0

0

This article was first published on The Bit Journal.

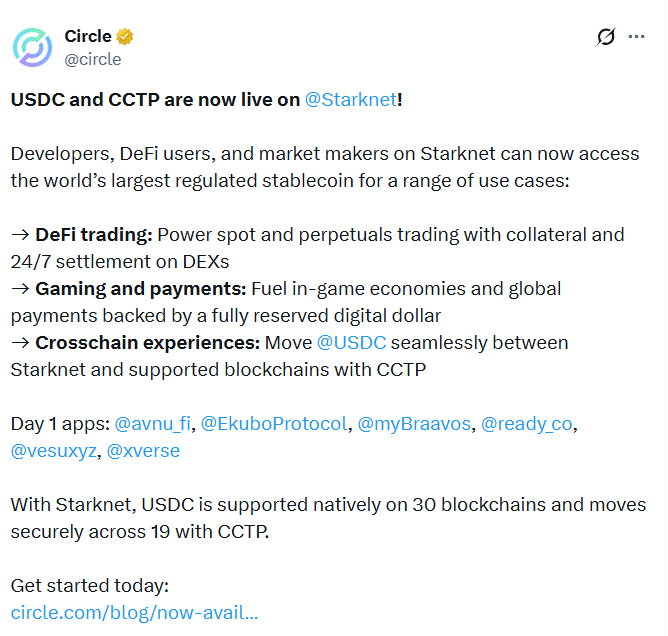

Circle has announced that USDC and its Cross-Chain Transfer Protocol, known as CCTP, are now live on the Starknet network. The rollout is meant to support native stablecoin settlement and quicker cross-chain transfers.

It also leans on zero-knowledge rollup technology, which is widely used to improve throughput on Layer 2 systems. Circle said the update could help apps that need fast payments, predictable pricing, and easier movement of funds.

The company confirmed two changes for users and builders. First, USDC is now issued natively on the Starknet network mainnet. That means the token is deployed directly on Starknet. It is not a bridged representation from Ethereum.

Second, CCTP is available to enable permissionless transfers. It allows users to move USDC at a 1:1 rate between supported chains and the Starknet network. It does so without creating wrapped tokens.

Stablecoins are central to crypto trading and on-chain payments. They are also used for payroll, remittances, and game purchases. Until this launch, much of the stablecoin liquidity on the Starknet network came from a token labeled USDC.e.

Also Read: Circle Launches Bridge Kit to Simplify USDC Transfers

This version originated on Ethereum. It reached Starknet through the StarkGate bridge. It worked as a practical tool. But it added bridging risk and extra steps for settlement. Circle’s native issuance aims to reduce those frictions.

Native issuance affects how users view and settle value. It can reduce reliance on wrapped assets. It can also simplify accounting for apps that hold stablecoin balances. Circle describes USDC as fully reserved.

It also points to compliance and operational controls. Those factors matter for businesses that want a predictable settlement. They matter even more when transactions happen at scale.

CCTP is designed to move USDC without minting wrapped versions. It aims to keep transfers simple and consistent. Developers can integrate the protocol in wallets and apps. That can help users bridge value with fewer manual steps.

It can also support faster onboarding. Users often fund accounts on one chain. Then they want to spend on another. CCTP is meant to make that flow smoother on the Starknet network. It may also help teams that manage treasuries across chains.

USDC.e will not disappear overnight. Legacy tokens are expected to remain active. They should stay clearly labeled in explorers and interfaces. That is meant to reduce confusion. The Starknet development team plans to work with ecosystem projects on a phased migration.

Liquidity can shift over time. That approach can limit disruptions for traders and lenders. It also gives exchanges and apps time to update. Circle expects native USDC to become the primary settlement asset on the Starknet network as adoption grows.

DeFi relies on stablecoins for swaps, lending, and collateral management. A native stablecoin can reduce complexity for protocol accounting. It can also improve routing for trades. Circle said native USDC can support continuous, around-the-clock settlement.

That feature matters for lending markets. It also matters for liquidations and price-sensitive trades. Several Starknet-based protocols were referenced as likely beneficiaries. The goal is to support more efficient activity on the Starknet network, especially when volumes rise.

Stablecoins are used for low-cost transfers and digital commerce. They are also used in game economies. Circle said USDC can serve as a trusted medium of exchange. That can help games price items in dollars.

It can also help players cash out value. For payments, stablecoins can support peer-to-peer transfers across borders. Lower fees can matter for small transactions. Faster settlement can matter for merchants.

Circle also pointed to Circle Mint for eligible users. That service can support direct issuance and redemption workflows. Institutional access can add liquidity. It can also support larger settlement demands.

It may help businesses integrate stablecoins without relying only on secondary markets. For the Starknet network, that could speed up adoption among payment providers and large app operators.

Circle’s launch brings native USDC and CCTP to the Starknet network. The move aims to improve settlement and cross-chain transfers. It also sets up a gradual shift away from USDC.e.

Developers may gain cleaner rails for DeFi, games, and payments. Users may see simpler funding and transfer flows. The next stage will depend on liquidity migration and app integration across the Starknet network.

Also Read: Will the Tether and Circle-led Stablecoin Exodus Fuel Market Recovery?

USDC: A dollar-pegged stablecoin issued by Circle

Starknet network: A Layer 2 scaling network that uses zero-knowledge technology

ZK rollup: A scaling method that batches transactions and proves them with zero-knowledge proofs

CCTP: Circle’s protocol for moving USDC across blockchains without wrapped tokens

Native USDC: USDC issued directly on a specific blockchain, not bridged from another chain

USDC.e: A bridged version of USDC used on Starknet before native issuance

StarkGate: a bridge used to transfer assets between Ethereum and Starknet

It is USDC issued directly on a chain. On Starknet, it is deployed on the Starknet network mainnet.

It enables 1:1 USDC transfers between supported chains and the Starknet network. It does not create wrapped tokens.

Yes. It should remain functional and labeled while liquidity migrates to native USDC on the Starknet network.

DeFi protocols, wallets, payment apps, and gaming projects that operate on the Starknet network can benefit.

Read More: Circle Upgrades Starknet With Native USDC and Cross-Chain Transfer Protocol">Circle Upgrades Starknet With Native USDC and Cross-Chain Transfer Protocol

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.