Whales Trap Bitcoin Below $85K as $92K Breakout Looms Large

0

0

NAIROBI (CoinChapter.com)— Bitcoin (BTC) traded at $81,417 on Monday, extending its weekend slide from highs near $85,000. The continued drop raised fresh concerns over whale-driven manipulation, with analysts citing spoofing tactics and thin liquidity as factors behind the price suppression.

A liquidation heatmap shared by Ufo Calls showed liquidity piling up above $85,000. “A short squeeze is incoming,” the account posted, citing concentrated short positions on Binance’s BTC/USDT pairs.

Whale Spoofing Allegations Resurface

Keith Alan of Material Indicators pointed to ongoing spoofing behavior by a large-volume entity. He claimed the suspected whale, dubbed “Spoofy,” used ask liquidity to suppress price and force BTC down from $87,500.

BTC order book data for Binance. Source: Keith Alan

“This whale is buying the dip and has bids laddered down to $78K,” Alan wrote.

He backed the claim with annotated Binance order book data. The charts showed clusters of spoof orders used to guide price downward over the last three weeks.

Bitcoin CME Gap Fills as Traders Eye Support Levels

BTC’s pullback also filled a key gap in the Chicago Mercantile Exchange (CME) futures market. According to Rekt Capital, the gap between $82,000 and $85,000 had long been an area of interest.

“The general CME gap has now been filled,” the analyst posted on X.

BTC/USDT 15-minute chart with CME futures data. Source: Daan Crypto Trades

Daan Crypto Trades described the weekend’s action as volatile, noting that Bitcoin managed to reclaim most losses. He warned a new CME gap could emerge depending on Monday’s open.

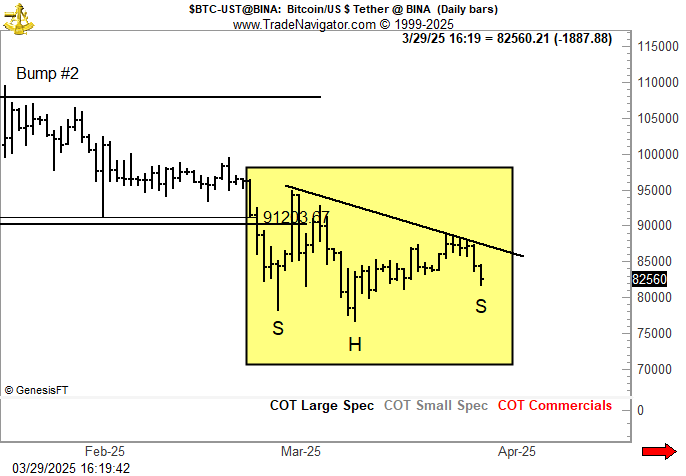

Wyckoff Structure or Bearish Breakdown?

Ted, an X-based trader, suggested Bitcoin remains in a Wyckoff-style re-accumulation phase. He described the drop below $85,000 as engineered panic meant to shake out bulls.

“Once BTC goes above $92K, bears will get rekt,” he said on Sunday.

Still, sentiment remained divided. Altcoin Sherpa called the current range “support,” but admitted price action lacked clarity.

“This region is pretty confusing… everything is ugly on the 1W,” he noted.

Peter Brandt offered a bearish angle. He cited a completed bear wedge and projected a price target of $65,635. “Just reporting what the chart says,” Brandt told followers.

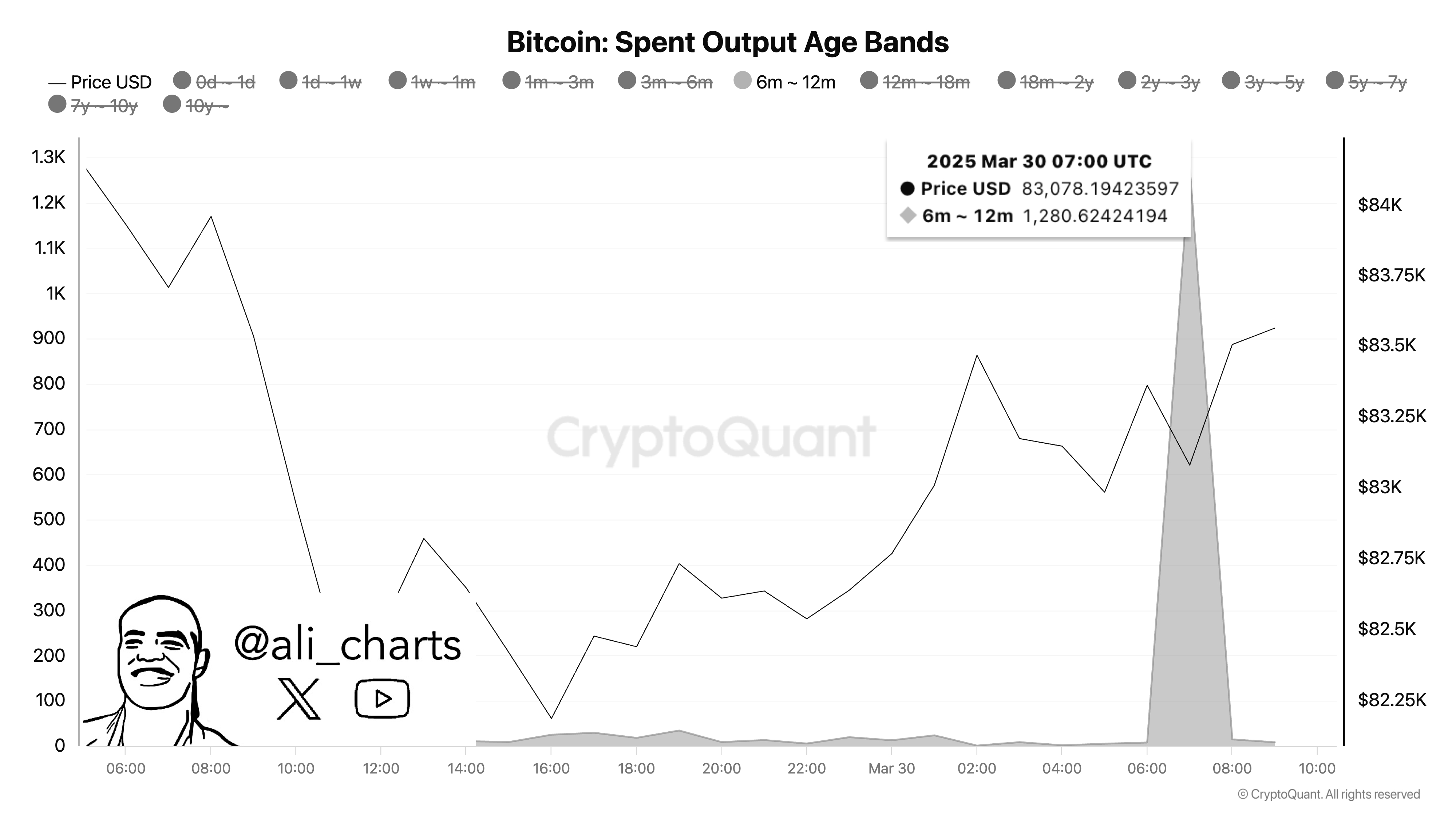

Whale Transactions and Liquidity Concerns

Ali Martinez highlighted that over 1,280 BTC, worth more than $106 million, moved within hours. The transaction volume signaled growing whale activity during periods of low liquidity.

Martinez warned that the bullish narrative surrounding global liquidity might not hold up.

“Global Money Supply dropped nearly $1 trillion in the past two weeks,” he wrote.

This backdrop also casts doubt on liquidity-driven rallies and raises questions about Bitcoin’s resilience near-term.

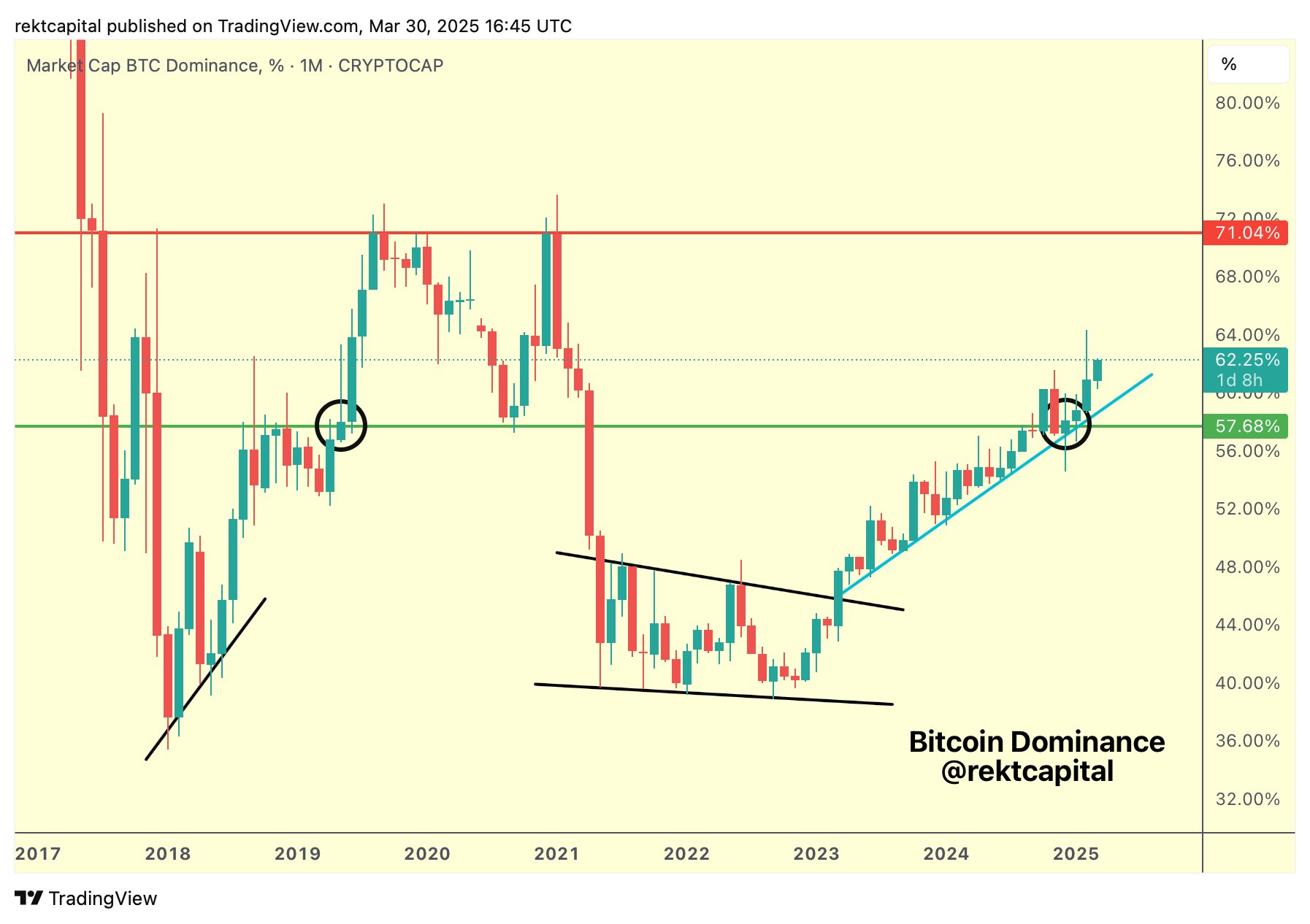

BTC Dominance Nears Rejection Zone

Bitcoin dominance hovered near 71% at press time. Rekt Capital suggested this level historically marks a turning point.

“If history repeats, altseason could begin after BTC dominance rejects from 71%,” he explained.

Still, Bitcoin must first clear $85,000 and challenge resistance near $92,000 to confirm any upside trend. With spoofing concerns and whale absorption in play, retail traders appear sidelined for now.

Above all, BTC price sits at a critical juncture, with whale behavior, liquidity gaps, and dominance trends all in focus. Whether bulls reclaim control or another leg down emerges depends on Bitcoin’s ability to clear the $85,000–$92,000 range under growing scrutiny.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.