Crypto market rebounds as BTC Breaks Past $111K while ETH, XRP and SOL Ignite Fresh Rally

0

0

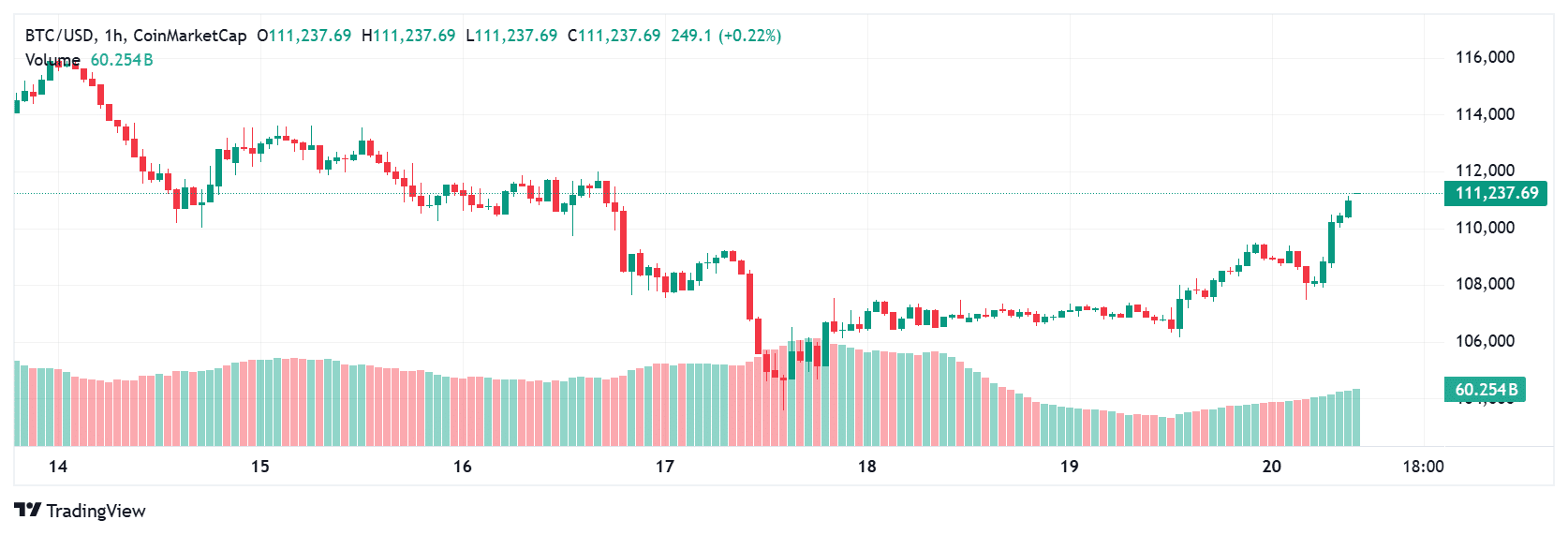

The cryptocurrency market regained its stride today, with Bitcoin climbing above $111,000 and top altcoins eyeing meaningful gains. According to live data, Bitcoin stands at around $111,198 with a market cap above $2.2 trillion.

Meanwhile, Ethereum is trading near $4,078, XRP around $2.46, and Solana near $193.35. These moves come at a moment when risk assets globally are stirring: Japanese equities hit a record high, the U.S. dollar has softened, and investor sentiment for crypto risk has improved.

What the numbers suggest

Bitcoin’s regain of the $110K-plus zone matters. It signals renewed confidence, especially since it had tested lower levels in recent days. A price above major psychological support often draws in buyers who were sidelined. For Ethereum, the strength near $4,000 suggests the second-largest crypto is benefiting both from momentum and its DeFi/smart-contract prominence.

XRP at roughly $2.46 reflects investor attention on its status in institutional flows, while Solana’s move to ~$193 reflects growing interest in layer-1s that emphasize speed and scale. These prices suggest that altcoins are again part of the broader rally rather than lagging behind.

What’s driving sentiment

Several macro-factors are at play. First, global equities have picked up; for example, Japan’s market soared, reflecting expectations of policy easing and risk-on sentiment.

When equity risk appetite improves, crypto tends to benefit as a higher-beta asset class. Second, the U.S. dollar has eased slightly, which typically lends tailwinds to dollar-denominated crypto assets. Third, on-chain indicators show accumulation in large addresses and healthier network metrics, which hint at structural support rather than purely speculative spikes.

Add to that the increasing institutional footprint: ETFs, treasury allocations, and regulatory clarity are helping tilt the narrative from “just speculation” to “part of the financial ecosystem”. That matters because when institutions lean in, volatility may remain, but the base of support is stronger.

Key signals to watch

-

Bitcoin dominance: If Bitcoin continues to outperform, the market could remain heavy on the safe-bet asset rather than speculative altcoins. But if dominance drops, altcoins might break out.

-

Support levels: For Bitcoin, ~$110K is now a base to protect. A drop below could invite heavier selling. Similarly, Ethereum’s support near $4,000 is critical.

-

Altcoin strength: XRP breaking above key resistance (around $2.60-$3.00) could signal a broader altcoin cycle. Solana clearing ~$200 and moving toward ~$230+ would reflect appetite for next-gen platforms.

-

Macro and regulatory backdrop: Things like central-bank posture, dollar moves, and policy announcements will sway direction. Positive regulatory news (new ETF approvals, clearer custody rules) could further lift confidence.

Cautions and caveats

This rally looks encouraging, but a few flags remain. Markets have recently been shaken by geopolitical or macro shocks, trade tensions, rate surprises, or regulatory clamp-downs, which can still hit crypto swiftly.

On-chain metrics are helpful signals but not guarantees of sustained up-trends: the technicals can shift fast. And finally, while altcoins are gaining, if Bitcoin falters, the rest may drop harder.

Conclusion

The crypto market is showing signs of a meaningful up-leg, not just a short bounce. Bitcoin’s climb above $111,000, combined with strong prices in Ethereum, XRP, and Solana, suggests renewed conviction. The interplay of macro tailwinds, institutional interest and improving on-chain fundamentals gives this rally depth.

That said, investors should keep an eye on support levels, macro surprises, and the pace of altcoin breakout behavior. If the momentum holds, the coming days may offer broader opportunities. Yet, as always in crypto, keep risk in check and expect turbulence.

Frequently Asked Questions

Q: Why does Bitcoin topping $110K matter?

Because it marks a psychologically and technically important support zone, clearing and holding it suggests buyers are comfortable and that previous resistance turned into support.

Q: What does the Ethereum price tell us?

Ethereum near $4K indicates the smart-contract ecosystem remains robust and is benefiting from both speculative interest and practical utility (DeFi, NFTs, staking).

Q: How are XRP and Solana relevant in this rally?

XRP at ~$2.46 highlights institutional speculation around regulatory progress and payment-network adoption. Solana near $193 reflects momentum in scalable blockchains outside of just Bitcoin/Ethereum.

Q: What indicators should I watch now?

Support zones (Bitcoin ~$110K, Ethereum ~$4K), Bitcoin dominance, macro factors (dollar strength, policy), altcoin breakout behaviour.

Q: Is the crypto market safe right now?

No. While improved, risk remains high. Volatility, regulatory shocks or macro surprises can reverse gains quickly. Allocation and risk management matter.

Glossary of key terms

Market cap – The total value of a cryptocurrency’s circulating supply multiplied by its price; provides a size ranking for the asset.

Dominance – The percentage share of total crypto market cap that one asset (typically Bitcoin) represents; higher dominance means other coins get less attention.

Layer-1 blockchain – A base blockchain (like Ethereum or Solana) that supports smart contracts and decentralized applications directly on its native network.

Support / resistance – Price levels where an asset tends to stop falling (support) or rising (resistance); breaking them often signals trend changes.

Read More: Crypto market rebounds as BTC Breaks Past $111K while ETH, XRP and SOL Ignite Fresh Rally">Crypto market rebounds as BTC Breaks Past $111K while ETH, XRP and SOL Ignite Fresh Rally

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.