Can Pudgy Penguins (PENGU) Recover After an 8% Drop?

0

0

- Pudgy Penguins (PENGU) trades at $0.01393 after an 8% daily decline.

- Market cap stands at $876.02M with 24h volume plunging 51.74%.

Pudgy Penguins (PENGU) faced a notable downturn, shedding 5.32% in value over the past 24 hours to trade at $0.01393. The project now holds a market capitalization of $876.02 million, which also marks a 5.59% decrease.

Its fully diluted valuation stands at $1.23 billion, while 62.86 billion PENGU tokens remain in circulation from a total supply of 88.88 billion. Meanwhile, the 24-hour trading volume nosedived by 51.74% to $265.69 million. With a volume-to-market cap ratio of 30.43%, activity shows a sharp decline in investor engagement.

Will PENGU Rebound?

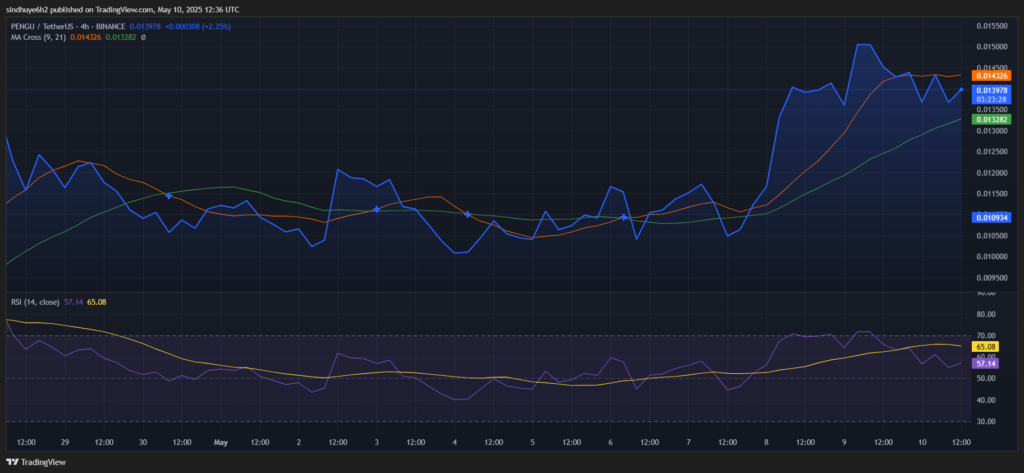

Currently, PENGU’s short-term trend reflects cautious optimism, yet resistance sits near $0.01432, slightly above its spot value. The support floor lies around $0.01328. A move above the resistance could push the token toward the $0.0155 region, while a breach below support risks retesting $0.012 levels.

The Relative Strength Index (RSI) holds at 57.14, suggesting mild bullishness, while the RSI average trails at 65.08, indicating the recent momentum may have already peaked. If RSI crosses above its average again, it could reignite buying pressure. However, with both values staying under 70, PENGU avoids overbought conditions.

On the moving averages, the 9-period line (orange) now stands at $0.01433, marginally above the 21-period (green) line at $0.01328. A bullish crossover has taken place, hinting at a short-term upward trend. This technical structure often signals buying interest building up, especially when paired with increasing volume. However, the recent volume slump tempers this interpretation and warrants caution.

While the Chaikin Money Flow (CMF) indicator is not directly shown on the chart, the price-volume behavior suggests neutral-to-slightly-negative accumulation. The downtrend in volume, despite a recent price lift, implies weaker conviction behind the upward moves.

If momentum sustains and the token holds above $0.0135, PENGU could aim to break its recent top. Conversely, slipping under $0.0132 might open the path to short-term declines. Given the moving average crossover and RSI behavior, the current phase signals consolidation with potential for reversal if market participation rises.

Highlighted Crypto News Today

BlackRock Meets SEC to Discuss Staking, Tokenization, and Crypto ETF Regulations

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.