L2 Hardfork had begun. Validators had intentionally halted Celo L1 block production as the protocol transitioned to an Ethereum Layer 2. Less than two hours later, block production resumed on Celo L2, with public RPC (Forno) and indexers coming online shortly after.

Implications for Users and Developers

The shift to Ethereum Layer-2 brings significant advantages. Leveraging Ethereum’s infrastructure improves security and network strength. Blocks production happens in one second instead of five, significantly increasing transaction speeds.

Celo retains its ultra-low transaction fees of $0.0005, ensuring cost-effective transactions. Native Ethereum bridging reduces reliance on external bridging solutions, which have historically been vulnerable to exploits.

With this transition, Ethereum developers can seamlessly build on Celo with minimal adjustments, improving developer compatibility. Marek Olszewski, CEO and co-founder of cLabs, called the migration an exciting return home for Celo, combining the best of both networks to scale Web3 with global reach.

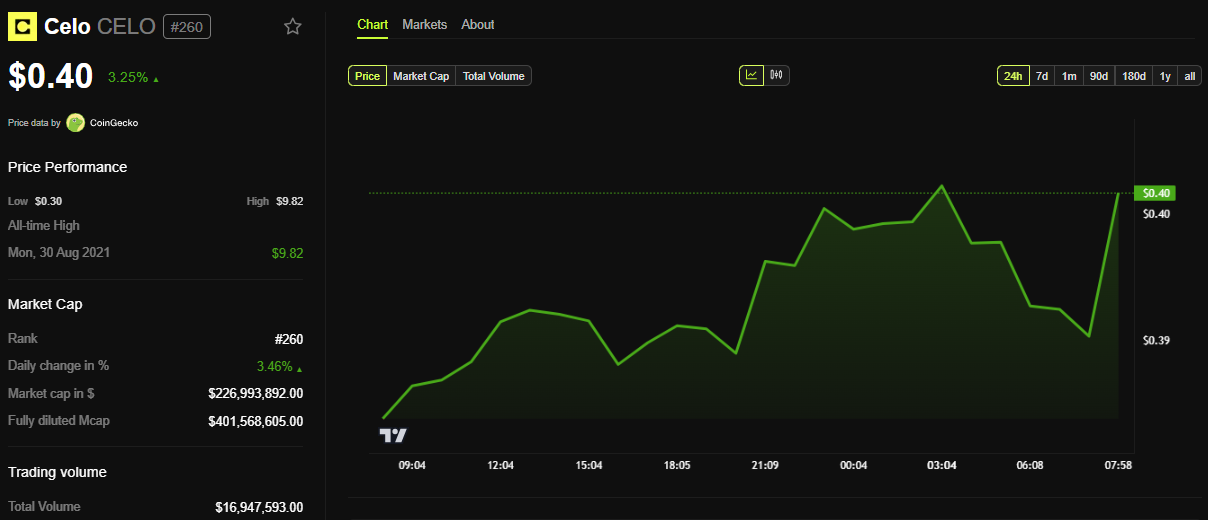

Following the announcement, CELO’s price jumped nearly four percent, reflecting market optimism about the move.

CELO Price Performance. Source: BeInCrypto

CELO Price Performance. Source: BeInCrypto

However, this transition comes at an intriguing time for Layer 2 networks. Solana (SOL) co-founder Anatoly Yakovenko recently questioned the necessity of Layer 2 solutions, stating that Solana’s monolithic Layer 1 architecture is sufficient.

Additionally, Binance founder Changpeng Zhao recently reignited the debate on whether AI projects should be built on Layer 1 or Layer 2 networks. This highlights the ongoing discussions about the best blockchain scaling approaches.

Meanwhile, Ethereum has seen a 95% drop in transaction fee revenue amid the shifting Layer 2 playing field. Users increasingly adopt these solutions for lower costs and improved efficiency.

As Celo fully integrates into the Ethereum ecosystem, users and developers can expect increased liquidity, seamless transactions, and enhanced security features.

“Celo has done a lot for crypto’s global adoption, and I am excited to see Celo fully embracing the Ethereum family,” Ethereum co-founder Vitalik Buterin commented.

However, the network must also brace for potential diversion of transaction fee revenue away from Ethereum’s main chain.

Celo’s ultra-low fees are attractive, but ensuring long-term network security and incentives for validators remains a challenge. It may need to explore alternative revenue streams, such as MEV (Maximal Extractable Value) capture or strategic partnerships.

Despite the backlash against L2 networks, Joanna Zeng, co-founder and CEO of SOON, an SVM rollup on Ethereum, advocates for L2s.

“L1s will not change their base layers, but they can still benefit from better scalability. Instead of arguing against L2s, the real opportunity is proving the strength of SVM by expanding beyond Solana,” Zeng told BeInCrypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.