Ethereum Hits Multi-Month High: Institutional Inflows Push ETH Toward $3,400

0

0

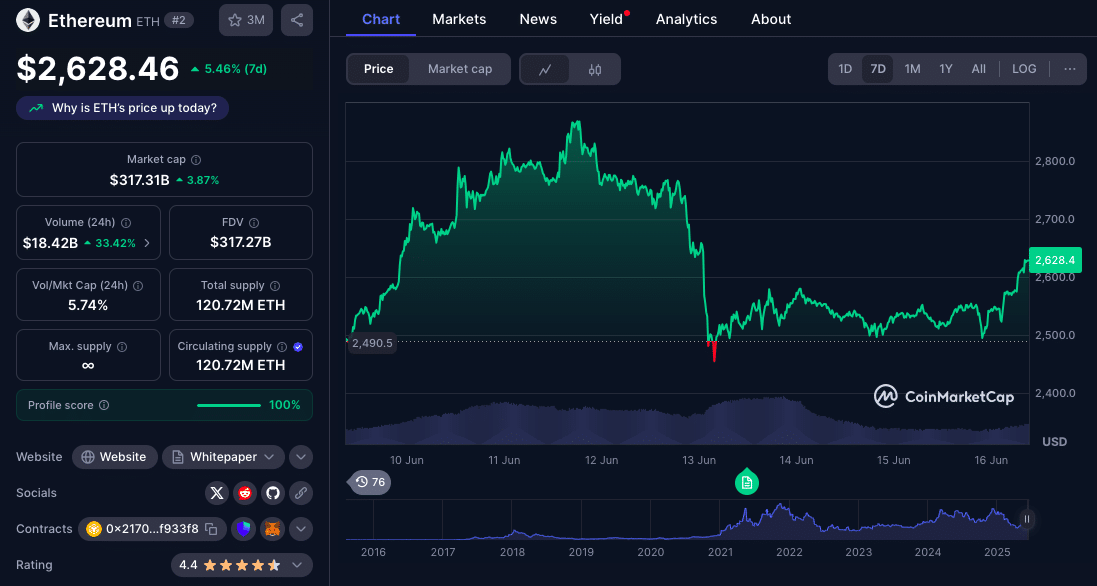

Ethereum is dominating crypto headlines as a sharp price surge takes ETH to the $2,850 resistance level, its highest in months. Backed by institutional inflows, technical setups and trader confidence, Ethereum is looking at a move to the $3,400 zone, a level not seen since early 2022.

At the time of writing, Ethereum is trading at $2,628.46, having briefly touched $2,800 on June 11 before some selling pressure. The recent move is the culmination of a 7 day rally that started when Ethereum price bounced from $2,414 on June 4 and has been reclaiming higher levels since. This Ethereum price surge has not only brought optimism to the altcoin space but also momentum to the crypto market which had been stuck in a range for a while.

Data-Driven Price Movement: Breaking Down the Bullish Sequence

From June 4 to June 12, Ethereum had 3 day gains in a staircase pattern, each move consolidating just above the last. June 9 was the turning point when ETH closed at $2,815 after opening at $2,680, showing buying interest. June 11 was the day when ETH broke $2,820 and touched $2,880, testing the long standing resistance at $2,850.

Analysts say the price action is a combination of technical breakouts and new demand. The ascending triangle and higher lows tell us the market is setting up for a bigger breakout. A clean daily close above $2,850 would get Ethereum price to $3,400 in short order.

Even during minor pullbacks, Ethereum held above its breakout levels, showing strength and depth in current demand.

Institutional Inflows Surge

This Ethereum price surge is being fueled by a big influx of capital from institutional investors. According to CoinShares’ latest weekly report, Ethereum focused investment funds have seen over $1.5 billion in net inflows over the past 7 weeks, the most sustained period of institutional activity in over a year.

Seamus Rocca, CEO at Xapo Bank, said in a recent interview that long term corporate allocations to Bitcoin and Ethereum are no longer fringe strategies.

“The increase in treasury exposure to crypto is real,” Rocca said. “But it must be sized properly, with an eye on long term viability rather than short term hype.”

This framework seems to be playing out across traditional finance desks, many of which are preparing for Q3 crypto exposure by balancing Bitcoin and Ethereum positions.

Technical Factors Support Bullish Sentiment

In addition to institutional demand, Ethereum’s breakout has been backed by technicals. An ascending triangle with high-volume breaks above resistance is a classic continuation pattern.

Ethereum’s futures open interest has reached an all-time high according to Coinglass. This means not only more leverage but also more market conviction. When open interest surges with price, it’s usually a sign of sustained bullishness not a pump.

Accumulation addresses (wallets that buy and hold ETH without selling) have been growing since early May. Glassnode data shows they added more ETH in the last 2 weeks than in the entire Q1 2025, reducing supply and pushing price up.

Ethereum Outperforms Bitcoin, Altcoin Season May Have Begun

The most telling sign of Ethereum’s strength is its performance vs Bitcoin. ETH/BTC has been rising for the last 10 days, a sign of traders rotating out of Bitcoin and into Ethereum and other large cap alts.

This is previously seen as the early sign of “altcoin season” when investors move capital into non-Bitcoin assets for higher returns. Solana, Arbitrum and Toncoin are also showing signs of life, Ethereum may be setting the tone for the rest of the ecosystem.

Some analysts are still cautious.

“While ETH is strong, we need to see daily closes above $2,850 to confirm” says independent trader Eliza M. “But if it holds, the next target is clearly $3,300-$3,400”

Conclusion: Can Ethereum Hold?

Ethereum price move has everyone’s attention. With strong technicals, growing demand, and ETF optimism all lining up, Ethereum could be heading to test the $3,400 zone if it can close above $2,850.

Traders and investors should be cautious around resistance, though the trend is seemingly bullish and Ethereum’s momentum is not just hype. If this continues, ETH could be the growth engine of crypto’s next leg up.

FAQs

What’s behind the Ethereum price surge?

Institutional inflows due to upcoming ETFs, bullish technicals and accumulation wallets.

Will Ethereum break $3,400 soon?

If Ethereum closes above $2,850 with volume, it could go to $3,400.

How does Ethereum compare to Bitcoin lately?

Ethereum has outperformed Bitcoin over the last week, ETH/BTC ratio is up, often a sign of an altcoin season.

Is the Ethereum price sustainable?

Sustainability depends on Ethereum holding above key resistance and institutional support. Looks good for the underlying trend.

Glossary

Ethereum (ETH) – The native cryptocurrency of the Ethereum blockchain, used for transactions, smart contracts and DeFi.

ETF (Exchange-Traded Fund) – A regulated investment vehicle that tracks an asset like ETH and trades on stock exchanges.

Open Interest – Total number of outstanding futures contracts that have not been settled.

Altcoin Season – A market phase when cryptocurrencies other than Bitcoin go up big.

Accumulation Address – A crypto wallet that accumulates assets without selling them, often used to identify long-term holders.

Sources

Read More: Ethereum Hits Multi-Month High: Institutional Inflows Push ETH Toward $3,400">Ethereum Hits Multi-Month High: Institutional Inflows Push ETH Toward $3,400

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.