Bitcoin Whales Bet Big as Speculators Exit With $100M in Losses

0

0

NAIROBI (CoinChapter.com)— Bitcoin’s price action is fueling a divide between long-term holders and short-term speculators. As panic sellers offload their holdings, large investors on Bitfinex are doubling down on leveraged longs, signaling confidence in the asset’s long-term potential.

Whales Accumulate as Panic Sellers Take $100M Loss

On-chain data shows Bitcoin (BTC) speculators suffered over $100 million in realized losses in the past six weeks, according to CryptoQuant. Short-term holders—those who acquired BTC in the last one to three months—were hit hardest, capitulating as BTC corrected 30% from its mid-January peak.

“This represents a reduction in the value of Bitcoin held by this cohort, who are now underwater as many bought at higher prices and are exiting with losses,” CryptoQuant contributor Onchained wrote on Mar. 13.

The market capitalization of these holdings has now dropped below their realized capitalization, signaling that these investors are actively selling at a loss. This selling pressure could weigh on Bitcoin’s short-term price trajectory.

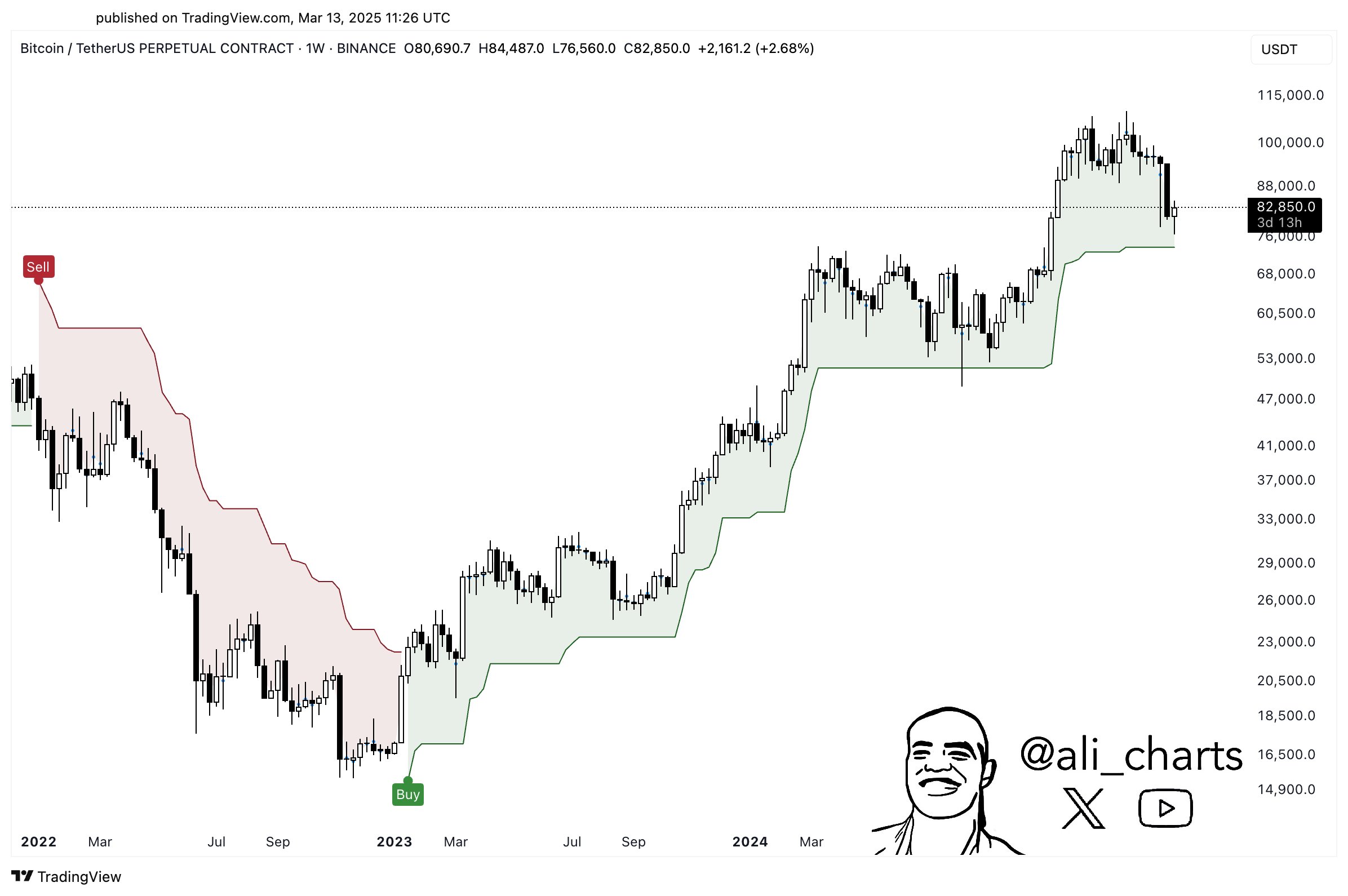

Bitcoin/USD vs. Bitfinex BTC margin longs. Source: TradingView

Data from Bitfinex shows that margin longs have surged to their highest level since Nov. 2024. In just 17 days, leveraged traders added 13,787 BTC worth approximately $5.7 billion, positioning for a bullish breakout.

Bitcoin’s Correlation With Liquidity Signals a $105K Target

While short-term speculators continue to exit, macro trends suggest Bitcoin could be poised for further gains.

Pakpakchicken, a pseudonymous trader on X, claims to have identified an 82% correlation between Bitcoin’s price and the global money supply (M2). Historically, BTC has surged when central banks ease monetary policy, increasing liquidity in the market.

“Periods of monetary easing tend to fuel greater investor interest in the asset, increasing its price potential,” the trader noted.

With global recession risks rising, central banks may be forced to expand M2 to stimulate economic growth. If this trend holds, Bitcoin could benefit from a fresh wave of liquidity, potentially pushing its price toward $105,000 in the coming months.

ETF Flows, Saylor’s $21B War Chest, and Trump’s Crypto Play

Beyond liquidity trends, industry-specific developments are also shaping Bitcoin’s trajectory.

Michael Saylor’s latest move to raise up to $21 billion for further BTC acquisitions has sparked renewed bullish sentiment. Strategy, the largest corporate Bitcoin holder, now controls 499,096 BTC with an acquisition cost of $33.1 billion.

Meanwhile, Bitcoin spot exchange-traded funds (ETFs) have seen $4.1 billion in outflows since Feb. 24. However, the streak of exits was recently broken with a modest $13.3 million inflow. This shift could signal stabilizing institutional interest.

Donald Trump’s administration is also reportedly exploring deeper ties to the crypto sector. A Wall Street Journal report on Mar. 13 revealed that Trump’s representatives have held discussions about acquiring a stake in Binance. A pro-crypto stance from the U.S. government could provide a regulatory tailwind for the industry.

Key Level at $74K as Bitcoin Enters Pivotal Phase

Despite bullish signals from whales and liquidity trends, Bitcoin remains at a critical juncture.

Ali Martinez, a crypto analyst on X, warned that Bitcoin’s weekly chart is approaching a key support level at $74,000.

“Watch $74,000 closely! The weekly chart hints at a potential trend shift if Bitcoin loses this key support,” he noted.

If BTC fails to hold this level, it could trigger further liquidations from leveraged traders, amplifying downside risk. Conversely, a strong bounce could reaffirm bullish momentum, setting the stage for a push toward $100,000.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.