Could BTC Plunge to $50K Before a Massive Rally to $250K?

0

0

The Bitcoin price forecast has changed after Bitcoin fell below its long-term 4-year curve, raising new questions about whether the market is heading for a deep correction or setting up for another major rally.

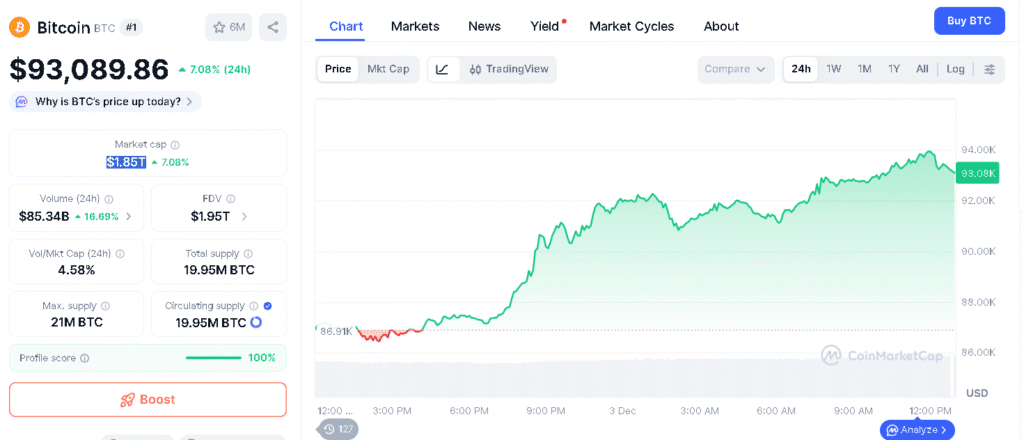

Bitcoin is trading around $93,135.86, with its total market value still near $2 trillion and holding a strong 58% share of the crypto market. Analysts now believe a move toward $250,000 is possible, but only if certain conditions are met first.

What is Bitcoin and why does it still dominate the crypto market?

Bitcoin is the world’s first and largest cryptocurrency, created in 2009 as a decentralized alternative to traditional money. It operates without any central authority and relies on blockchain technology to secure transactions.

Over the years, Bitcoin has built strong trust among investors, institutions, and traders. Even during market slowdowns, it continues to hold the largest share of the crypto market, which is why its price movements often set the direction for the entire industry.

What is happening with Bitcoin’s 4-year cycle right now?

The Bitcoin price forecast has shifted as Bitcoin slipped below its long-standing 4-year parabolic curve, a level that has historically shaped every major bull and bear phase.

After the recent recovery, $BTC is now trading around $93,135.86, up nearly 7% in the past 24 hours, with its total market capitalization hovering near $1.85 trillion, while it continues to control a strong 58% share of the overall crypto market. Peter Brandt sees Bitcoin’s long-term growth slowing down with each passing cycle.

He notes that every big bull run in the past has eventually been followed by a drop of more than 75% from the highs. Since Bitcoin first appeared, this same rise-and-fall pattern has played out five times, showing that sharp corrections are nothing new for the asset.

Can Bitcoin really fall to $50,000 before a major rally?

The Bitcoin price forecast points to a possible drop toward $50,000 if current support levels fail. Peter Brandt has said that if this decline does reach $50K, the next bull-market cycle could still drive $BTC into the $200,000 to $250,000 range.

He also warned that losing the 4-year curve often leads to longer bear-market phases. Still, he added that Bitcoin’s current strength makes such an extreme fall to $50,000 less likely than in previous cycles.

What do miner movements and on-chain signals suggest right now?

Another factor influencing the Bitcoin price forecast is what miners are doing. Not long ago, a miner moved 50 BTC, valued at roughly $4.33 million, from rewards earned more than 15 years ago. The timing of that transfer lined up with wider signs of miner capitulation after Bitcoin fell below its 4-year curve.

Brandt had warned earlier that losing this long-term support could increase selling pressure from miners. Still, the ADX indicator was trending lower, suggesting that even though the market remains weak, the force behind the bearish trend is starting to fade.

At the same time, social activity around Bitcoin increased sharply. Data showed growing conversations about Bitcoin, MicroStrategy, Tether, Dent, Chainlink, and Polkadot, indicating that both retail and institutional interest was picking up again.

What is the short-term Bitcoin price forecast from chart levels?

The short-term Bitcoin price forecast now shows $BTC trading well above recent support after its move toward $93,135.86, but downside risks have not disappeared. Analysts say a pullback toward $80,000 is still possible if buying momentum fades.

If that level fails to hold, Bitcoin could begin sliding back toward $50,000. Brandt has also said that a clear drop below $75,000 would sharply raise the chances of a full decline to $50K, which would mark the deepest phase of the current bear market.

Even at current levels, he still views the market as offering a potential long opportunity for traders who are ready to manage risk carefully.

Has Bitcoin’s famous 4-year cycle started to weaken?

The broader Bitcoin price forecast is also being shaped by a noticeable change in how this market cycle is playing out. In earlier years like 2013, 2017, and 2021, Bitcoin followed a familiar pattern of steady buildup, a sharp breakout, an intense mania phase, and then a crash.

This time, that dramatic mania stage has yet to appear. Since the April 2024 halving, Bitcoin moved sideways for several months, saw a brief push higher after the U.S. election period, and then slipped back into consolidation.

Even though it reached new all-time highs, the kind of euphoric surge that marked past cycle peaks never fully arrived. Institutional buying has also changed how supply works in the market.

These days, Bitcoin ETFs can absorb more $BTC in a single day than miners generate in an entire month. Because of this deep pool of buyers, the supply shock that once fueled sharp bull runs now has a much softer impact on price.

Conclusion

The final Bitcoin price forecast remains balanced between caution and long-term optimism. Bitcoin is now trading near $93,135.86, holding a strong 58% market dominance, but it is still facing pressure after slipping below its 4-year curve.

A deeper drop toward $50,000 cannot be ruled out if key support near $80,000 and $75,000 fails to hold. At the same time, Peter Brandt believes that such a decline, if it happens, could help reset the market for the next major cycle.

He sees the potential for $BTC to reach between $200,000 and $250,000 in a future bull run. With cycle gains shrinking and institutional forces reshaping supply, the next few months may show whether Bitcoin’s familiar rhythm is changing or simply taking a pause before its next big move.

Glossary

4-Year Cycle: Bitcoin’s price pattern rising in bulls and falling in bears every four years.

Miner Capitulation: When miners sell large BTC amounts, often after losses, affecting the market.

Market Dominance: Bitcoin’s share of the total crypto market.

Parabolic Curve: A steep long-term upward price trend on Bitcoin charts.

ADX Indicator: A tool that shows how strong a market trend is.

Frequently Asked Questions About Bitcoin Price Forecast

What is happening with Bitcoin’s 4-year cycle now?

Bitcoin has dipped below 4-year curve. This might mean market slows down or goes through short correction before its next big rise.

Can Bitcoin really drop to $50,000?

It’s possible for Bitcoin to fall to $50,000 if key support levels fail. But the chance is lower as the market is still showing strength.

What could happen after a $50,000 drop?

It could rebound. And later potentially reach $200,000–$250,000 in next bull cycle.

How does social activity affect Bitcoin?

More conversations online about Bitcoin and other crypto projects show that small investors and big institutions are paying attention again.

Has Bitcoin fallen sharply in the past?

Yes. in previous cycles, Bitcoin dropped more than 75% after big bull runs. This is normal part of its market behavior.

Sources

Read More: Could BTC Plunge to $50K Before a Massive Rally to $250K?">Could BTC Plunge to $50K Before a Massive Rally to $250K?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.