BNB Price Rebounds as Traders React to CZ’s Pardon — But One Roadblock Remains

0

0

BNB is up 4.4% in the past 24 hours, standing out as the only top-10 coin to post positive 30-day gains (+11%). The move follows US President Donald Trump’s pardon of former Binance CEO Changpeng “CZ” Zhao, which wiped his felony record and reignited sentiment around the BNB price.

But price action suggests something deeper is driving this rebound – exchange outflows, supply shifts, and a technical setup that could define the next leg.

Exchange Outflows Hint at Renewed Buying Pressure

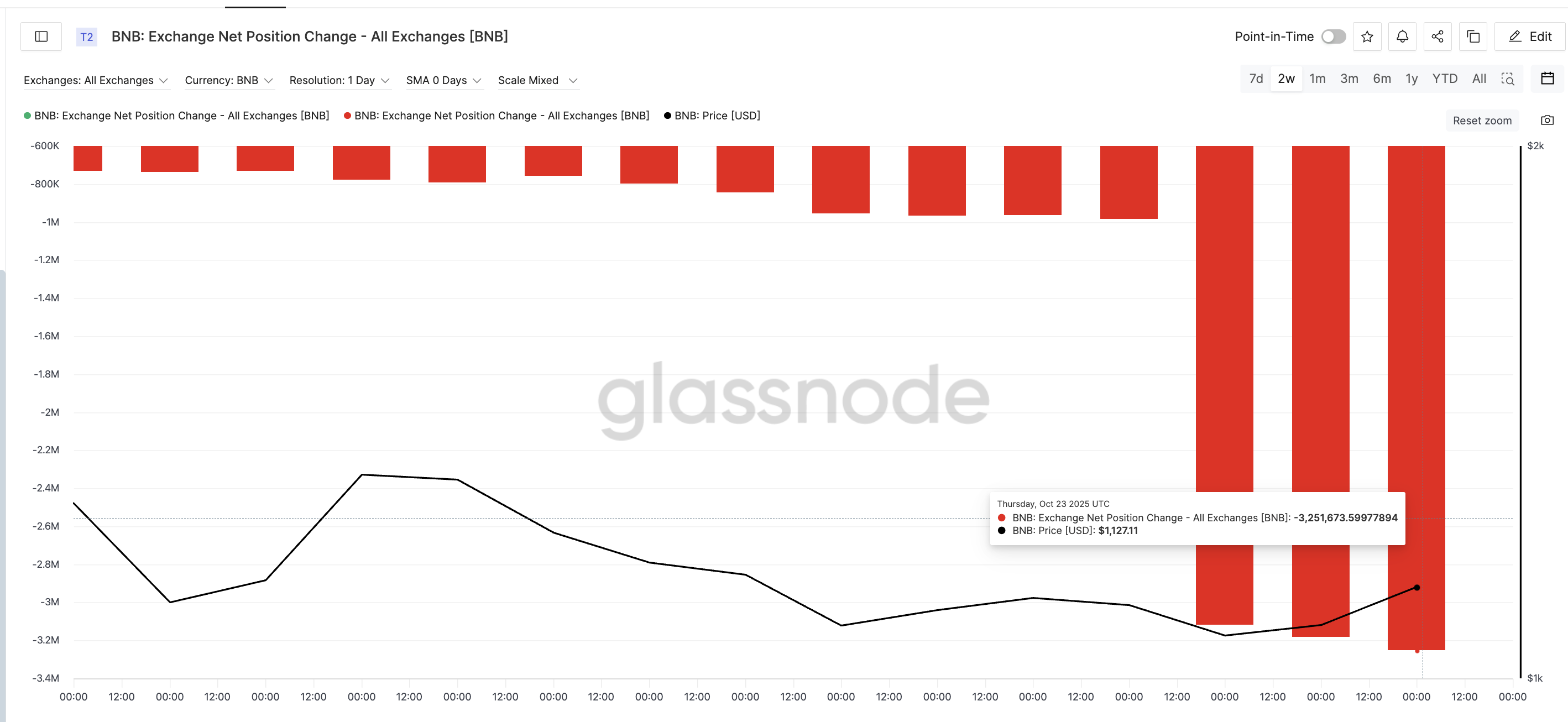

The Exchange Net Position Change, which tracks the flow of coins into or out of exchanges, shows that BNB outflows have surged sharply since October 20. When this value is negative, it means coins are leaving exchanges, often signaling accumulation by holders.

On October 20, net outflows were 982,619 BNB. By October 23, they jumped to 3.25 million BNB, a more than 230% rise in just three days.

BNB Exchange Seeing Outflows: Glassnode

BNB Exchange Seeing Outflows: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That’s a strong signal that large holders, possibly anticipating the pardon or a broader recovery, began pulling their tokens off exchanges, a move usually seen when traders plan to hold rather than sell.

However, one key group hasn’t joined in yet, forming the roadblock.

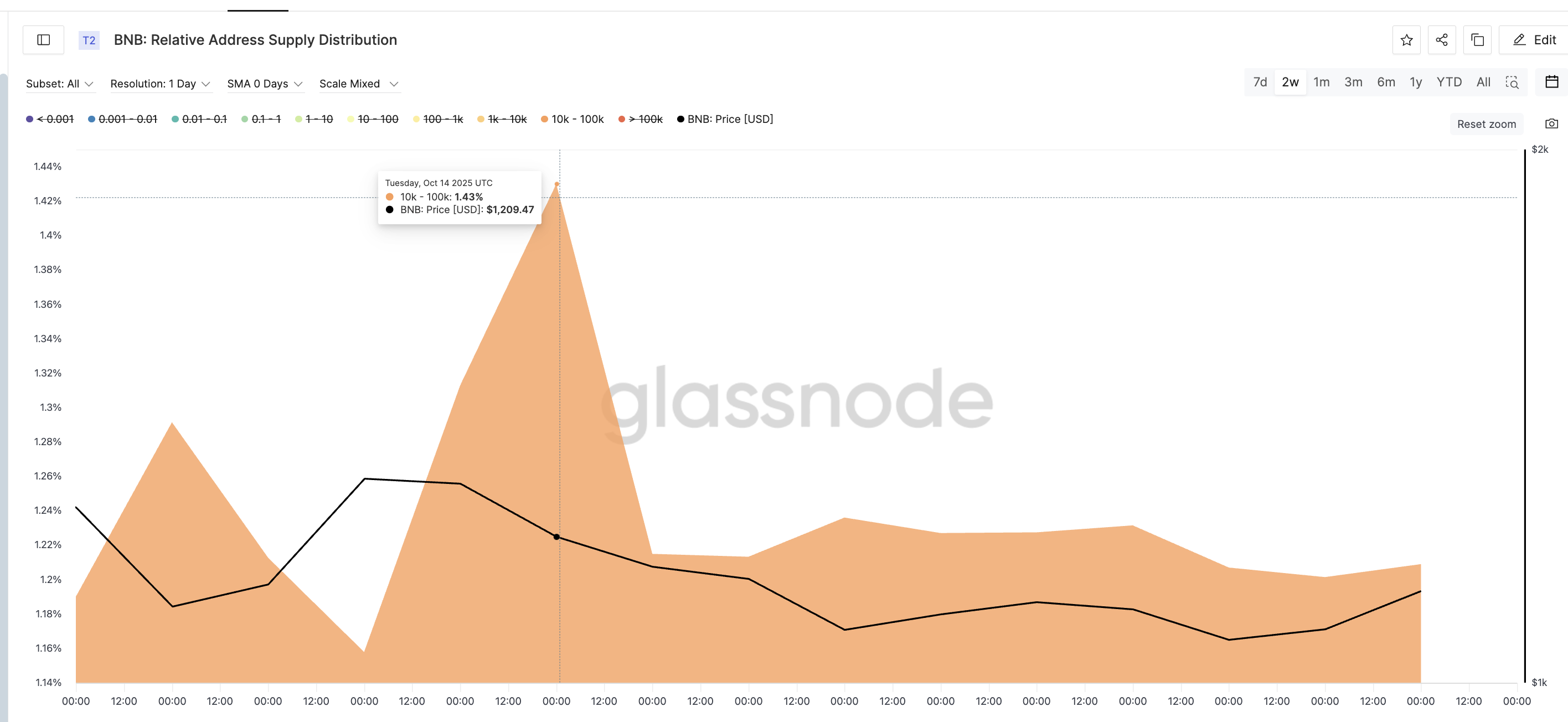

The Relative Address Supply Distribution, which measures how much supply is held by different wallet sizes, shows that wallets holding 10,000–100,000 BNB (including large whales) cut their share from 1.43% on October 14 to 1.20% on October 23.

Big BNB Wallets Dropping Supply: Glassnode

Big BNB Wallets Dropping Supply: Glassnode

That drop helped drive the mid-October correction. If these holders start accumulating again, it could add weight to the bullish trend emerging from the recent outflows.

BNB Price Finds Support, Hidden Bullish Divergence Forms

BNB’s price has been trading inside a broadening ascending wedge since late July, typically a bearish reversal pattern. After dropping from the $1,379 (its all-time high) on October 13 to near $1,020, BNB bounced off the wedge’s lower boundary.

It eventually reclaimed $1,105, confirming short-term support.

The Relative Strength Index (RSI), which measures buying versus selling momentum, shows a hidden bullish divergence. While the price made higher lows since August 2, RSI made lower lows. This usually signals continuation of the prior uptrend.

BNB Price Analysis: TradingView

BNB Price Analysis: TradingView

If BNB closes above $1,242 (the 0.618 Fibonacci level) — a zone that often acts as the strongest resistance — it could march toward $1,302 and potentially retest $1,379.

Failing to hold $1,105, however, could reopen downside risk toward $1,020 and even $891.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.